Check

if

self-employed

OMB No. 1545-0047

Department of the Treasury

Internal Revenue Service

Check if

applicable:

Address

change

Name

change

Initial

return

Final

return/

termin-

ated

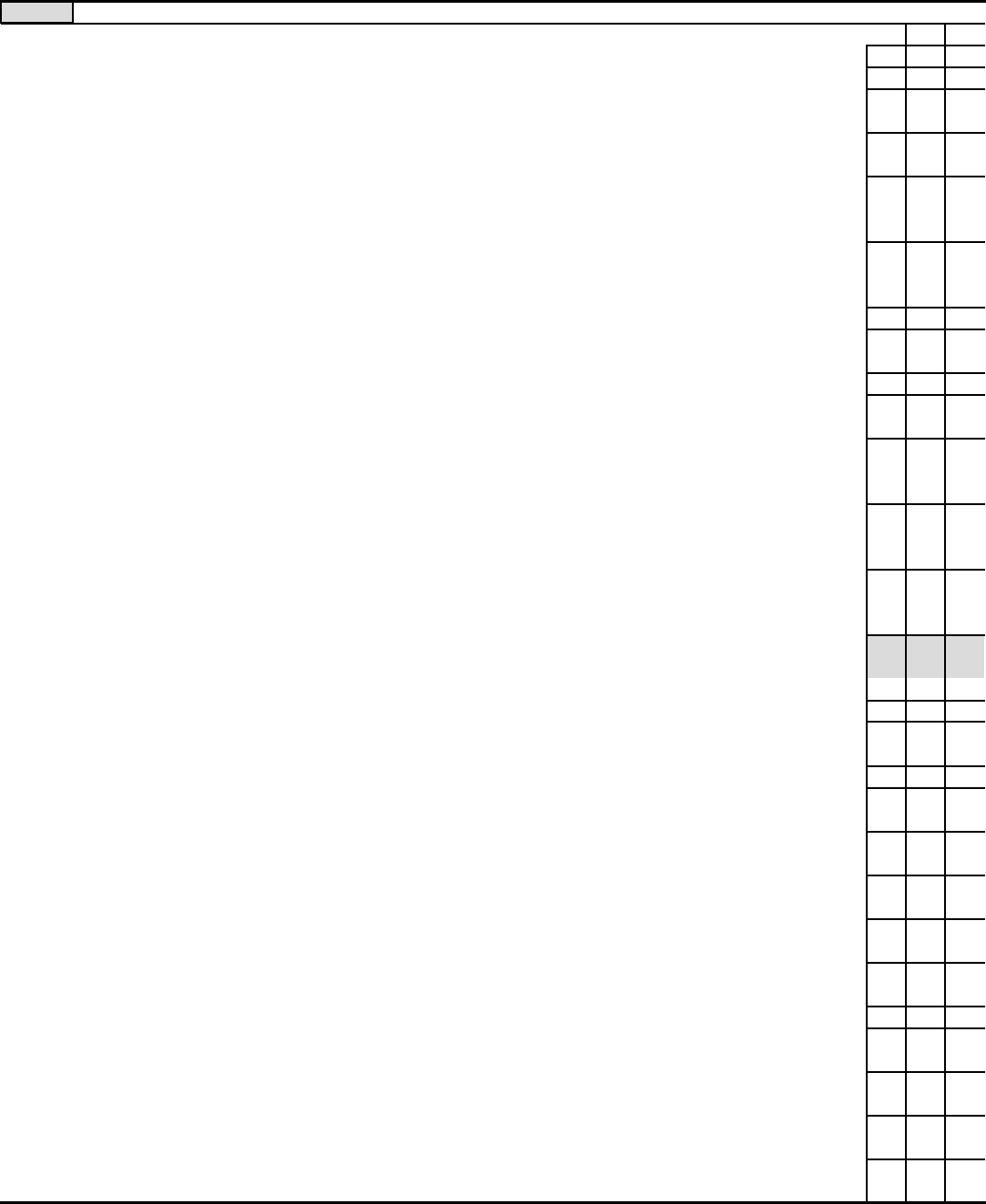

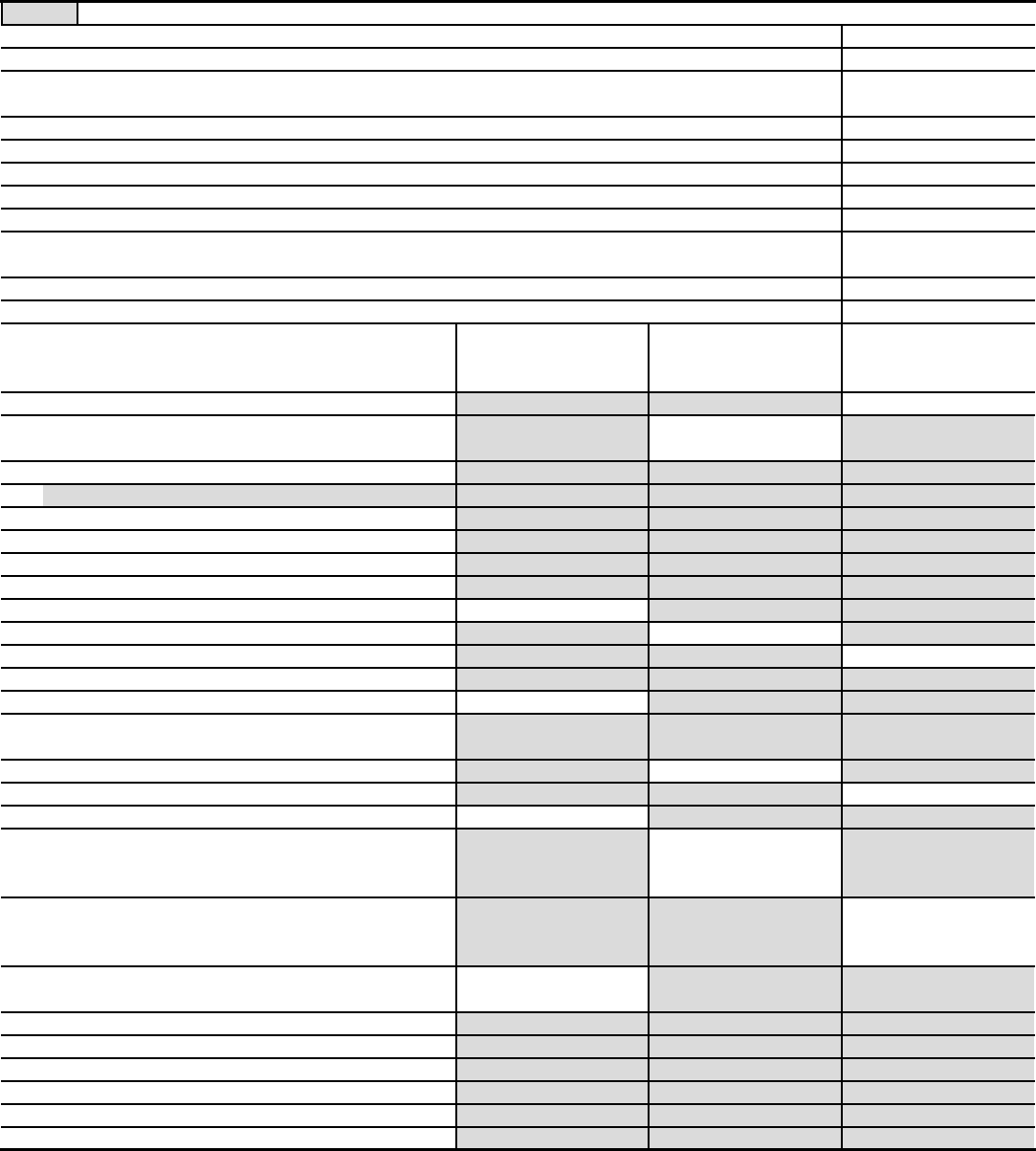

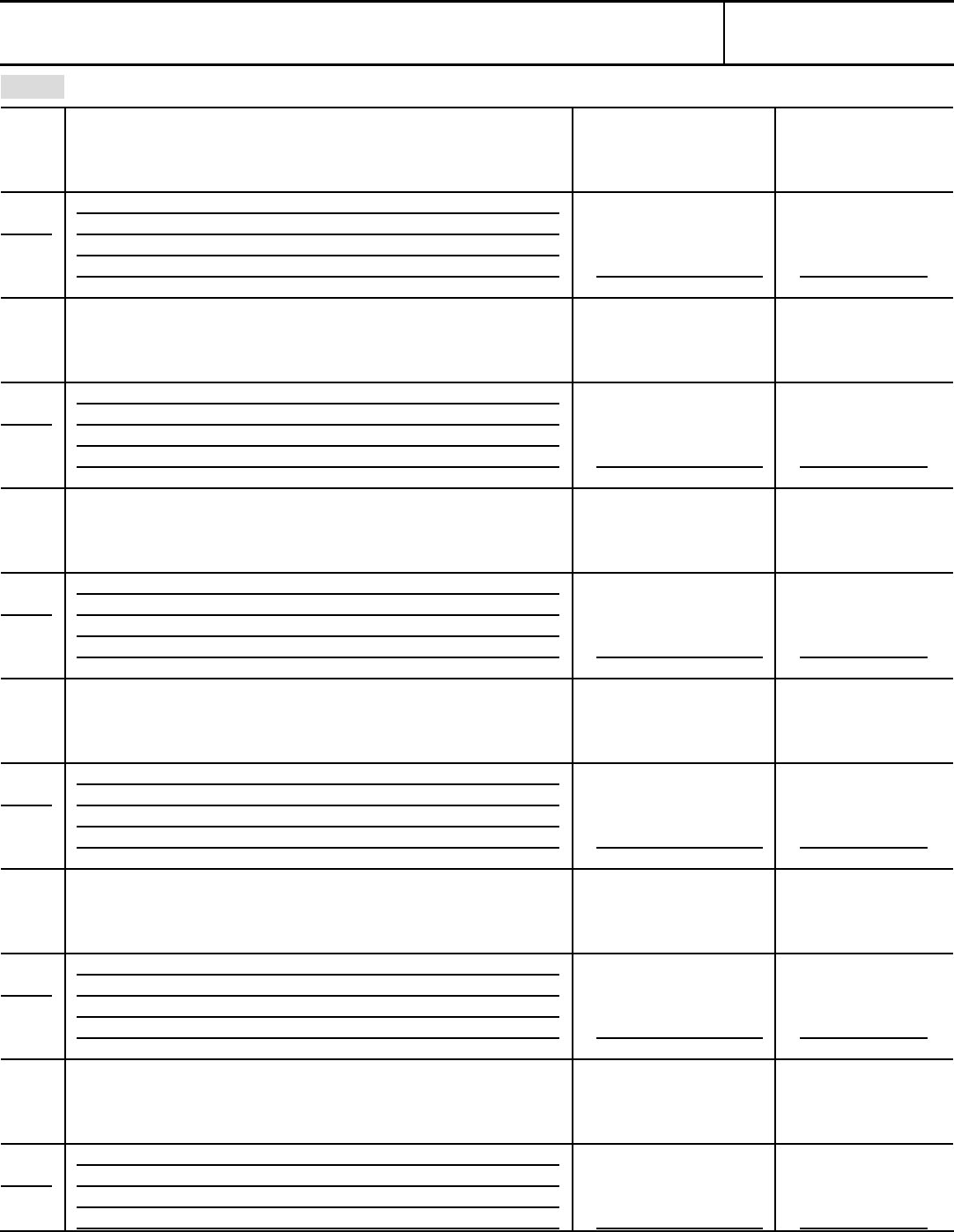

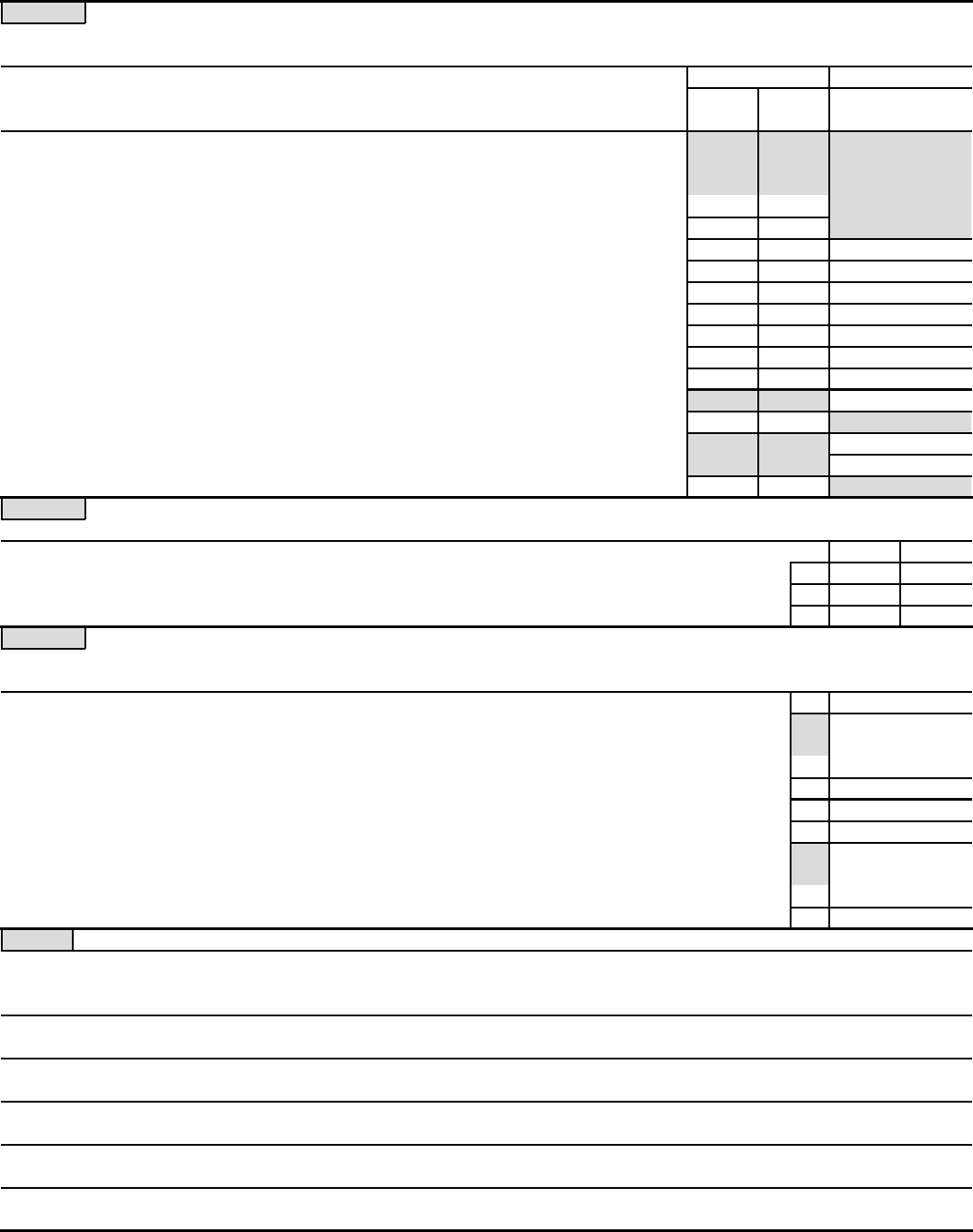

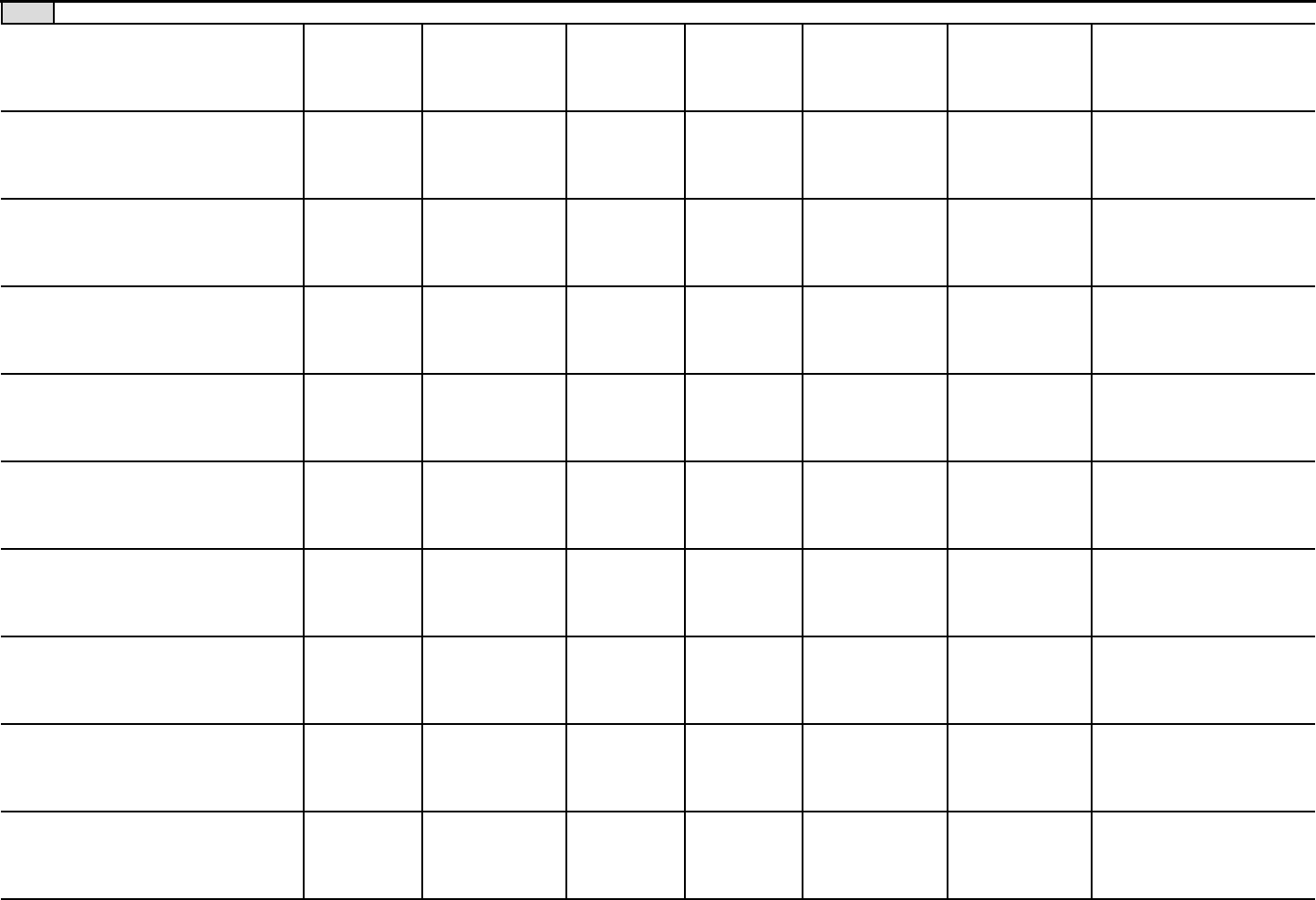

Gross receipts $

Amended

return

Applica-

tion

pending

Are all subordinates included?

732001 11-28-17

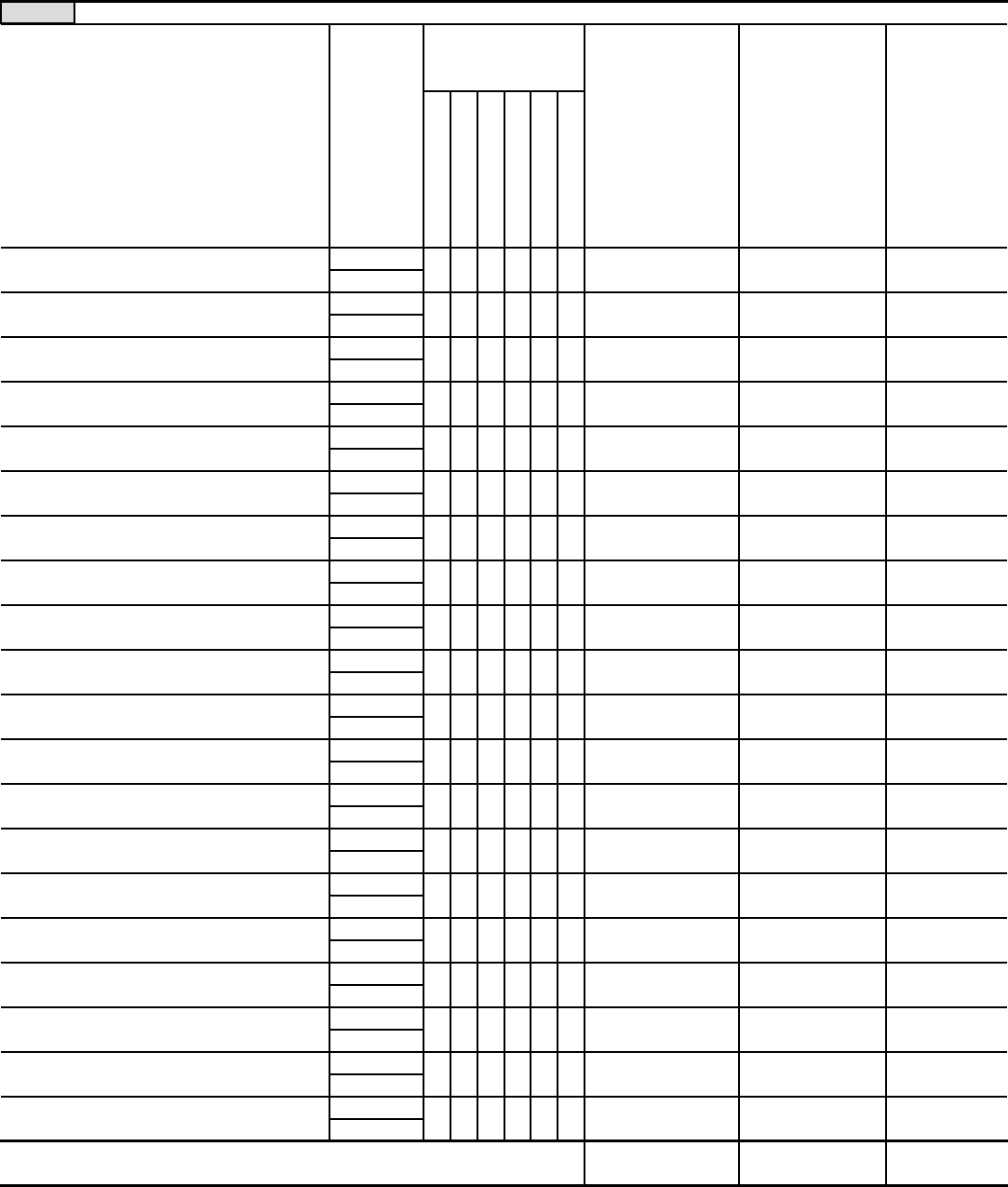

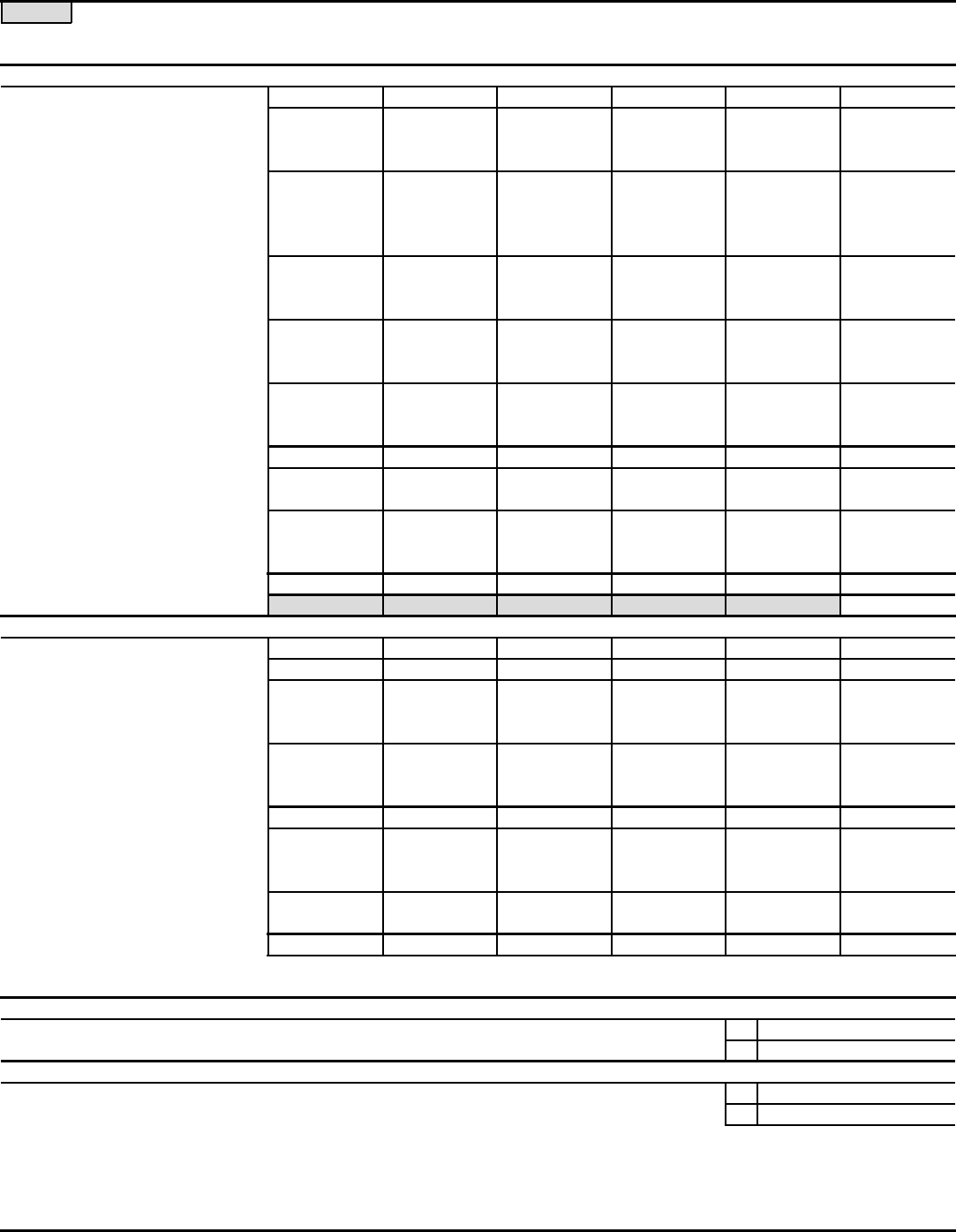

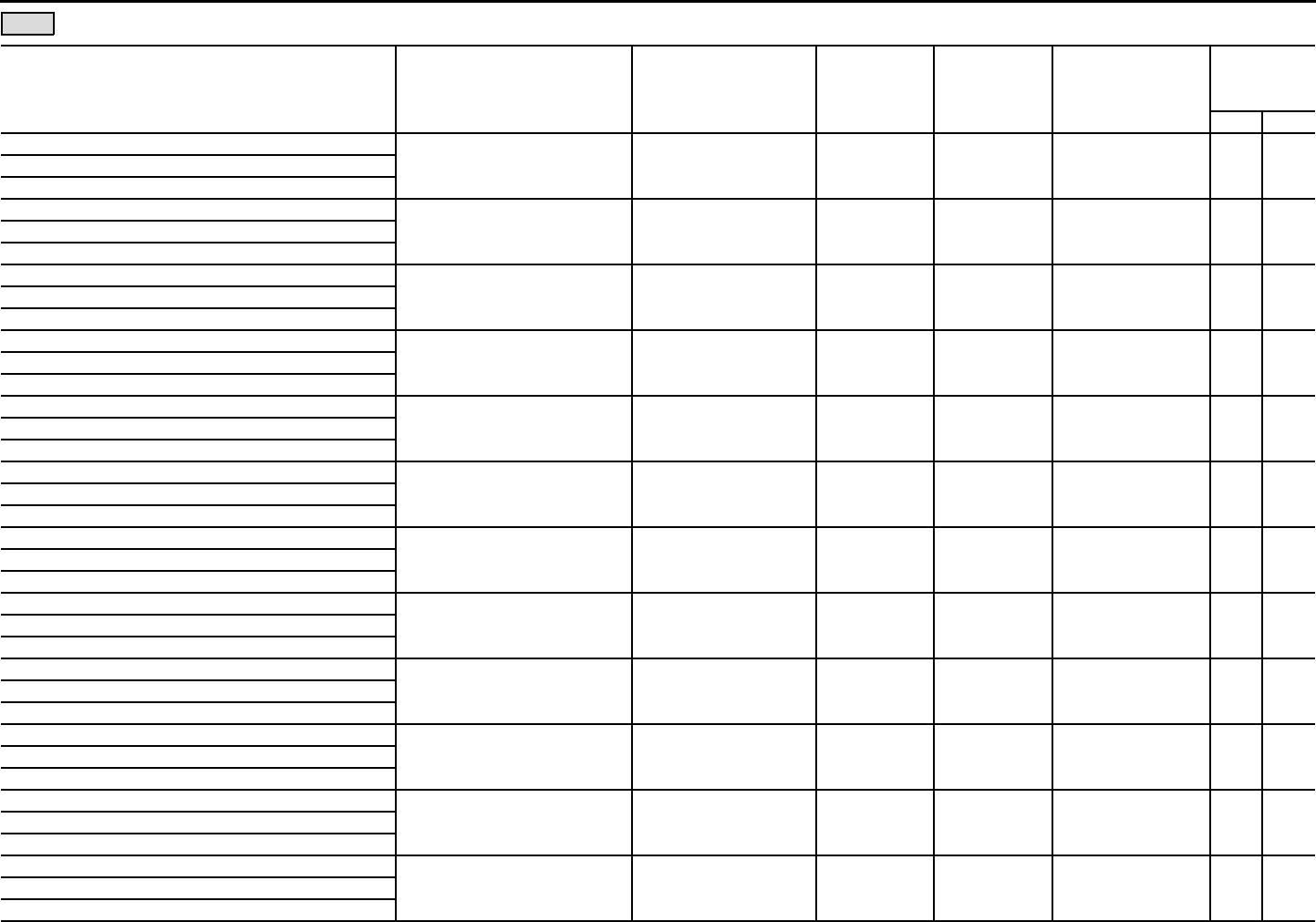

Beginning of Current Year

Paid

Preparer

Use Only

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

| Do not enter social security numbers on this form as it may be made public.

Open to Public

Inspection

| Go to www.irs.gov/Form990 for instructions and the latest information.

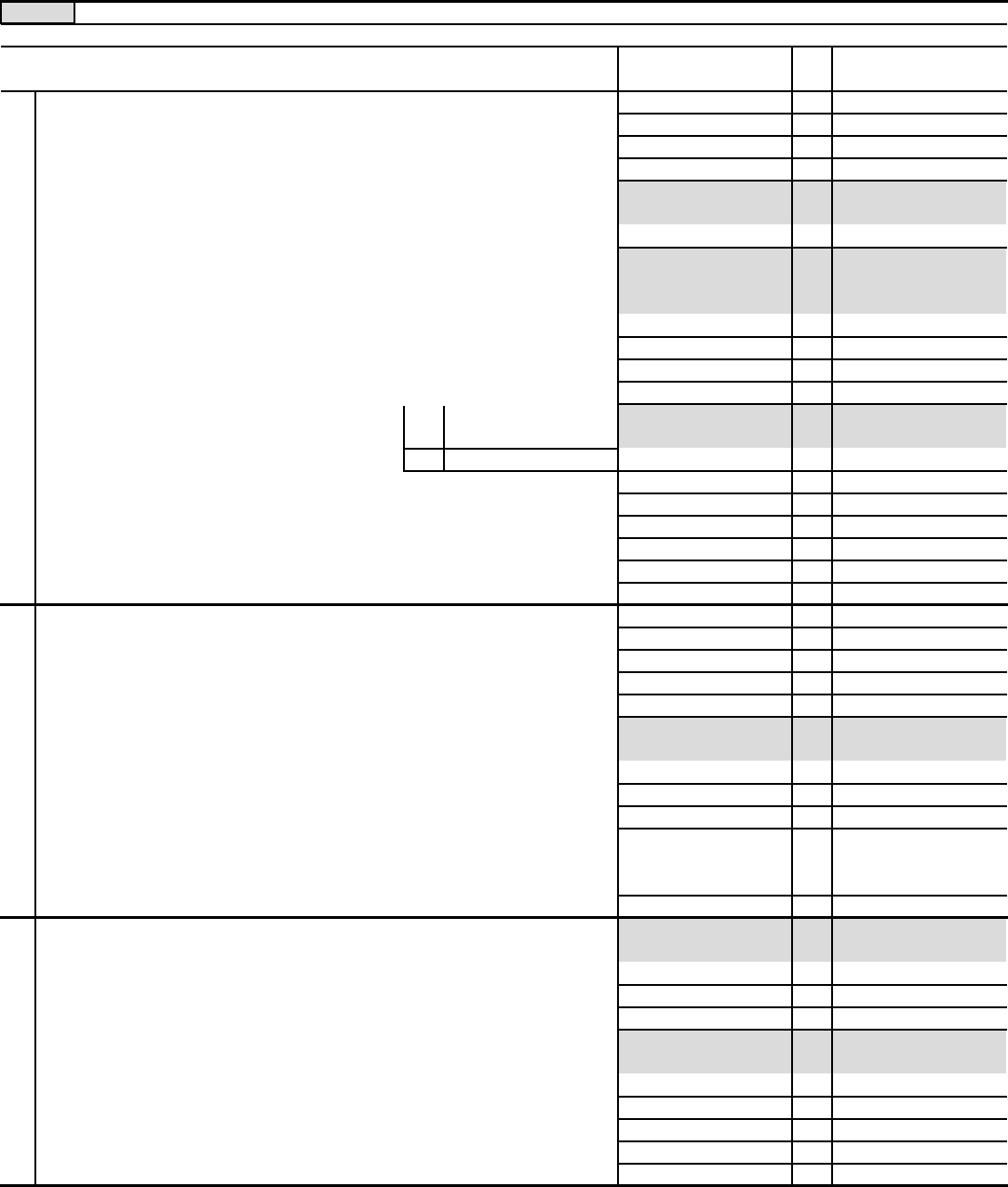

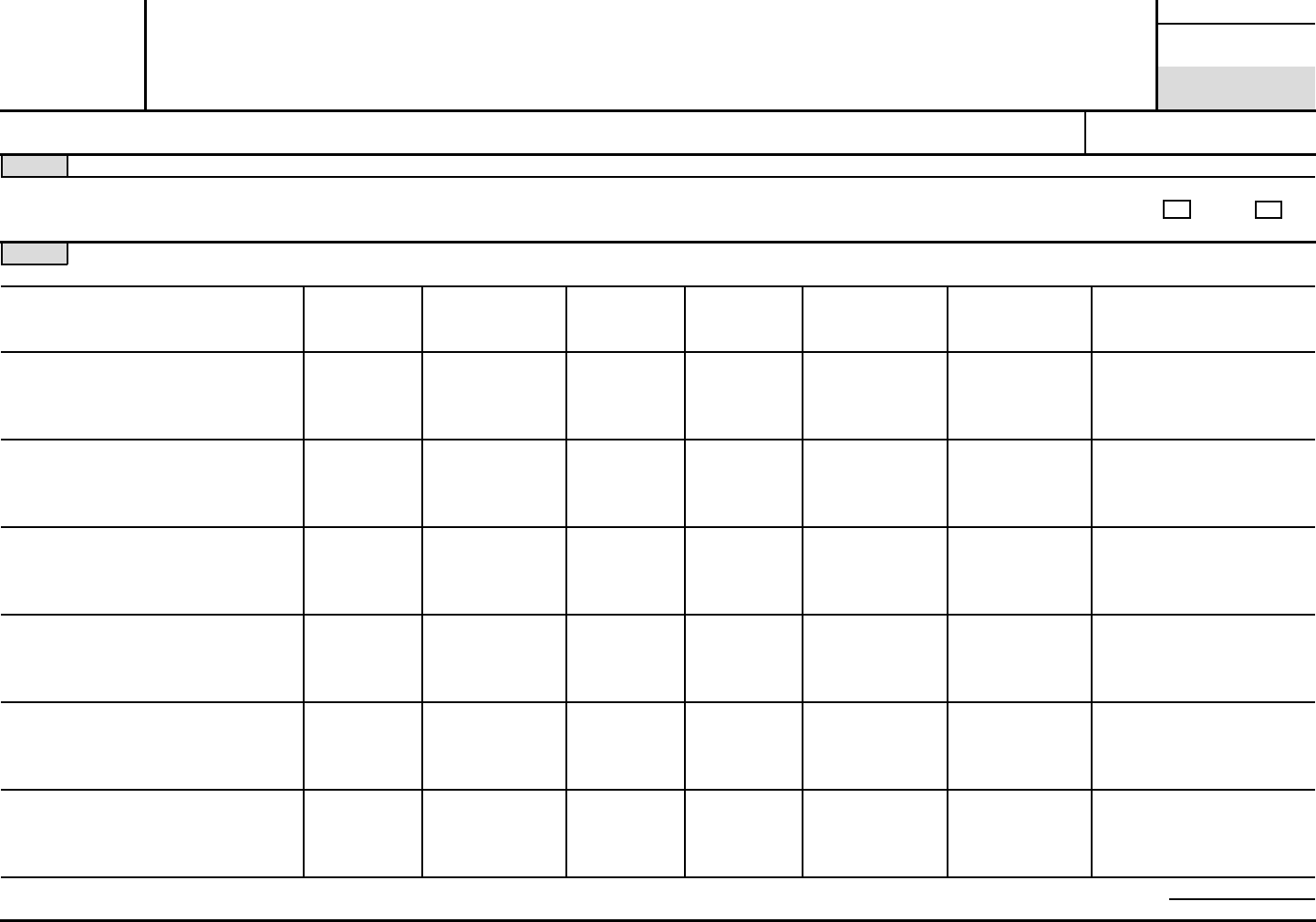

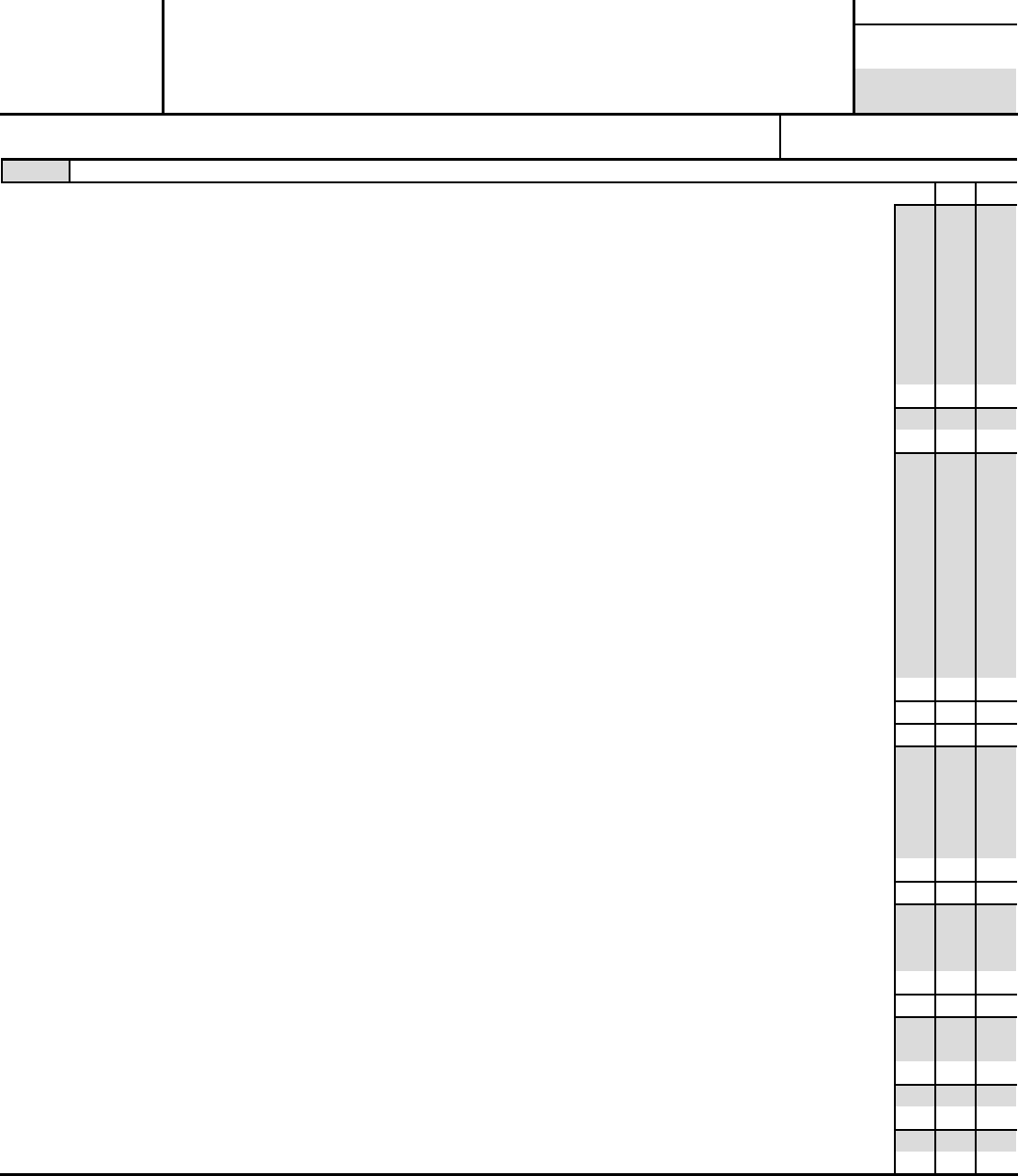

A For the 2017 calendar year, or tax year beginning and ending

B C D Employer identification number

E

G

H(a)

H(b)

H(c)

F Yes No

Yes No

I

J

K

Website: |

L M

1

2

3

4

5

6

7

3

4

5

6

7a

7b

a

b

Activities & Governance

Prior Year Current Year

8

9

10

11

12

13

14

15

16

17

18

19

Revenue

a

b

Expenses

End of Year

20

21

22

Sign

Here

Yes No

For Paperwork Reduction Act Notice, see the separate instructions.

(or P.O. box if mail is not delivered to street address) Room/suite

)

501(c)(3) 501(c) ( (insert no.) 4947(a)(1) or 527

|

Corporation Trust Association Other

Form of organization: Year of formation: State of legal domicile:

|

|

Net Assets or

Fund Balances

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

Signature of officer Date

Type or print name and title

Date

PTIN

Print/Type preparer's name Preparer's signature

Firm's name Firm's EIN

Firm's address

Phone no.

Form

Name of organization

Doing business as

Number and street Telephone number

City or town, state or province, country, and ZIP or foreign postal code

Is this a group return

for subordinates?Name and address of principal officer: ~~

If "No," attach a list. (see instructions)

Group exemption number |

Tax-exempt status:

Briefly describe the organization's mission or most significant activities:

Check this box if the organization discontinued its operations or disposed of more than 25% of its net assets.

Number of voting members of the governing body (Part VI, line 1a)

Number of independent voting members of the governing body (Part VI, line 1b)

Total number of individuals employed in calendar year 2017 (Part V, line 2a)

~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~

Total number of volunteers (estimate if necessary)

Total unrelated business revenue from Part VIII, column (C), line 12

Net unrelated business taxable income from Form 990-T, line 34

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~

••••••••••••••••••••••

Contributions and grants (Part VIII, line 1h) ~~~~~~~~~~~~~~~~~~~~~

Program service revenue (Part VIII, line 2g) ~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~

Investment income (Part VIII, column (A), lines 3, 4, and 7d)

Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e) ~~~~~~~~

Total revenue - add lines 8 through 11 (must equal Part VIII, column (A), line 12) •••

Grants and similar amounts paid (Part IX, column (A), lines 1-3)

Benefits paid to or for members (Part IX, column (A), line 4)

Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10)

~~~~~~~~~~~

~~~~~~~~~~~~~

~~~

Professional fundraising fees (Part IX, column (A), line 11e)

Total fundraising expenses (Part IX, column (D), line 25)

~~~~~~~~~~~~~~

Other expenses (Part IX, column (A), lines 11a-11d, 11f-24e)

Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25)

Revenue less expenses. Subtract line 18 from line 12

~~~~~~~~~~~~~

~~~~~~~

••••••••••••••••

Total assets (Part X, line 16)

Total liabilities (Part X, line 26)

Net assets or fund balances. Subtract line 21 from line 20

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~

••••••••••••••

May the IRS discuss this return with the preparer shown above? (see instructions) •••••••••••••••••••••

LHA Form (2017)

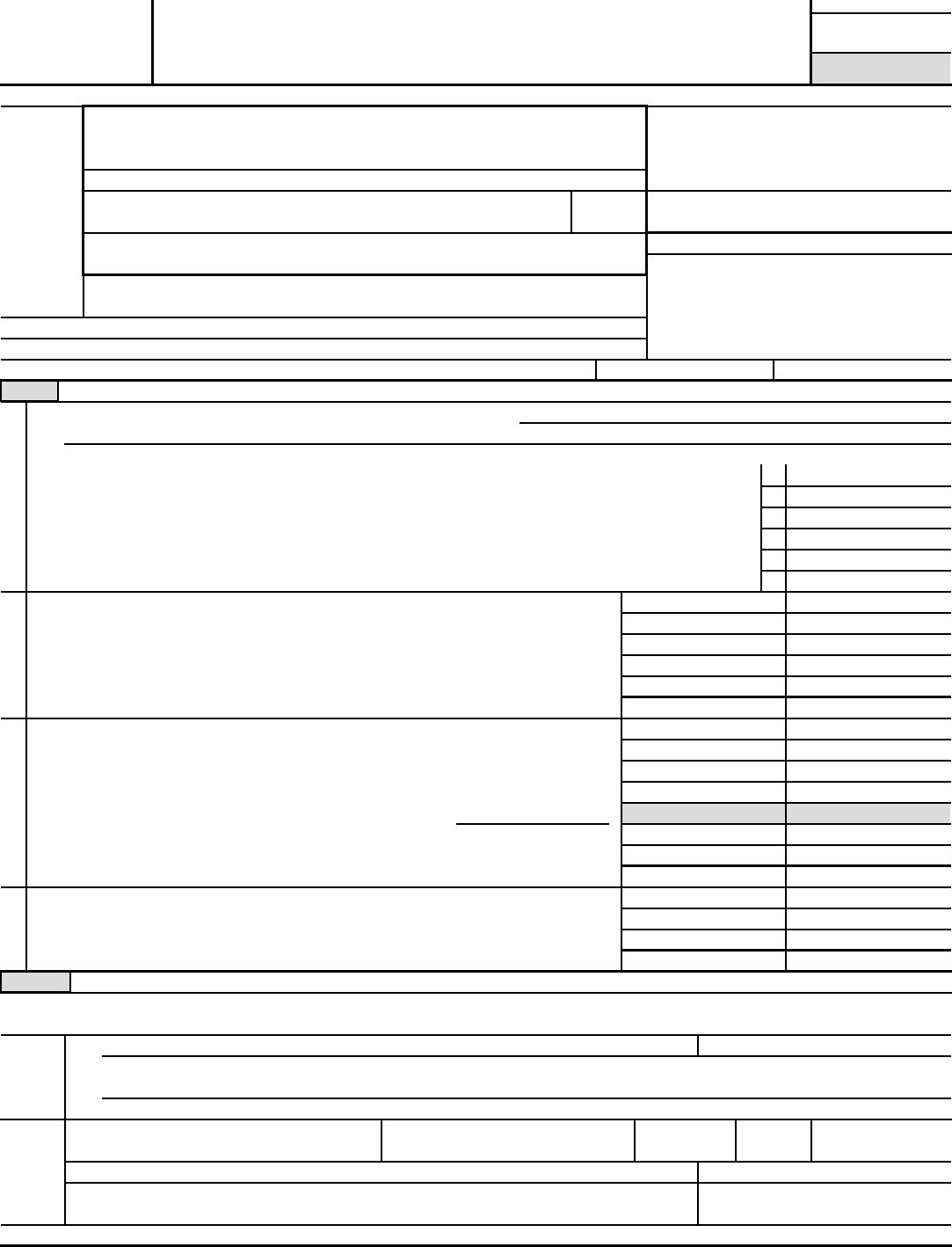

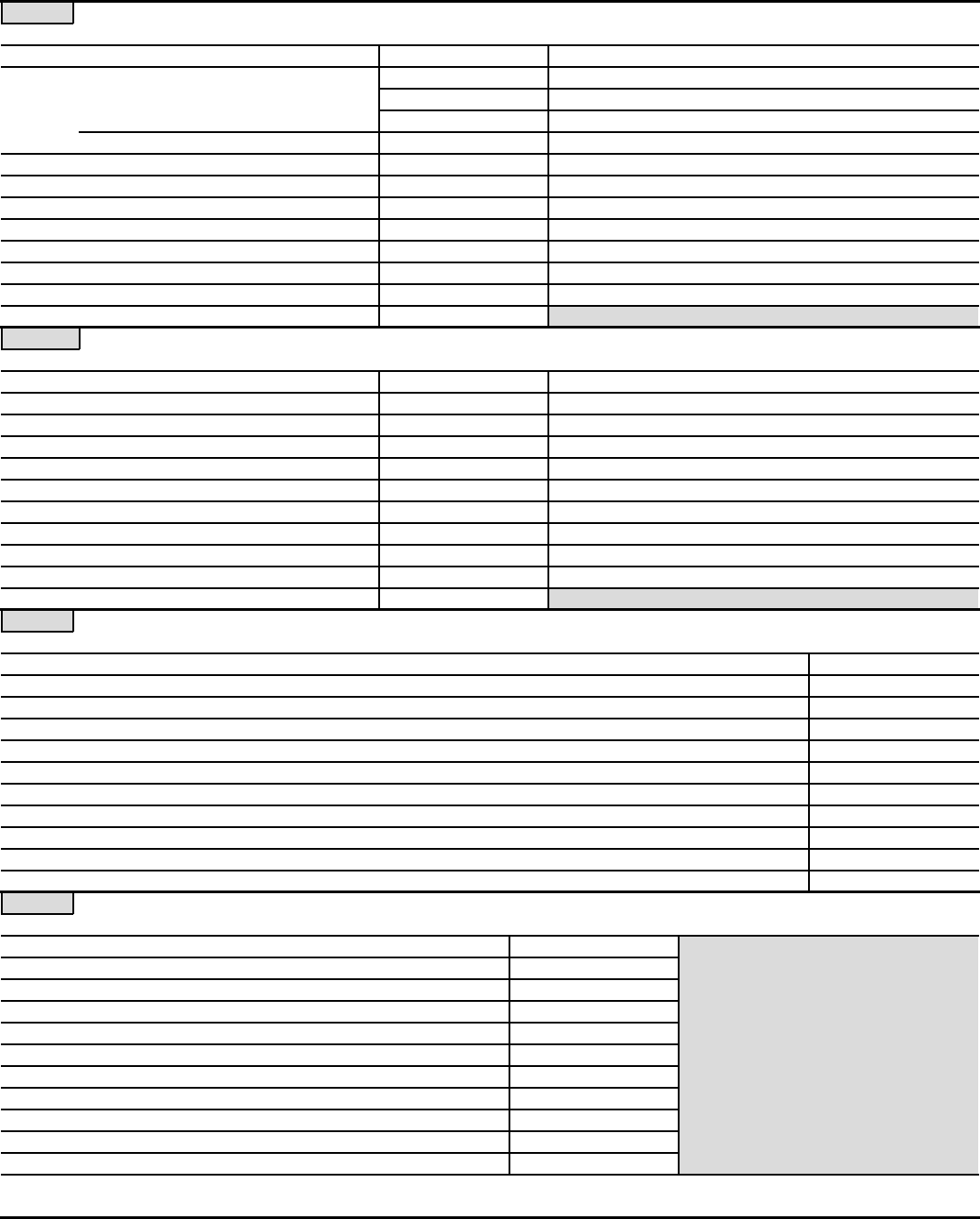

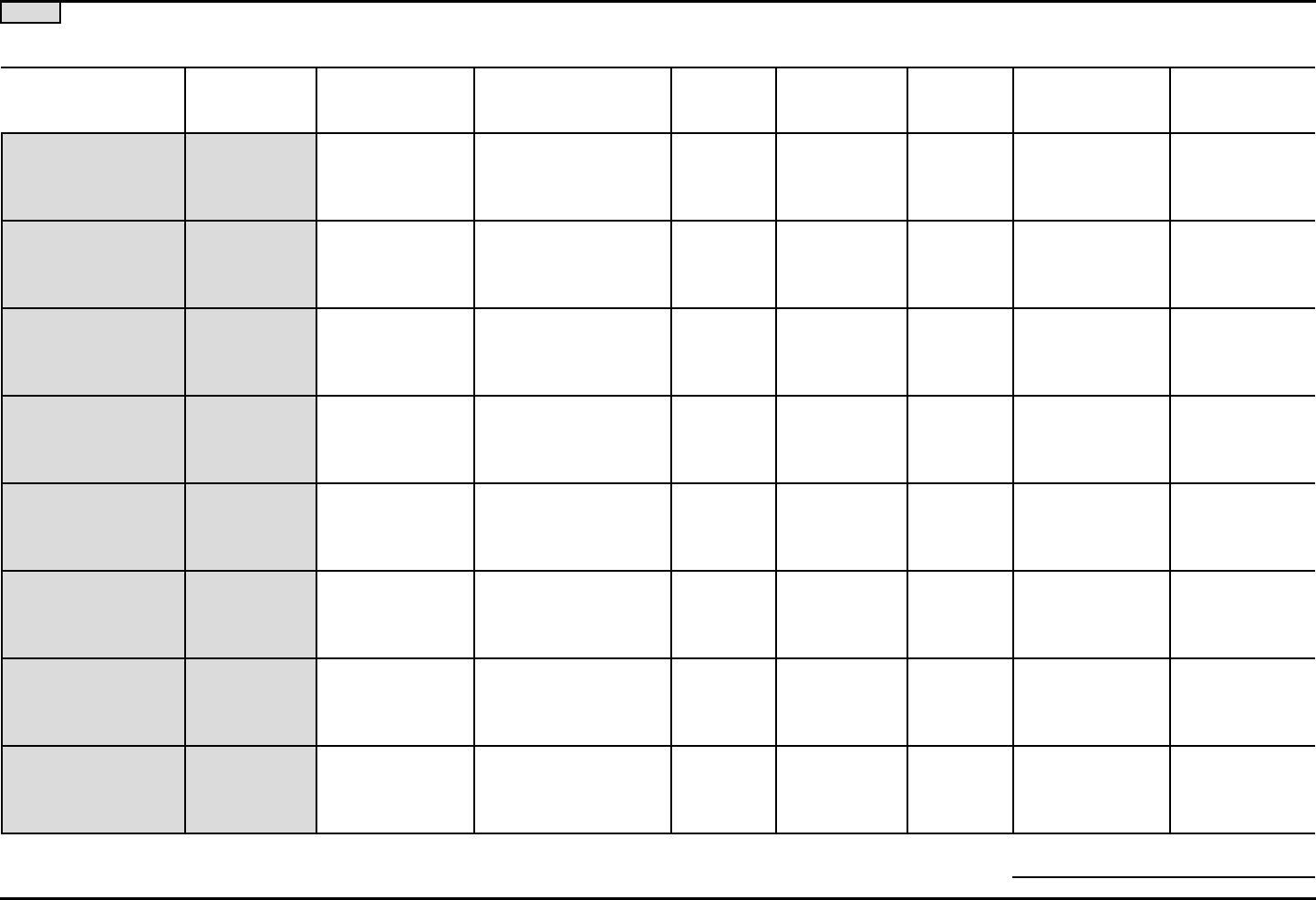

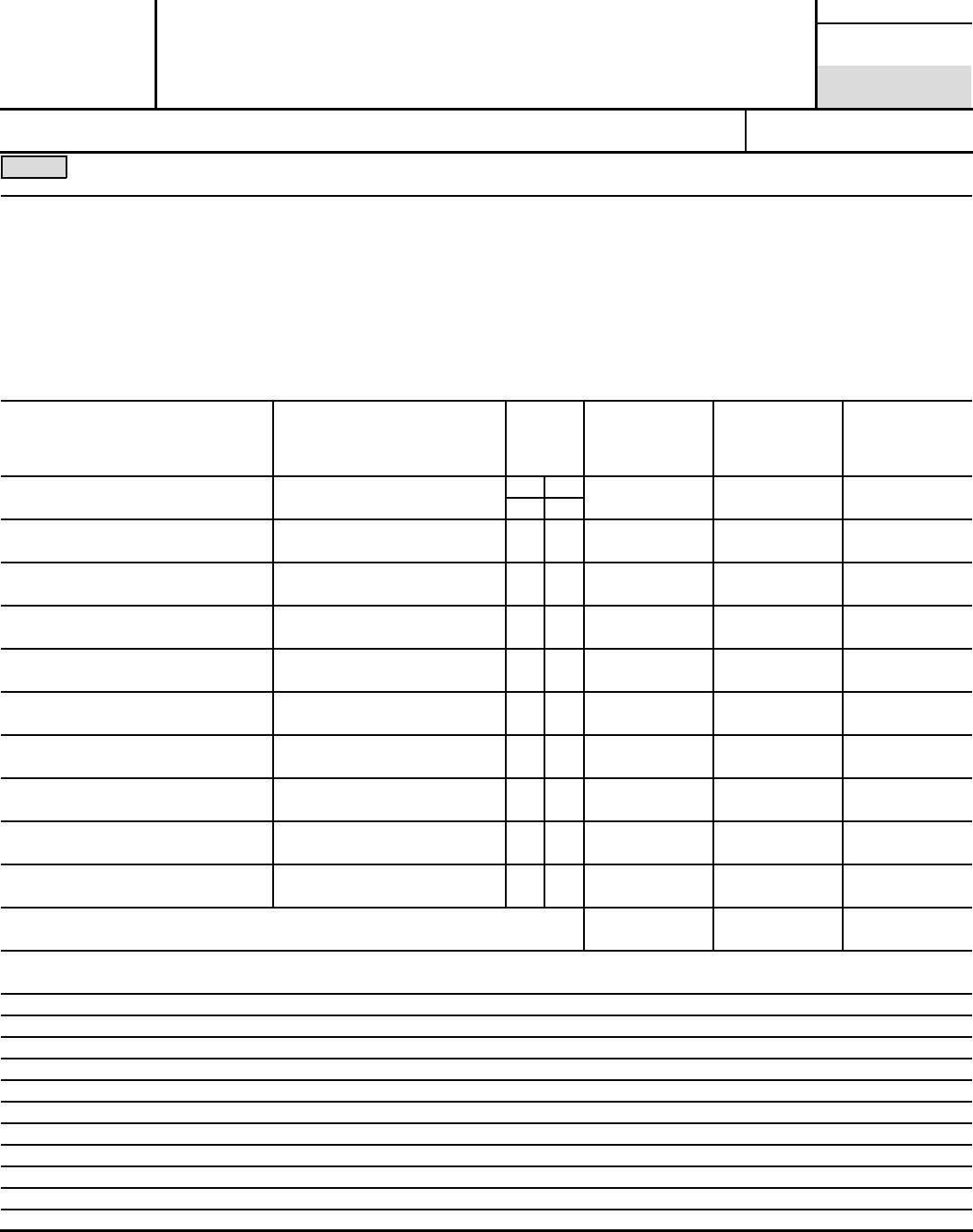

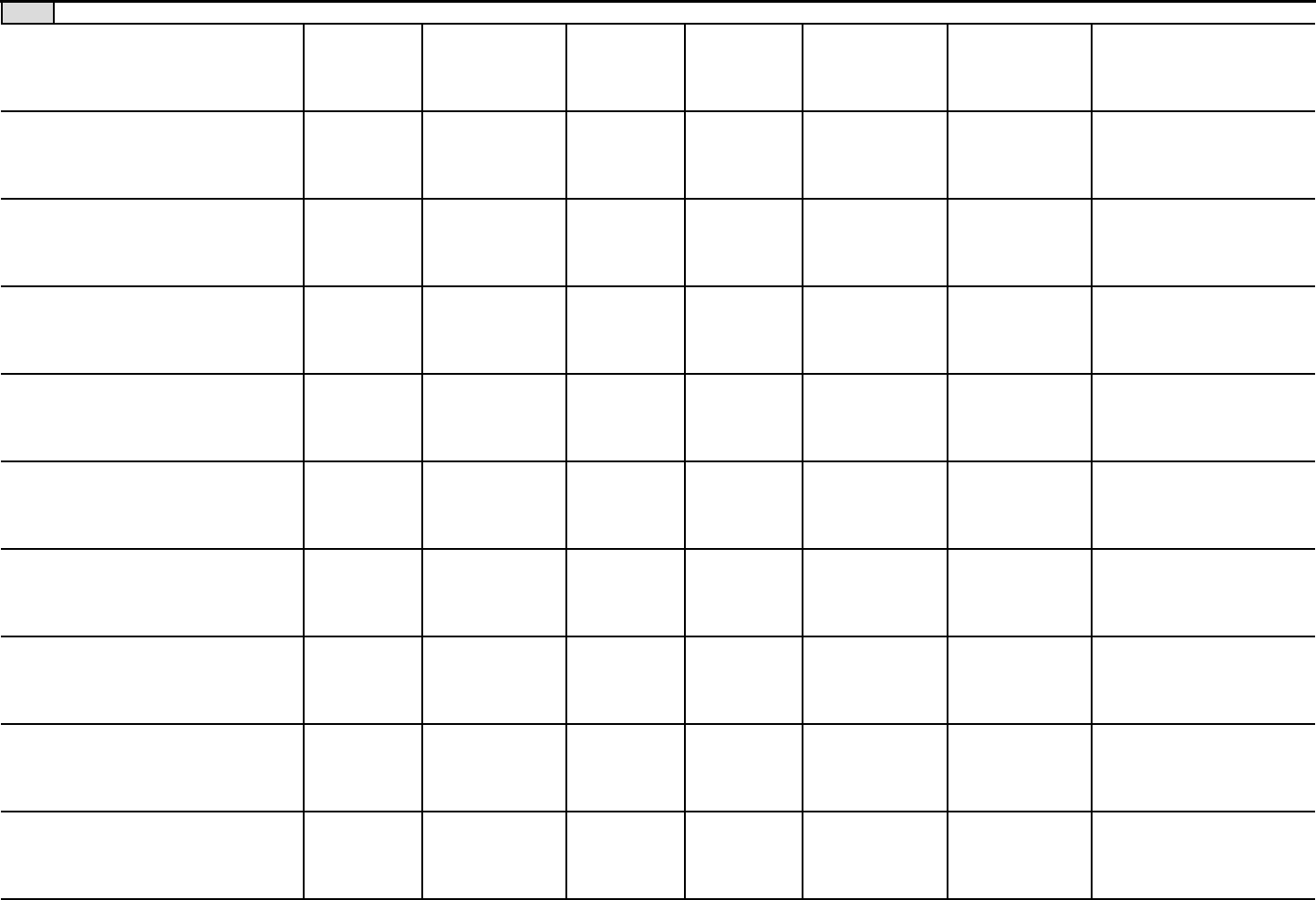

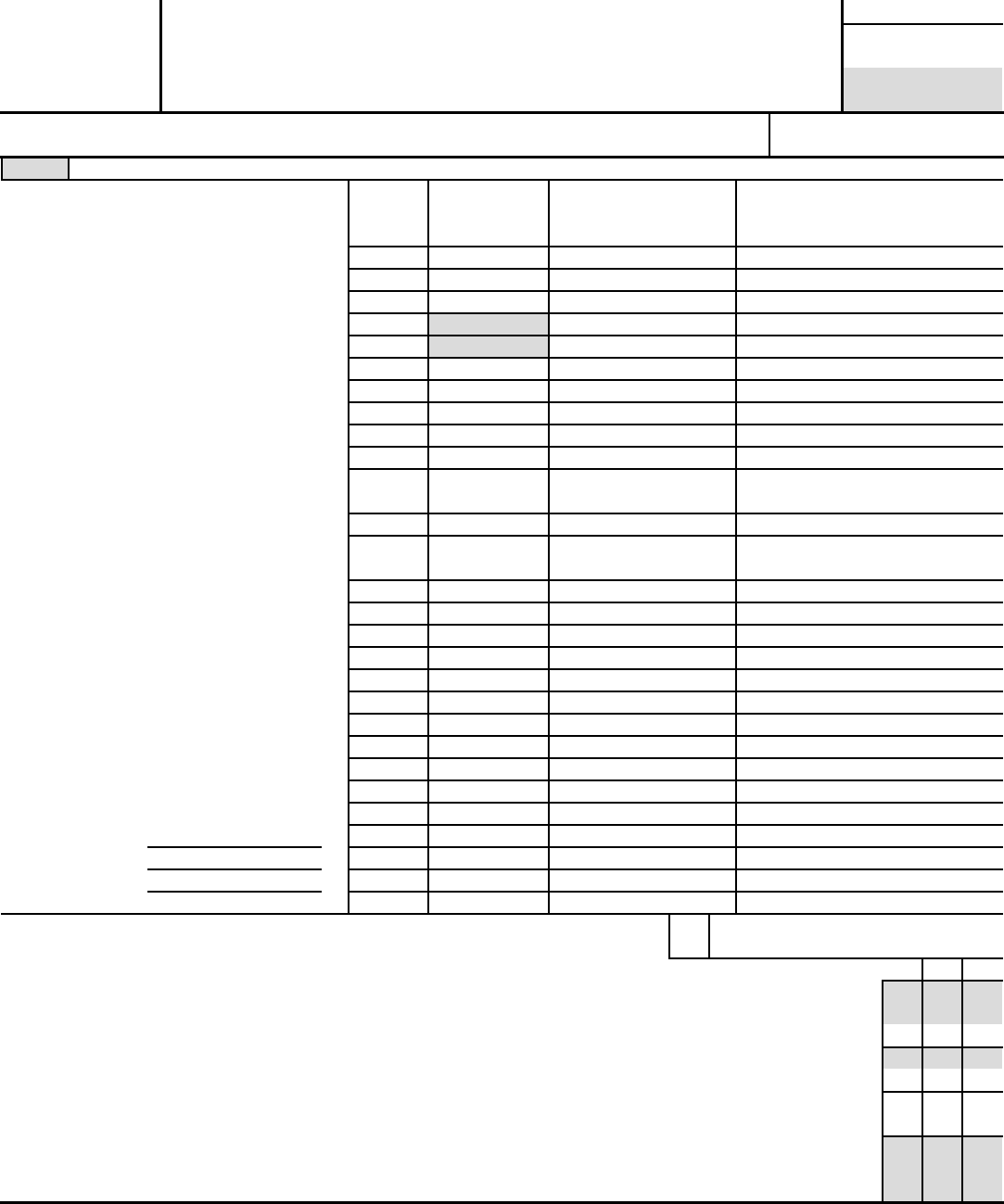

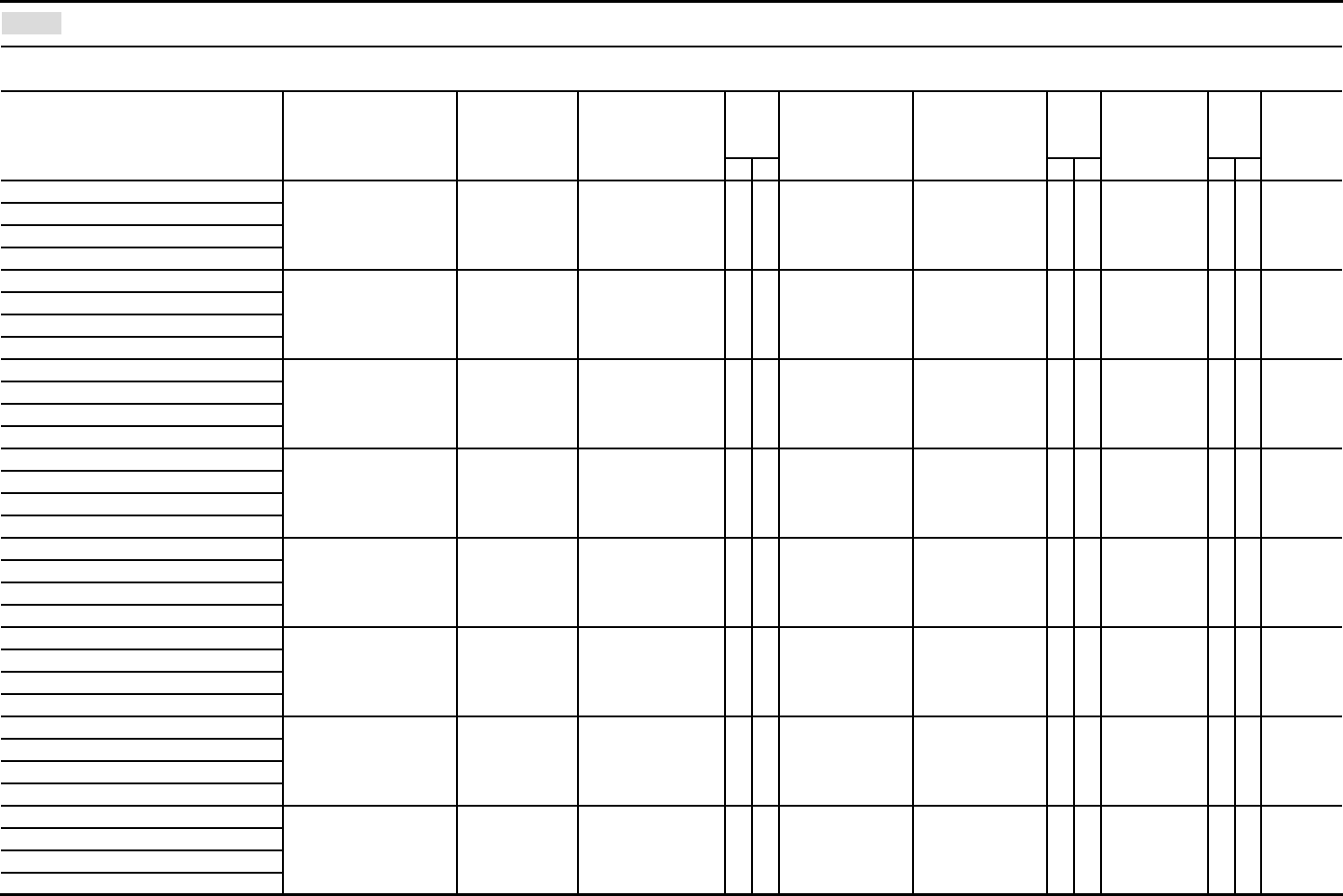

Part I Summary

Signature Block

Part II

990

Return of Organization Exempt From Income Tax

990

2017

§

=

=

9

9

9

** PUBLIC DISCLOSURE COPY **

JUL 1, 2017 JUN 30, 2018

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC.

13-1644147

123 WILLIAM STREET 10 FL (212)541-7800

393,636,092.

NEW YORK, NY 10038

DR. LEANA WEN X

SAME AS C ABOVE

X

WWW.PLANNEDPARENTHOOD.ORG

X 1922 NY

LEADERSHIP AND ADVOCACY IN THE

FIELD OF REPRODUCTIVE HEALTH - SEE SCHEDULE O

29

29

676

150

0.

214,566.

344,001,712. 259,024,664.

2,701,857. 1,053,372.

12,691,065. 6,712,944.

7,843,341. 7,395,614.

367,237,975. 274,186,594.

155,369,755. 88,677,922.

0. 0.

61,468,224. 66,756,480.

12,203,883. 9,568,145.

47,365,418.

88,801,305. 84,282,706.

317,843,167. 249,285,253.

49,394,808. 24,901,341.

446,345,578. 467,407,950.

85,338,397. 73,827,724.

361,007,181. 393,580,226.

VICKIE BARROW-KLEIN, CFO

MARGARET A. BRADSHAW P00501222

KPMG LLP 13-5565207

345 PARK AVENUE

NEW YORK, NY 10154-0102 (212) 758-9700

X

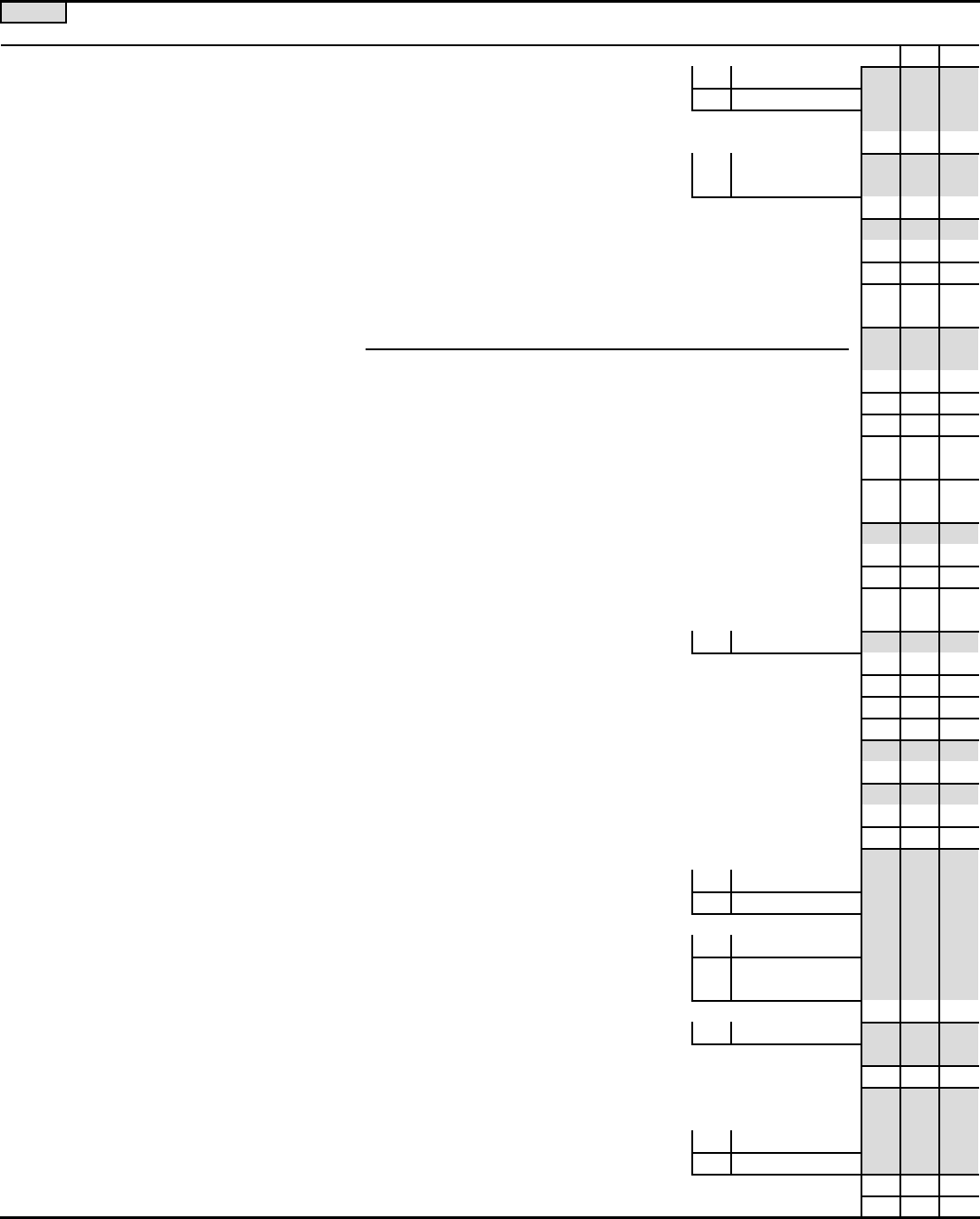

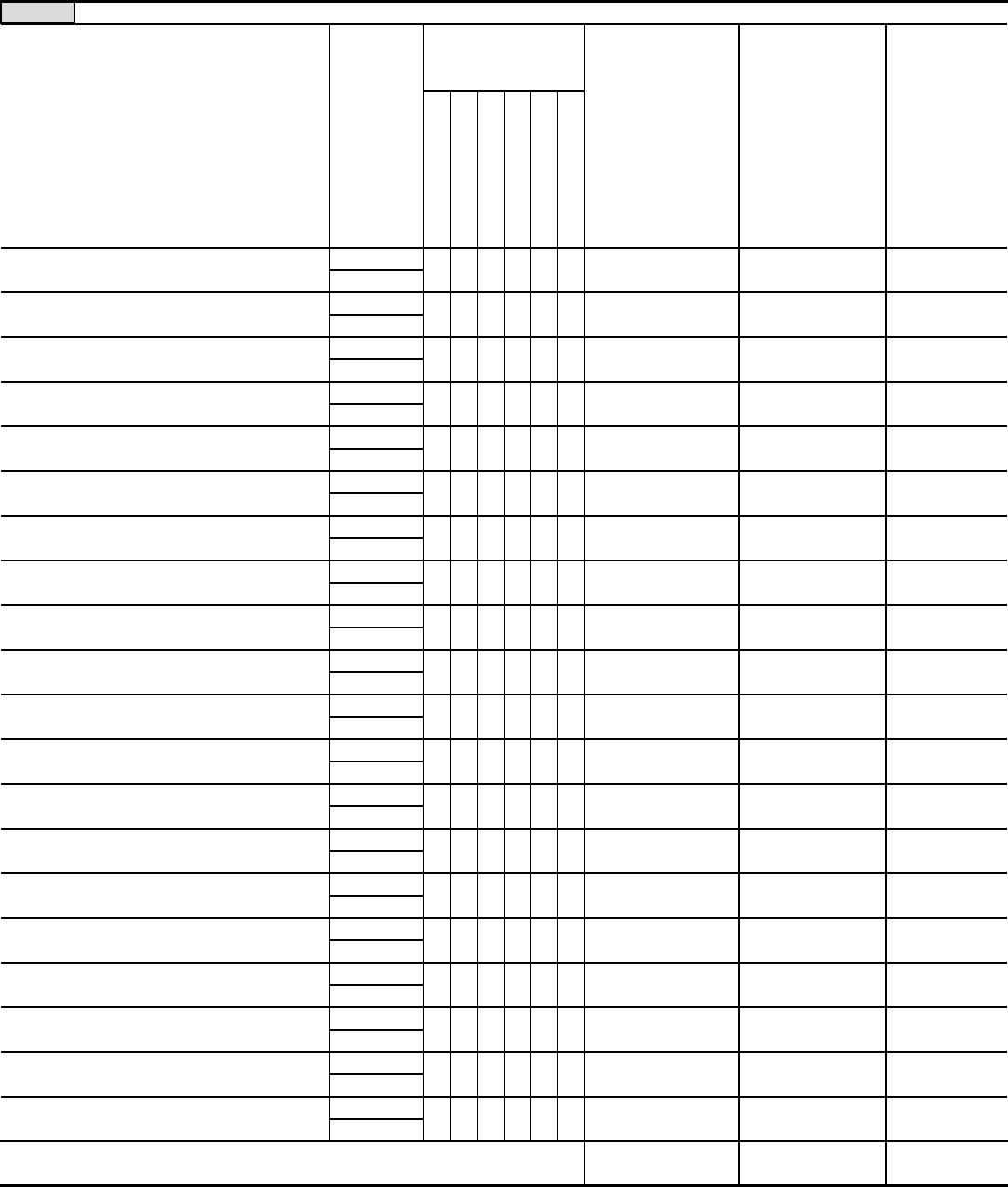

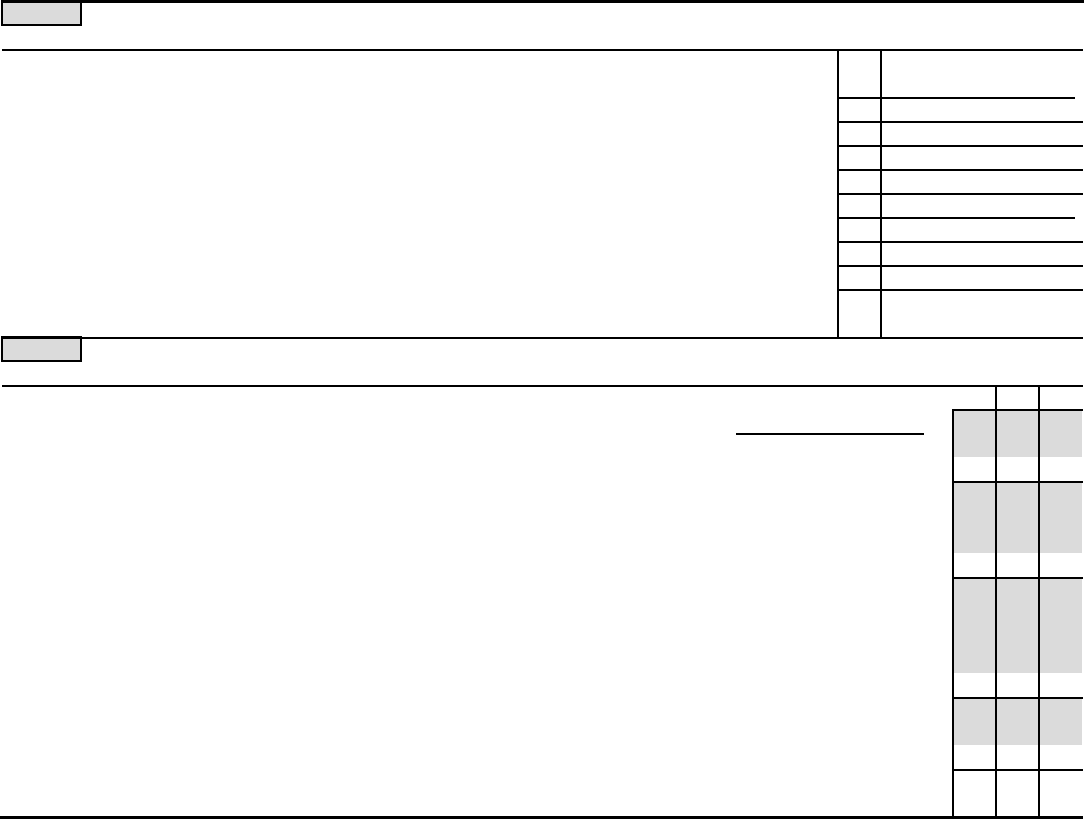

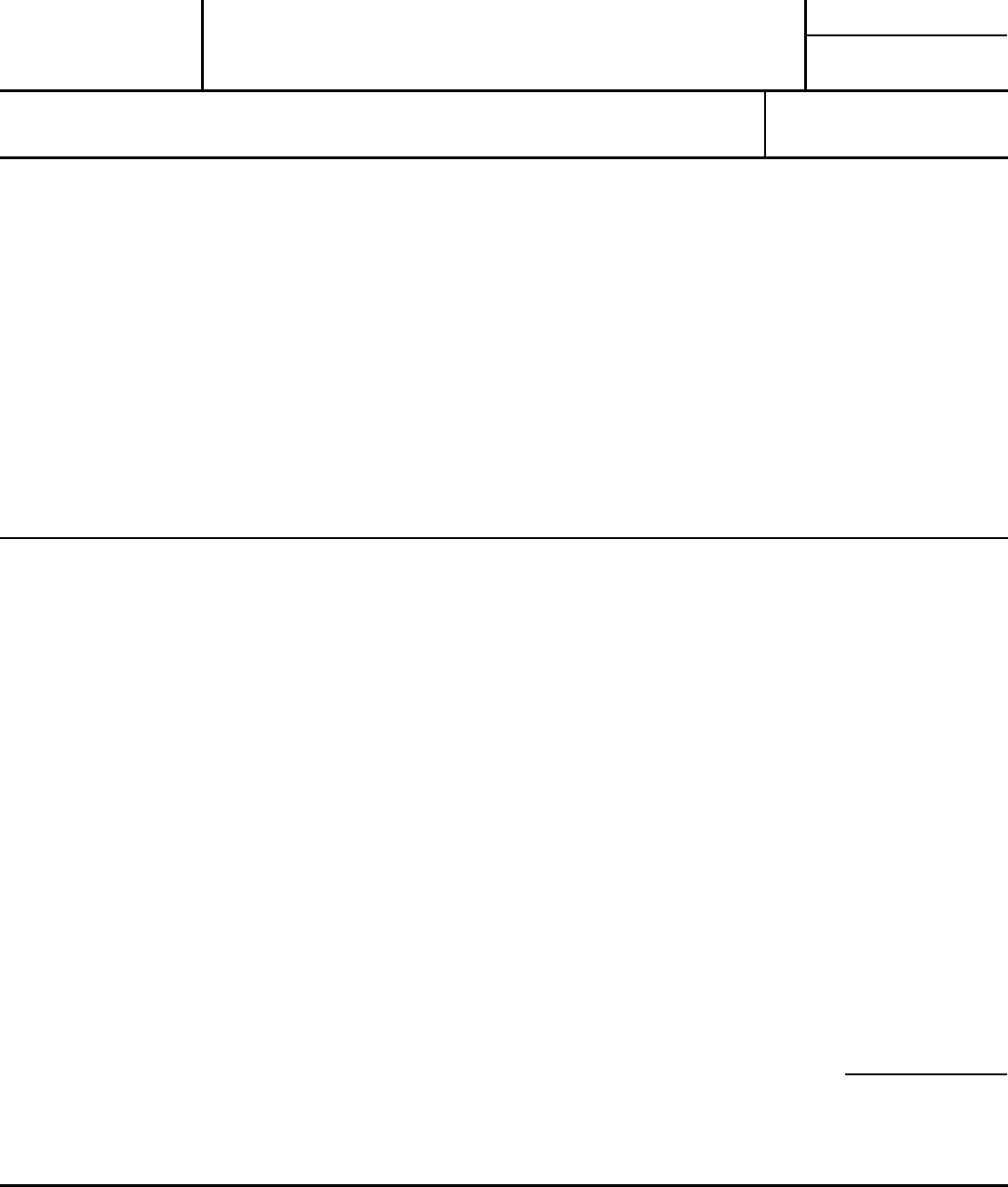

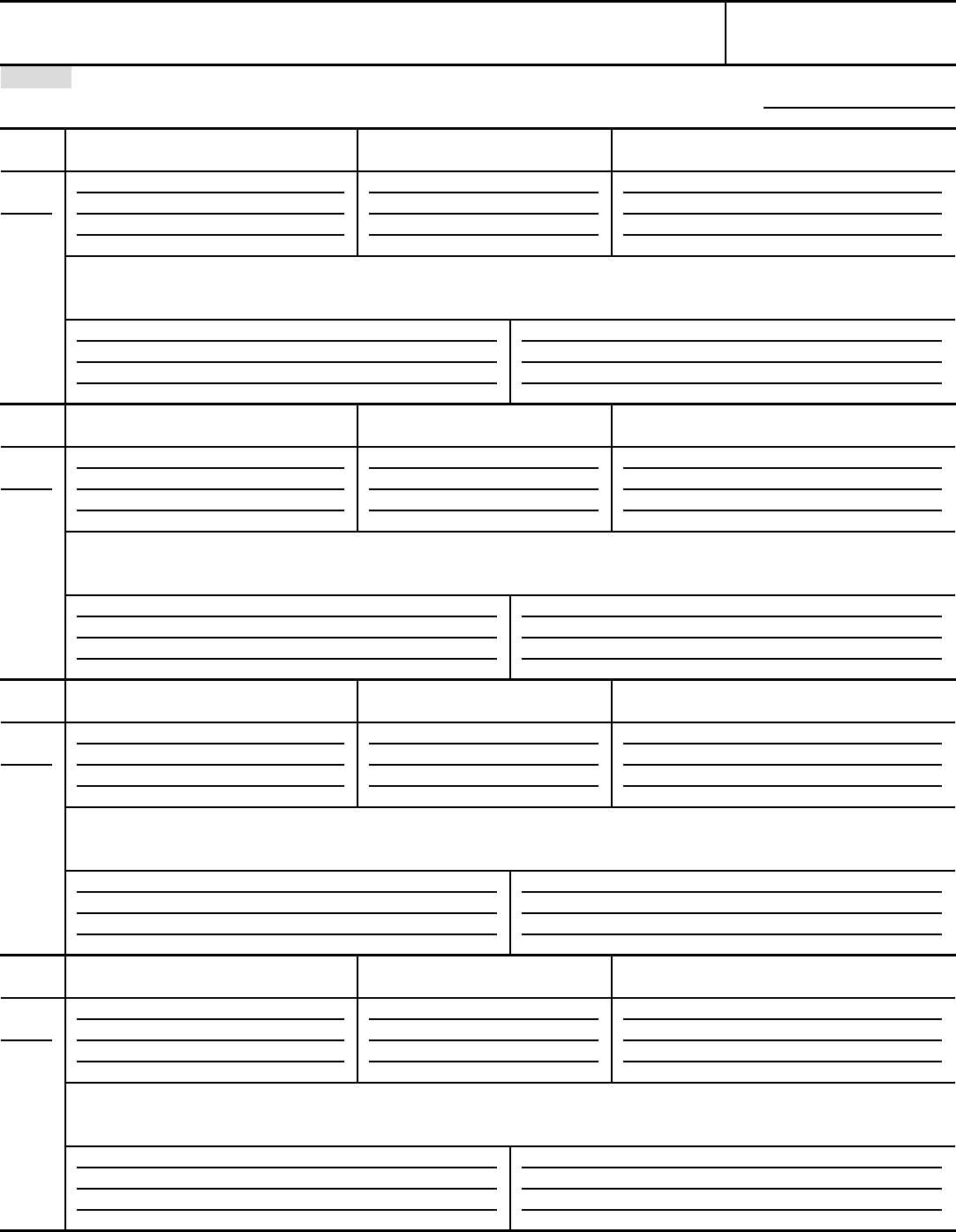

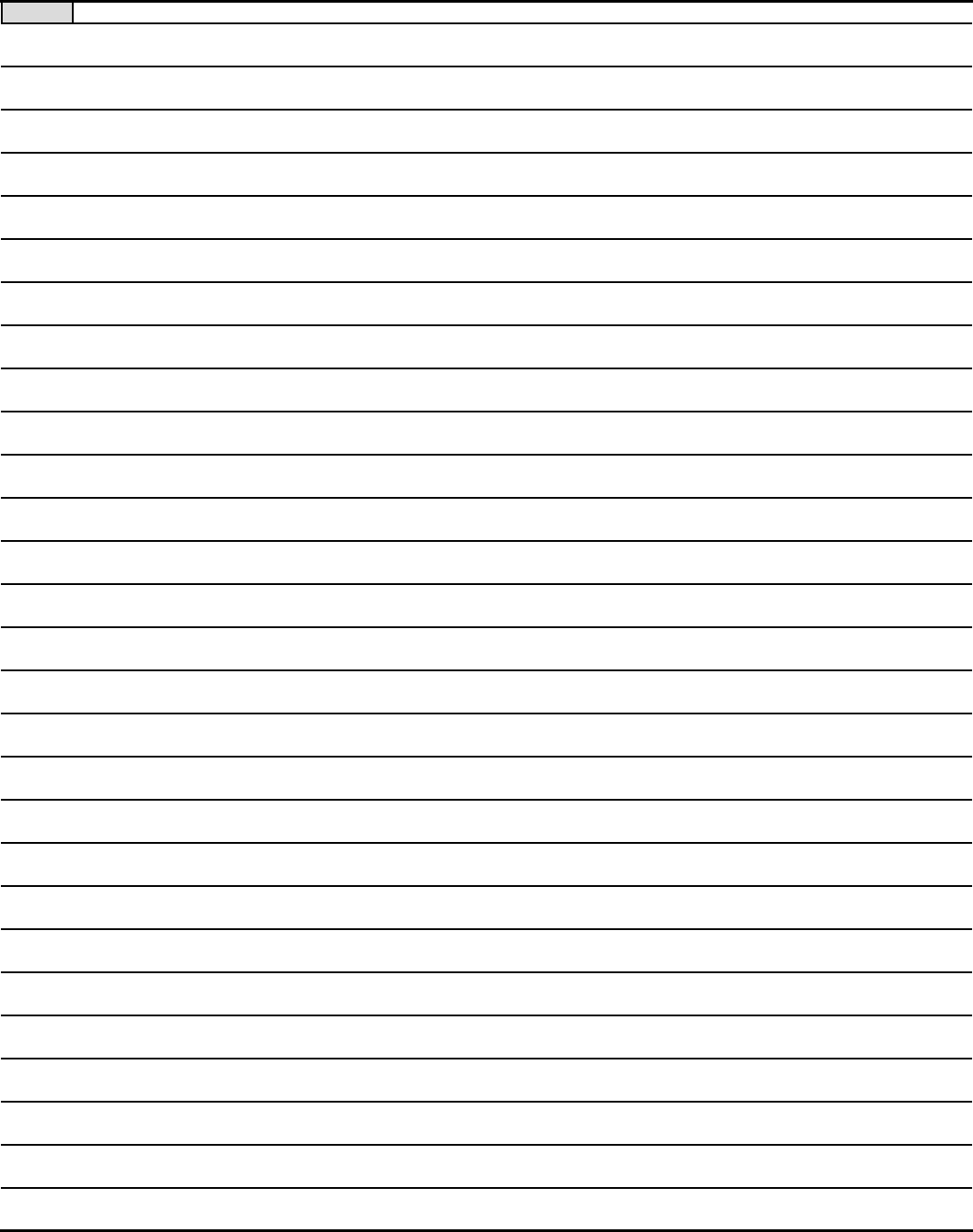

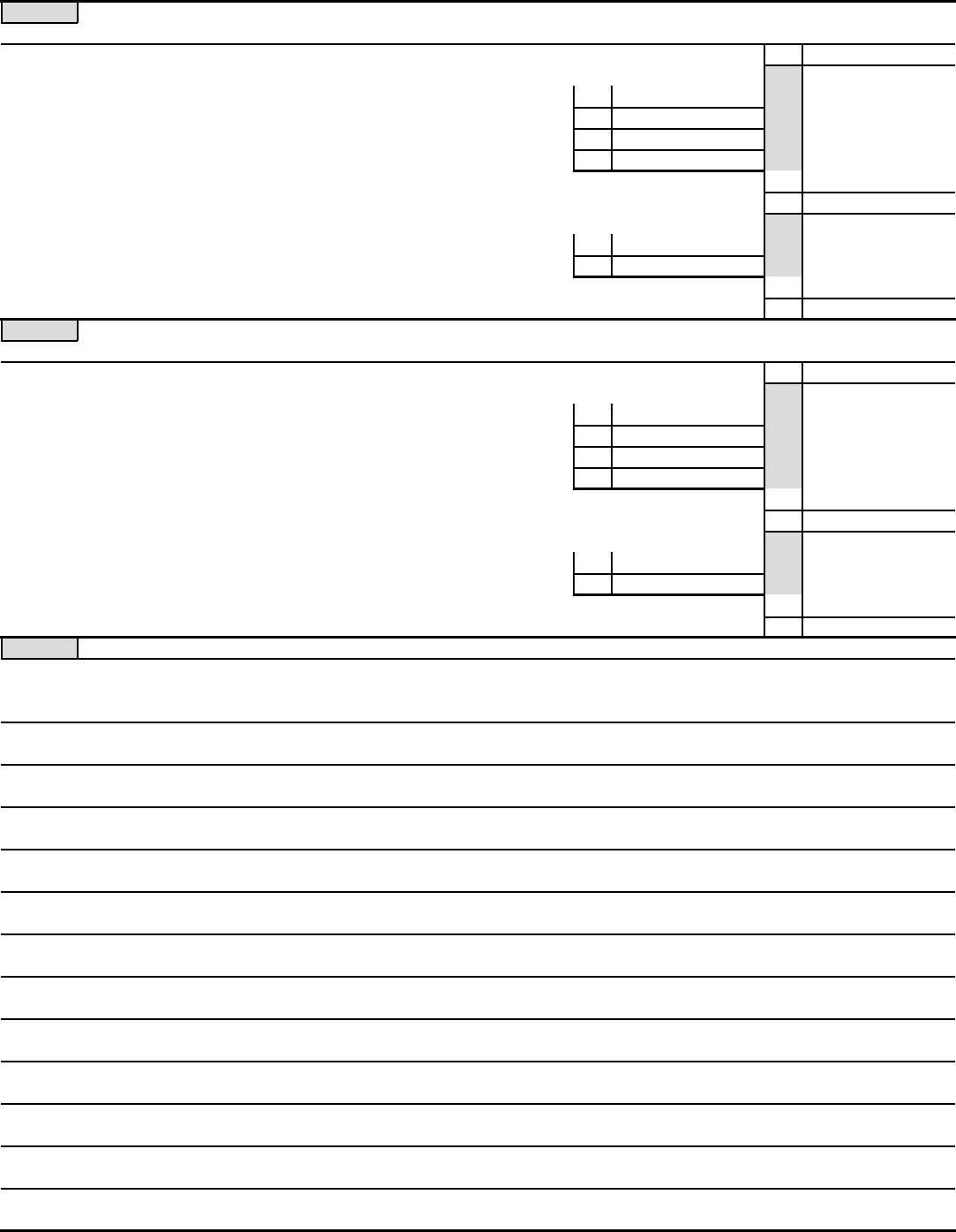

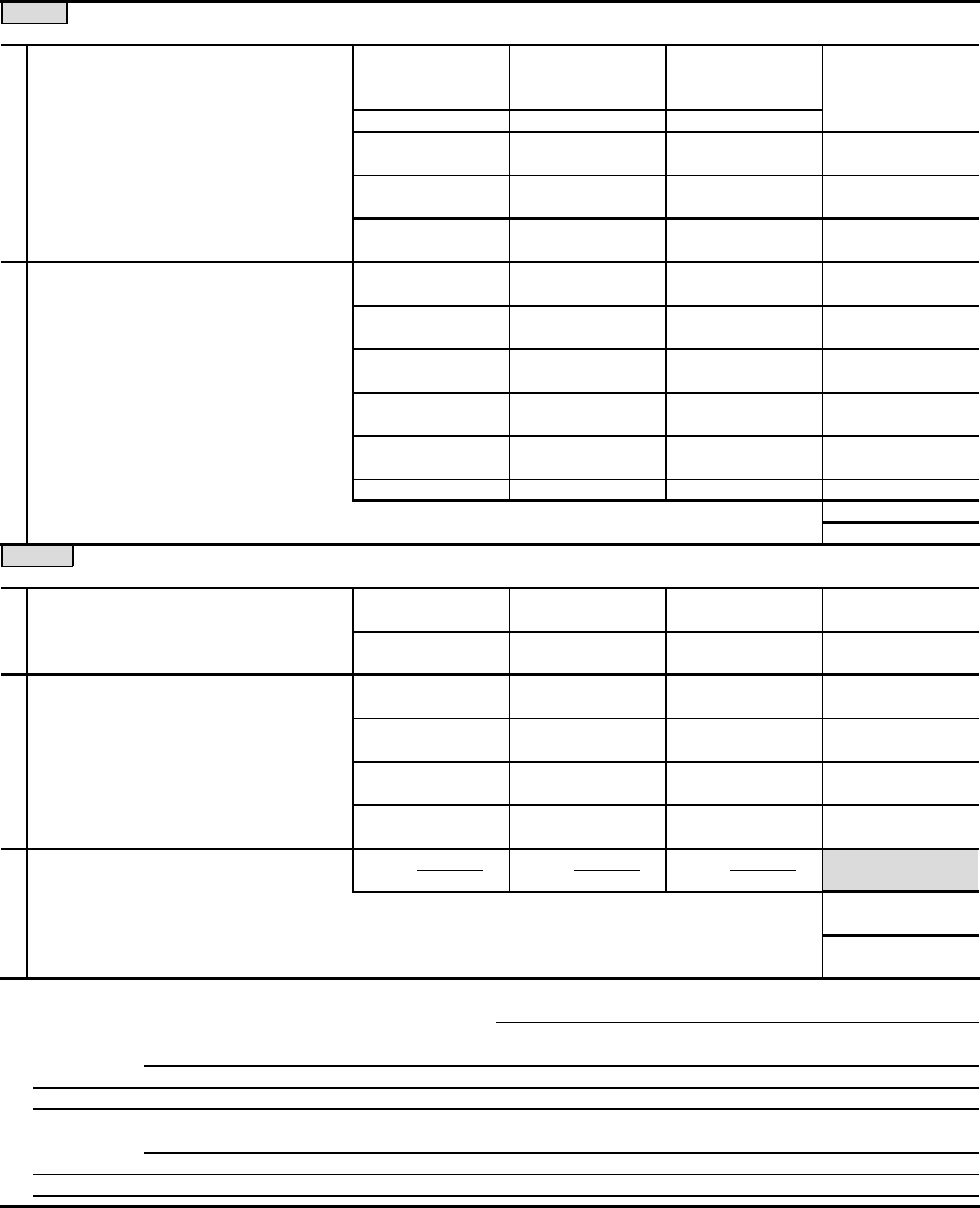

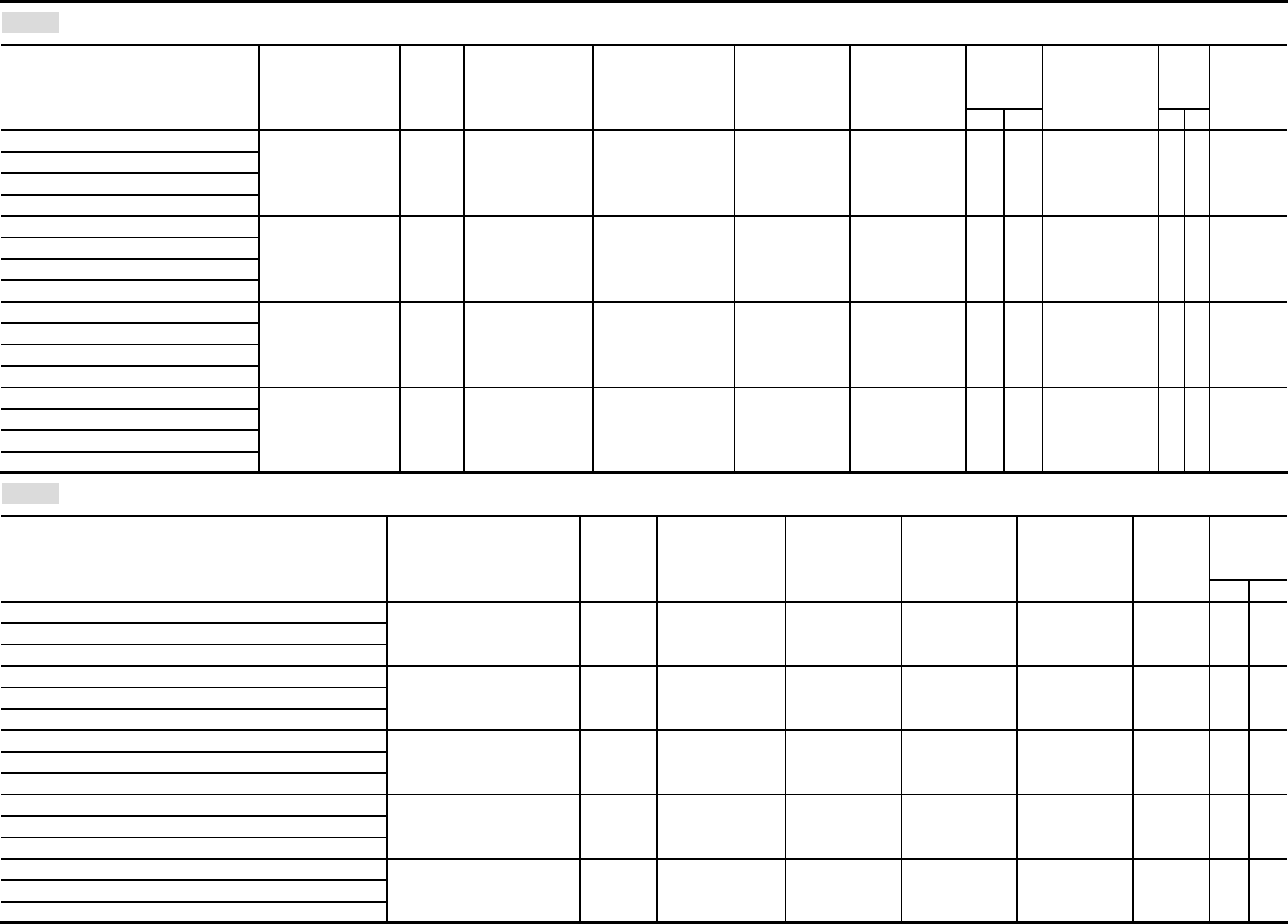

OMB No. 1545-1879

For calendar year 2017, or tax year beginning , 2017, and ending , 20

Department of the Treasury

Internal Revenue Service

Date Check if

also paid

preparer

Check

if self-

employed

ERO's SSN or PTIN

ERO's

signature

Firm's name (or

yours if self-employed),

address, and ZIP code

EIN

Phone no.

723061 11-09-17

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

For use with Forms 990, 990-EZ, 990-PF, 1120-POL, and 8868

Employer identification number

1a, 2a, 3a, 4a, 5a 1b, 2b, 3b, 4b, 5b,

Do not

1a

2a

3a

4a

5a

b Total revenue, 1b

2b

3b

4b

5b

Form 990

Form 990-EZ b Total revenue,

Form 1120-POL

b Total tax

Form 990-PF b Tax based on investment income

Form 8868 b Balance due

6

(a) (b) (c)

8453-EO

e-file

Check if self-

employed

PTIN

Print/Type preparer's name Preparer's signature Date

Firm's name

Firm's EIN

Firm's address

Phone no.

Form

Name of exempt organization

(Whole Dollars Only)

Check the box for the type of return being filed with Form 8453-EO and enter the applicable amount, if any, from the return. If you check the box on

line or below and the amount on that line of the return being filed with this form was blank, then leave line or

whichever is applicable, blank (do not enter -0-). If you entered -0- on the return, then enter -0- on the applicable line below. complete more

than one line in Part I.

if any (Form 990, Part VIII, column (A), line 12) ~~~~~~

check here

check here if any (Form 990-EZ, line 9) ~~~~~~~~~~~~~~

check here

(Form 1120-POL, line 22) ~~~~~~~~~~~~~~~~~

check here (Form 990-PF, Part VI, line 5) ~~~

check here (Form 8868, line 3c) ~~~~~~~~~~~~~~~~~~~~

I authorize the U.S. Treasury and its designated Financial Agent to initiate an Automated Clearing House (ACH) electronic funds withdrawal

(direct debit) entry to the financial institution account indicated in the tax preparation software for payment of the organization's federal

taxes owed on this return, and the financial institution to debit the entry to this account. To revoke a payment, I must contact the U.S.

Treasury Financial Agent at 1-888-353-4537 no later than 2 business days prior to the payment (settlement) date. I also authorize the financial

institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to answer inquiries

and resolve issues related to the payment.

If a copy of this return is being filed with a state agency(ies) regulating charities as part of the IRS Fed/State program, I certify that I

executed the electronic disclosure consent contained within this return allowing disclosure by the IRS of this Form 990/990-EZ/990-PF

(as specifically identified in Part I above) to the selected state agency(ies).

Under penalties of perjury, I declare that I am an officer of the above named organization and that I have examined a copy of the organization's 2017

electronic return and accompanying schedules and statements, and, to the best of my knowledge and belief, they are true, correct, and complete. I

further declare that the amount in Part I above is the amount shown on the copy of the organization's electronic return. I consent to allow my

intermediate service provider, transmitter, or electronic return originator (ERO) to send the organization's return to the IRS and to receive from the IRS

an acknowledgement of receipt or reason for rejection of the transmission, the reason for any delay in processing the return or refund, and

the date of any refund.

Signature of officer Date Title

(see instructions)

I declare that I have reviewed the above organization's return and that the entries on Form 8453-EO are complete and correct to the best of my

knowledge. If I am only a collector, I am not responsible for reviewing the return and only declare that this form accurately reflects the data on the

return. The organization officer will have signed this form before I submit the return. I will give the officer a copy of all forms and information to be

filed with the IRS, and have followed all other requirements in Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS Providers

for Business Retur

ns. If I am also the Paid Preparer, under penalties of perjury I declare that I have examined the above organization's return and

accompanying schedules and statements, and, to the best of my knowledge and belief, they are true, correct, and complete. This Paid Preparer

declaration is based on all information of which I have any knowledge.

Under penalties of perjury, I declare that I have examined the above return and accompanying schedules and statements, and, to the best of my know-

ledge and belief, they are true, correct, and complete. Declaration of preparer is based on all information of which the preparer has any knowledge.

Form (2017)

LHA

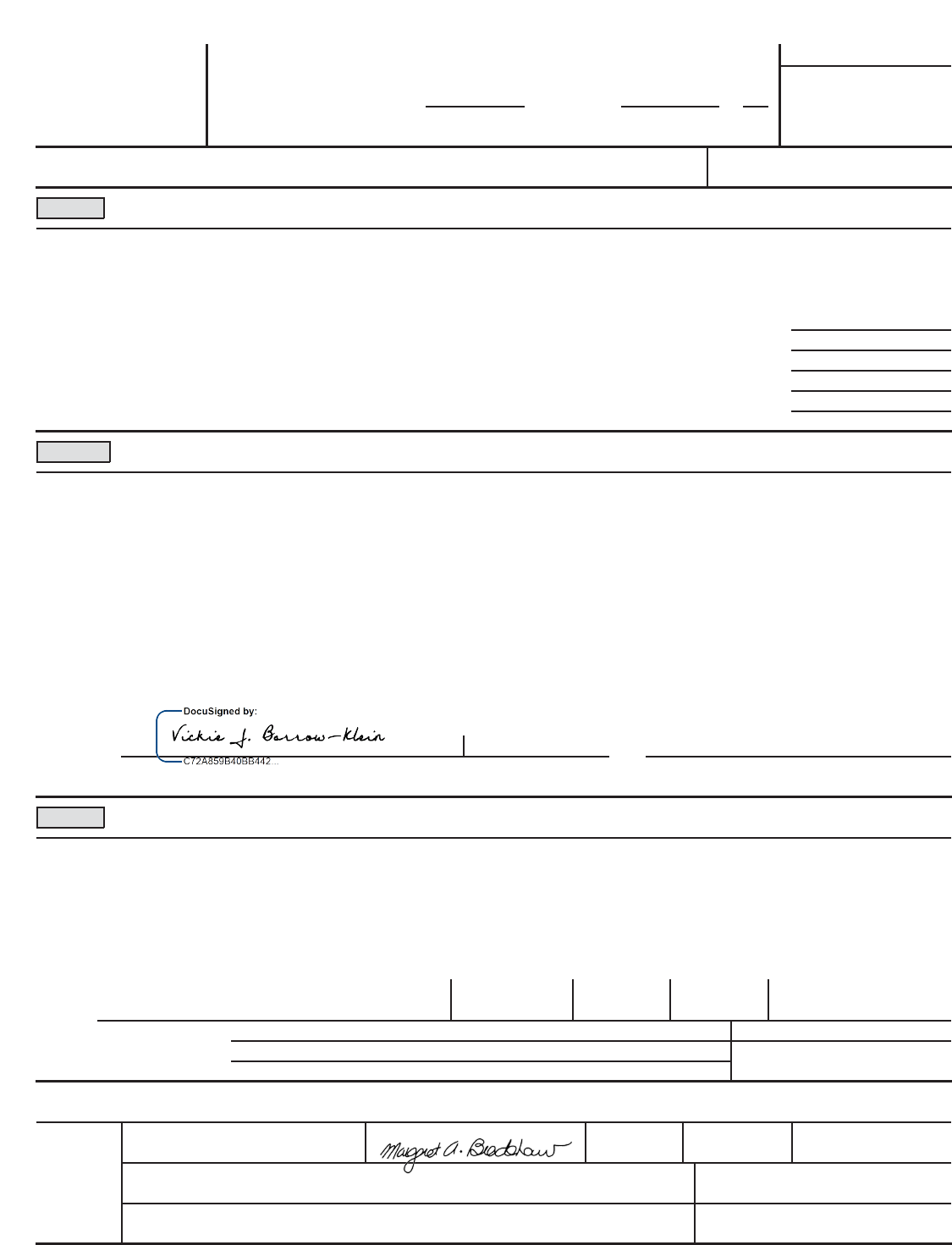

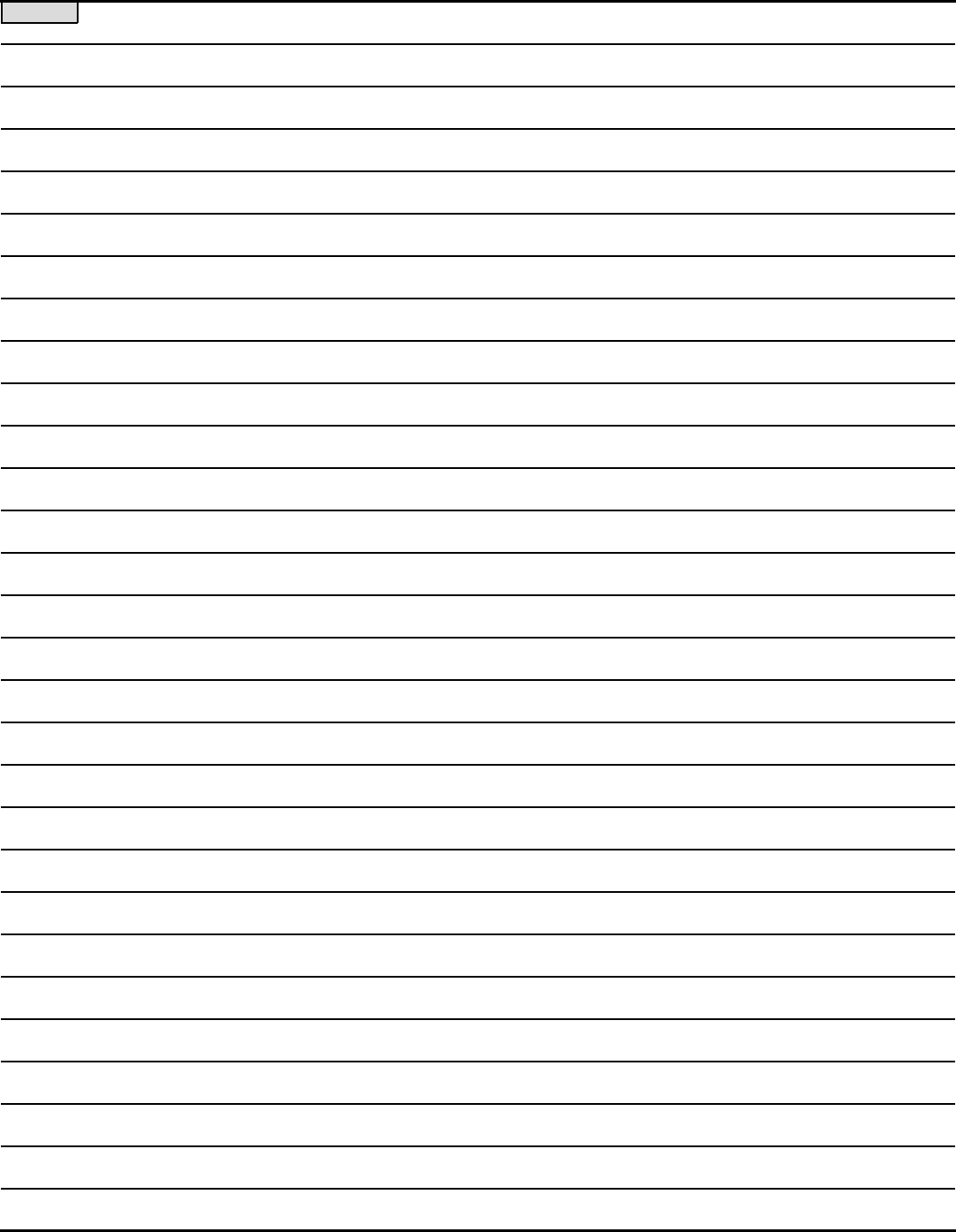

Exempt Organization Declaration and Signature for

Electronic Filing

Part I

Type of Return and Return Information

Part II

Declaration of Officer

Sign

Here

Part III

Declaration of Electronic Return Originator (ERO) and Paid Preparer

ERO's

Use

Only

Paid

Preparer

Use Only

8453-EO

2017

J

J

J

J

J

==

=

=

9

9

9

JUL 1 JUN 30 18

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X 274,186,594.

CFO

P00501222

13-5565207

KPMG LLP

345 PARK AVENUE

NEW YORK, NY 10154-0102 (212) 758-9700

10000214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

2/14/19

Margaret A. Bradshaw

DocuSign Envelope ID: 05F411E7-FF5A-40C3-A02D-150C19094CF3

2/14/2019

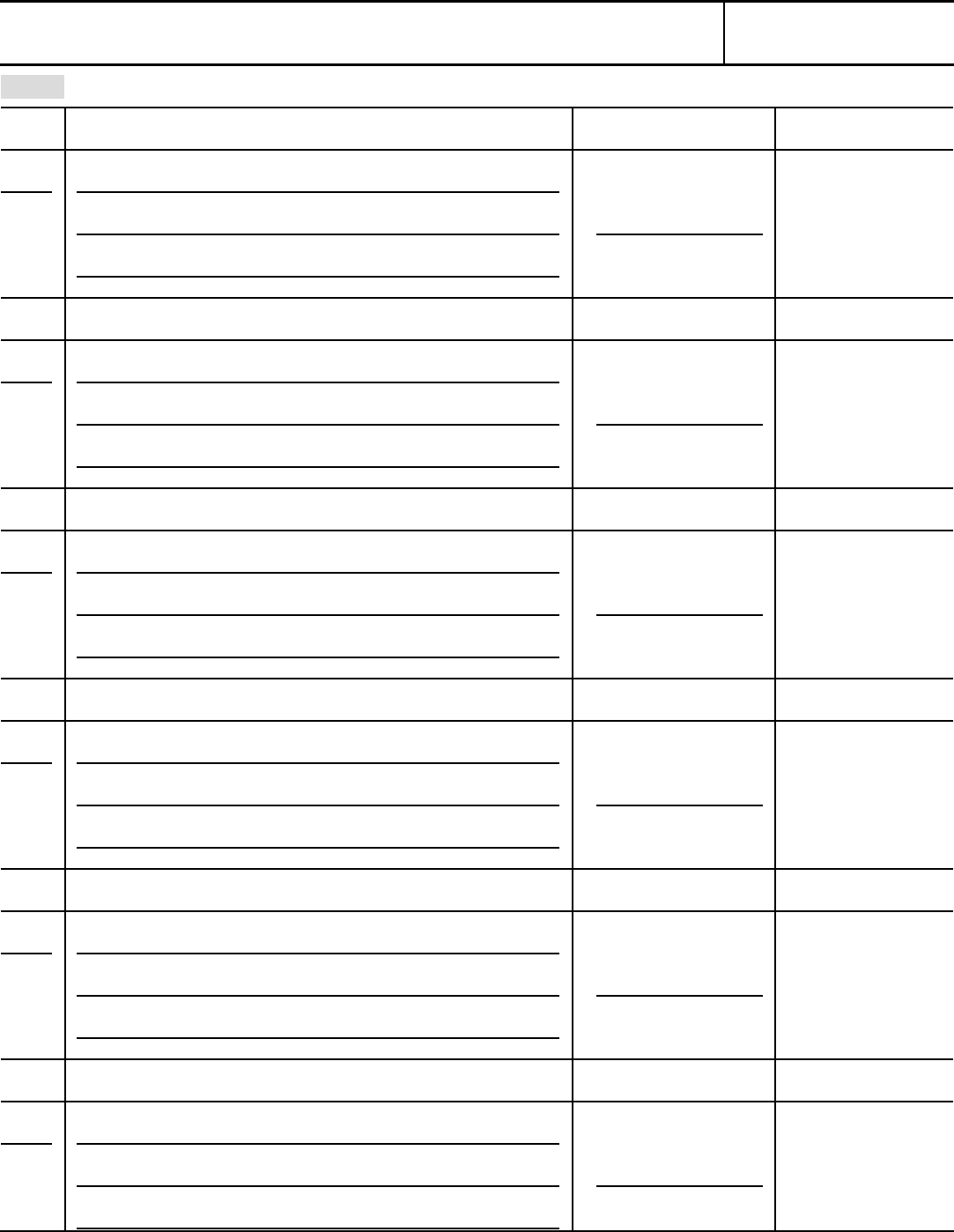

Code: Expenses $ including grants of $ Revenue $

Code: Expenses $ including grants of $ Revenue $

Code: Expenses $ including grants of $ Revenue $

Expenses $ including grants of $ Revenue $

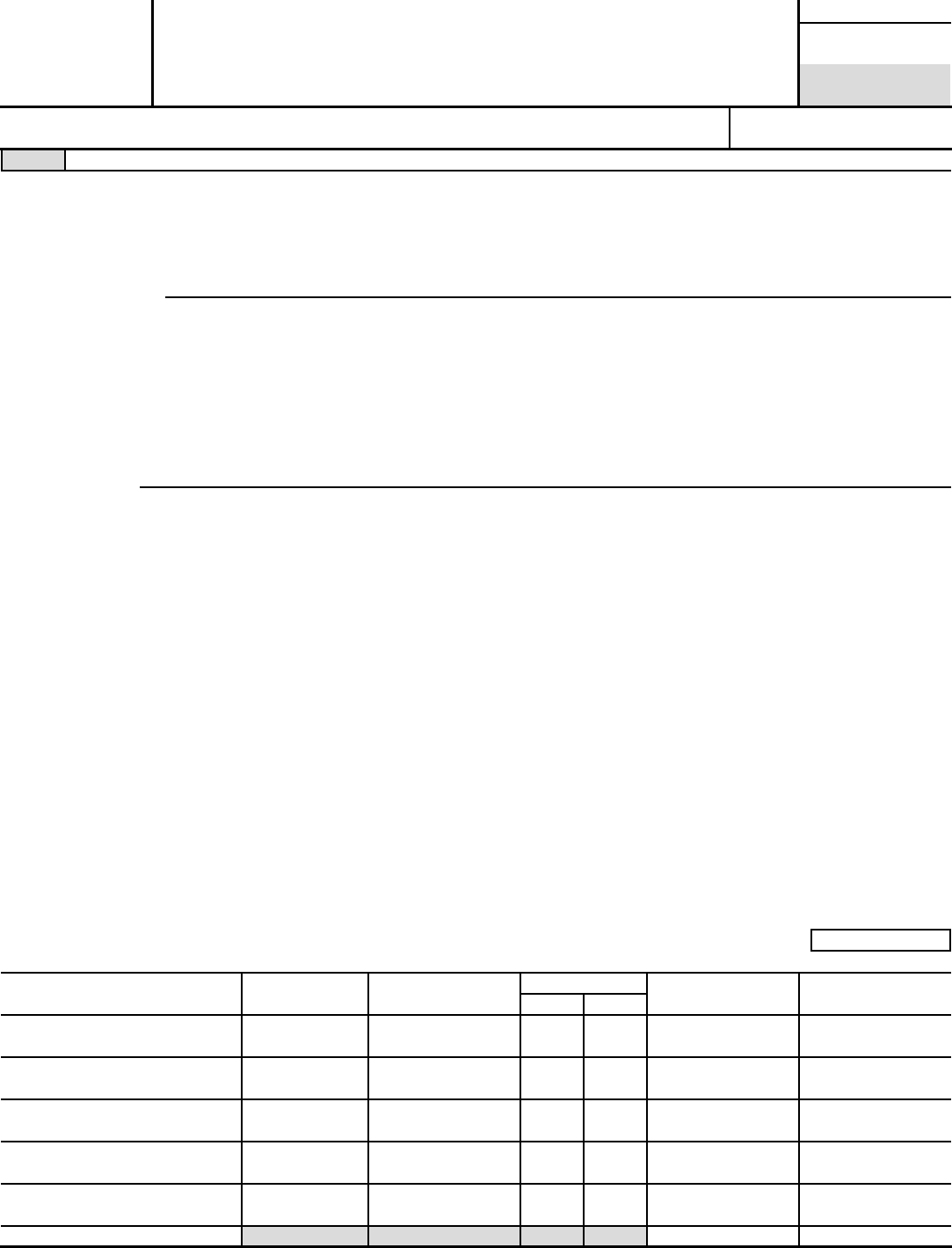

732002 11-28-17

1

2

3

4

Yes No

Yes No

4a

4b

4c

4d

4e

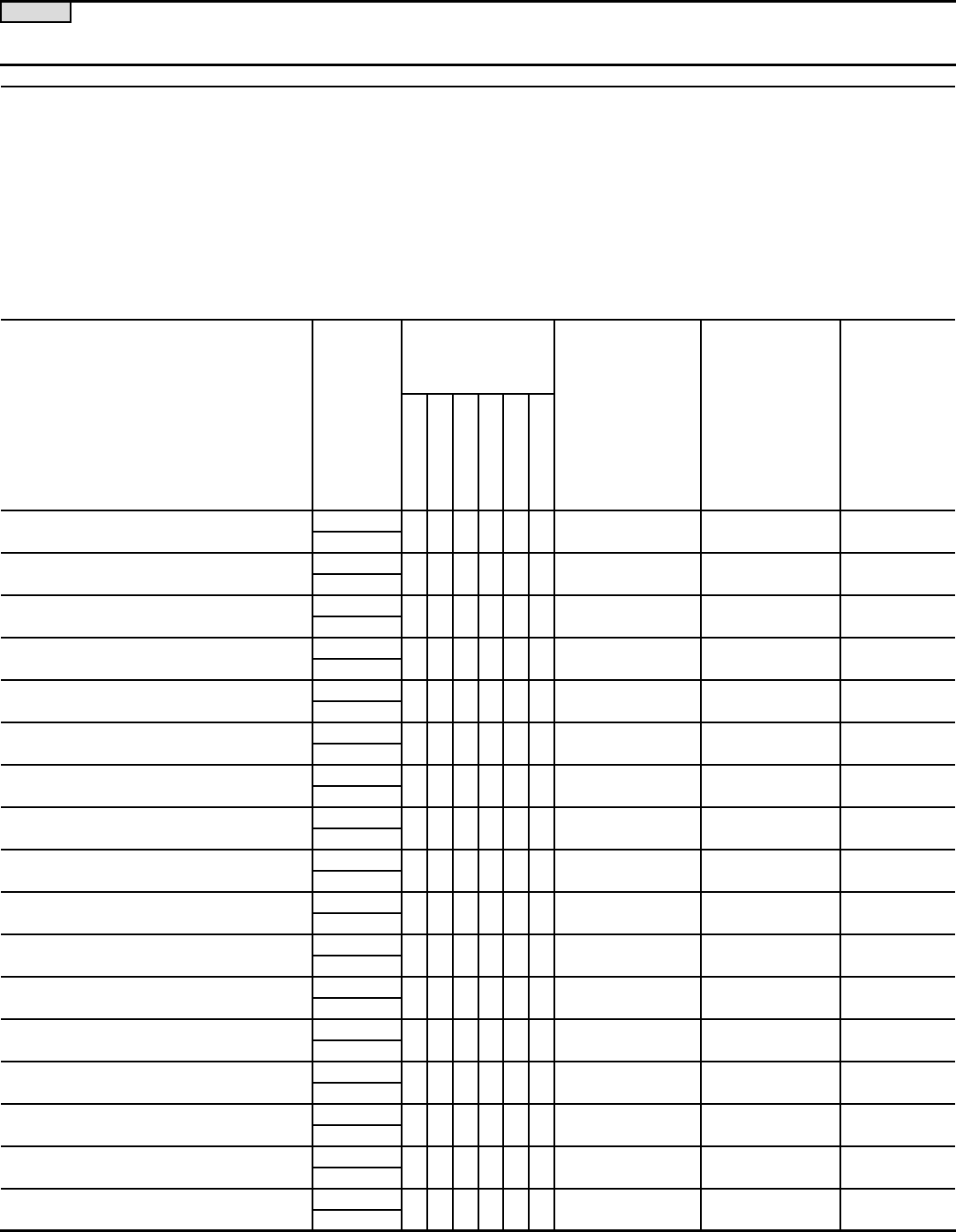

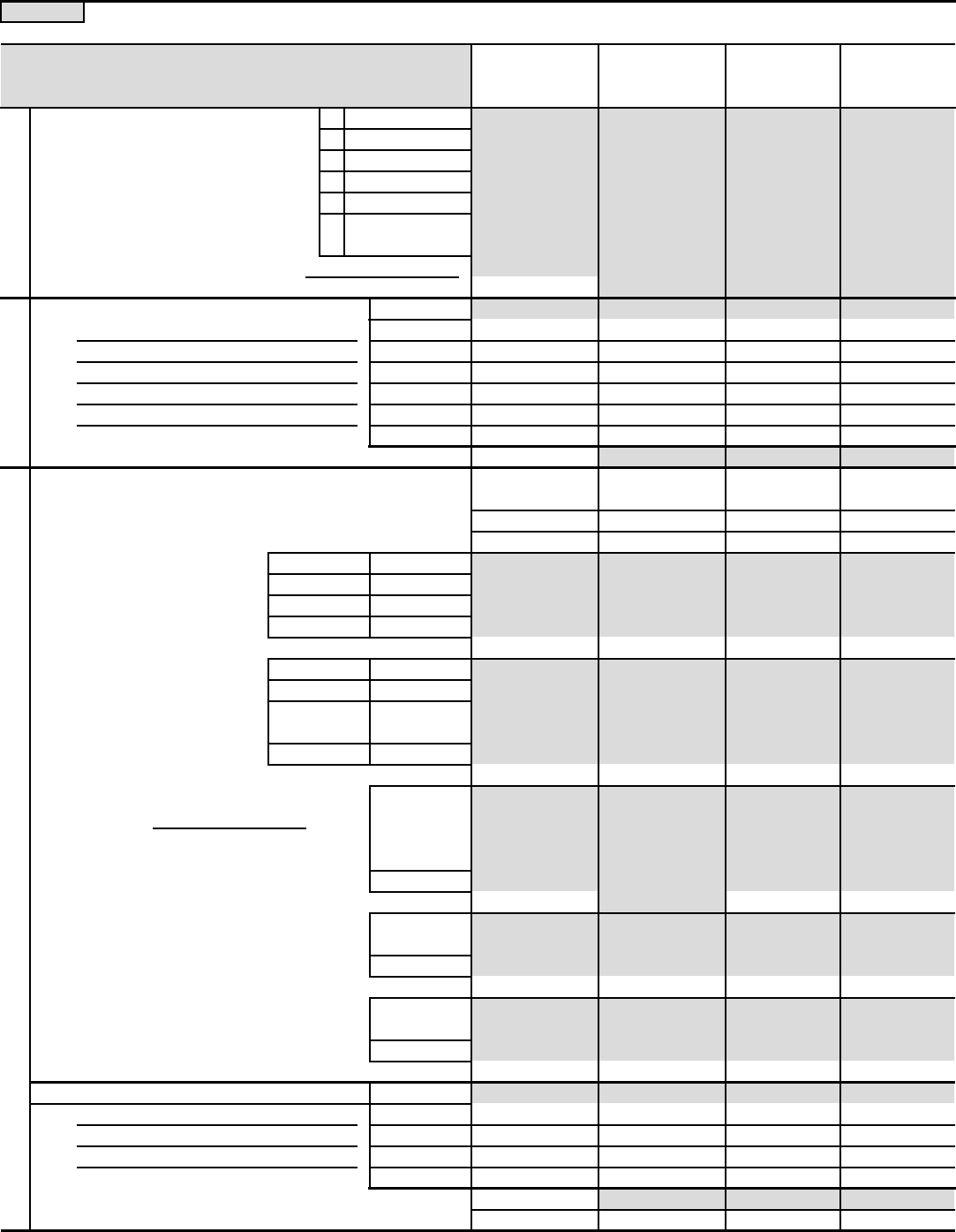

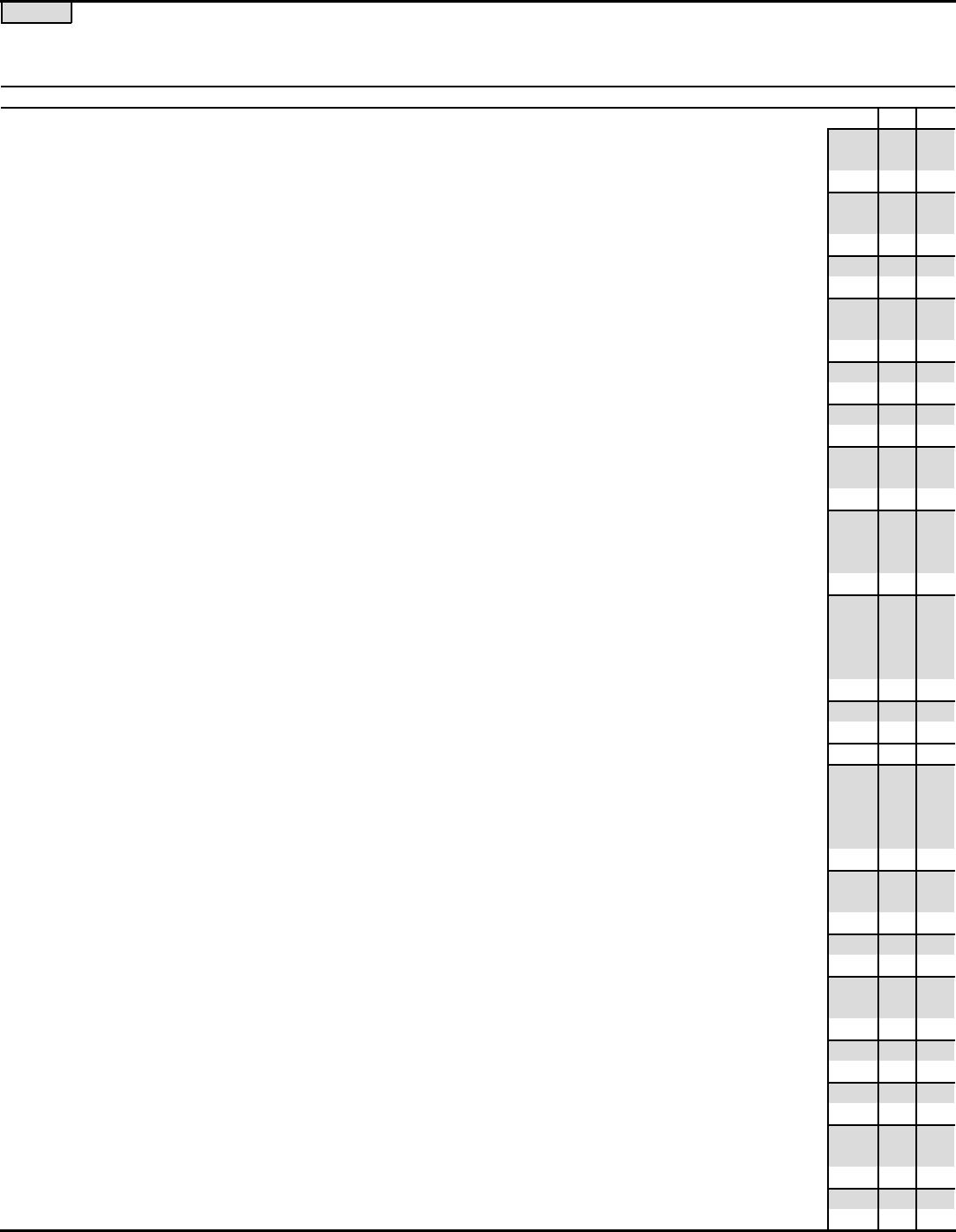

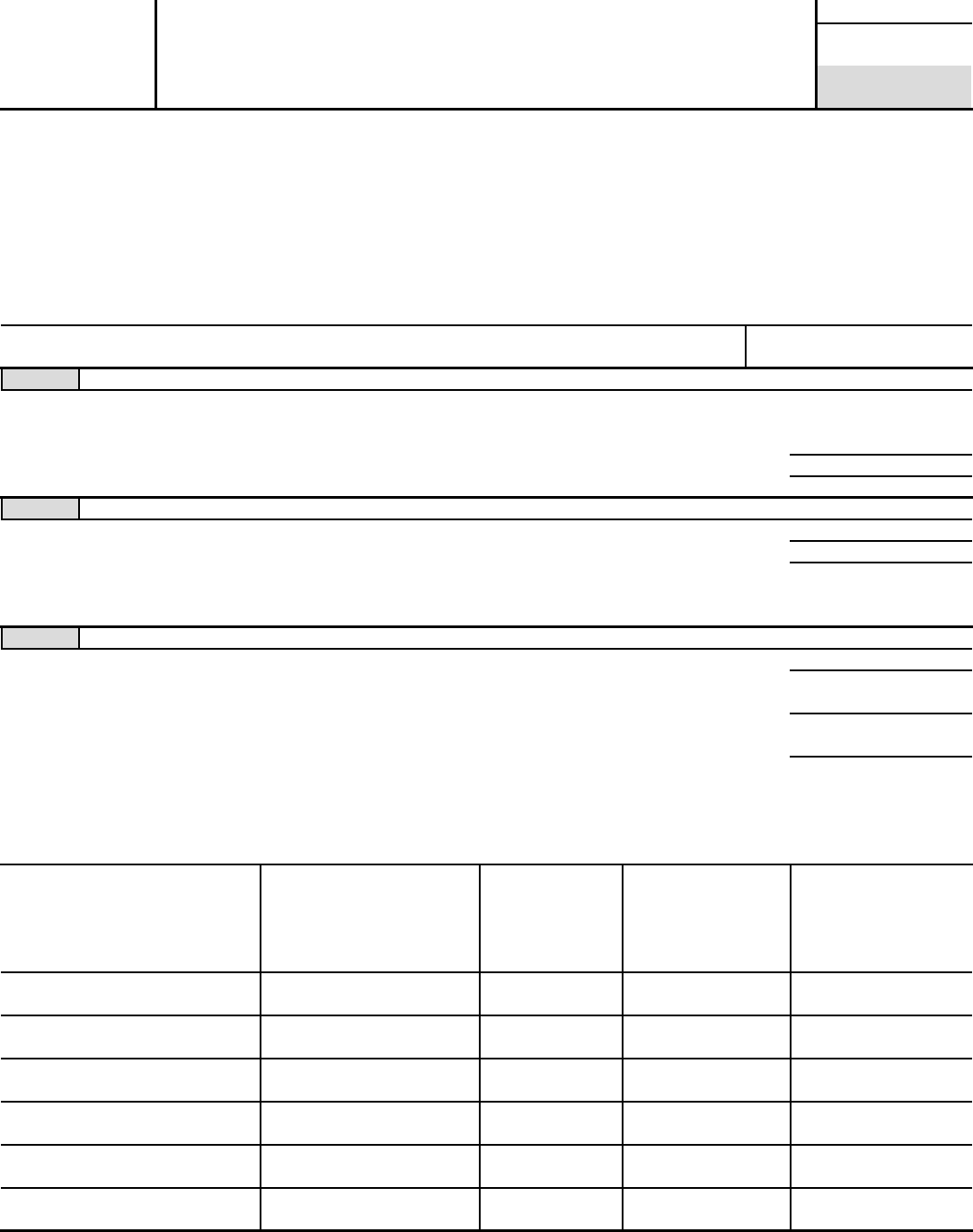

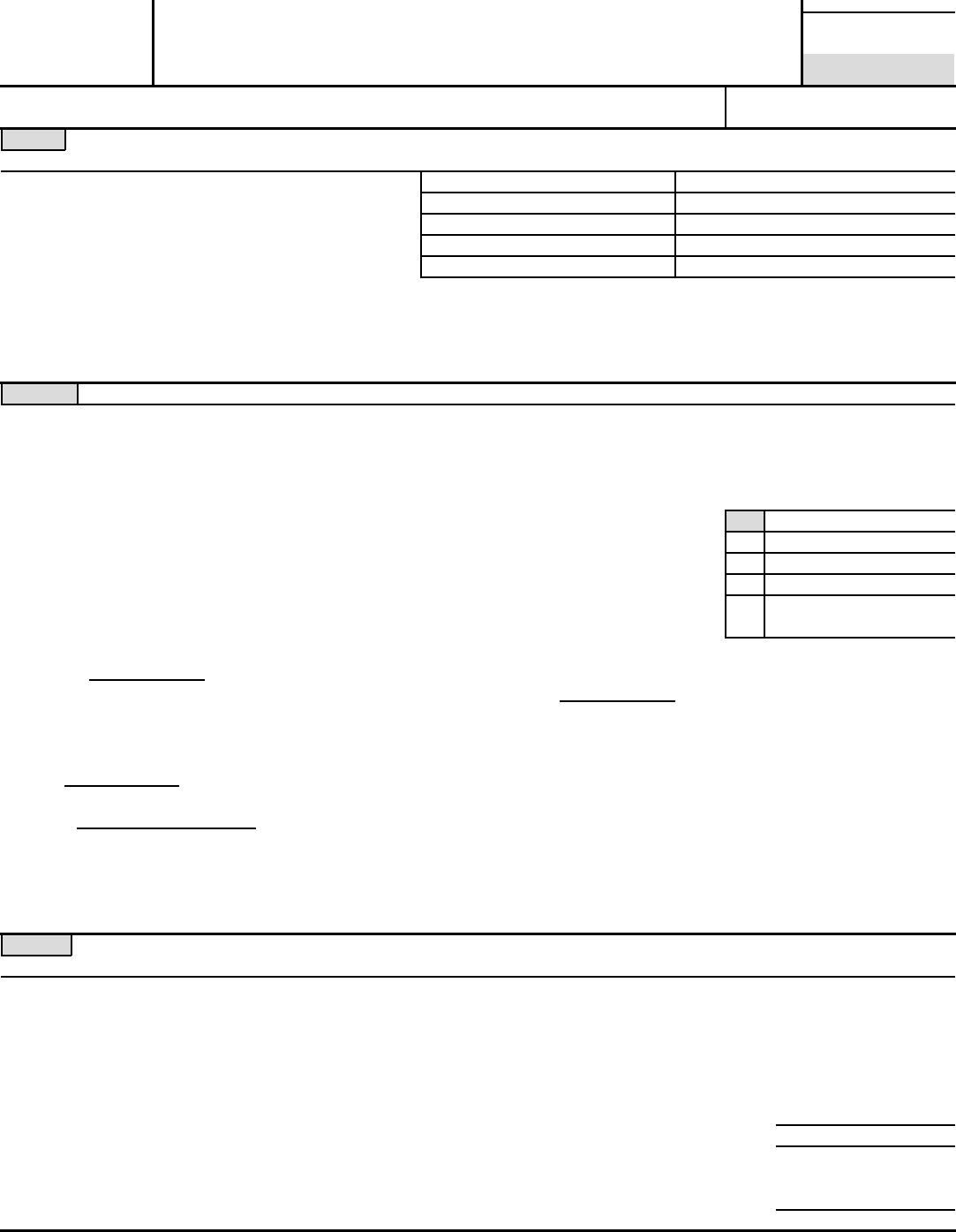

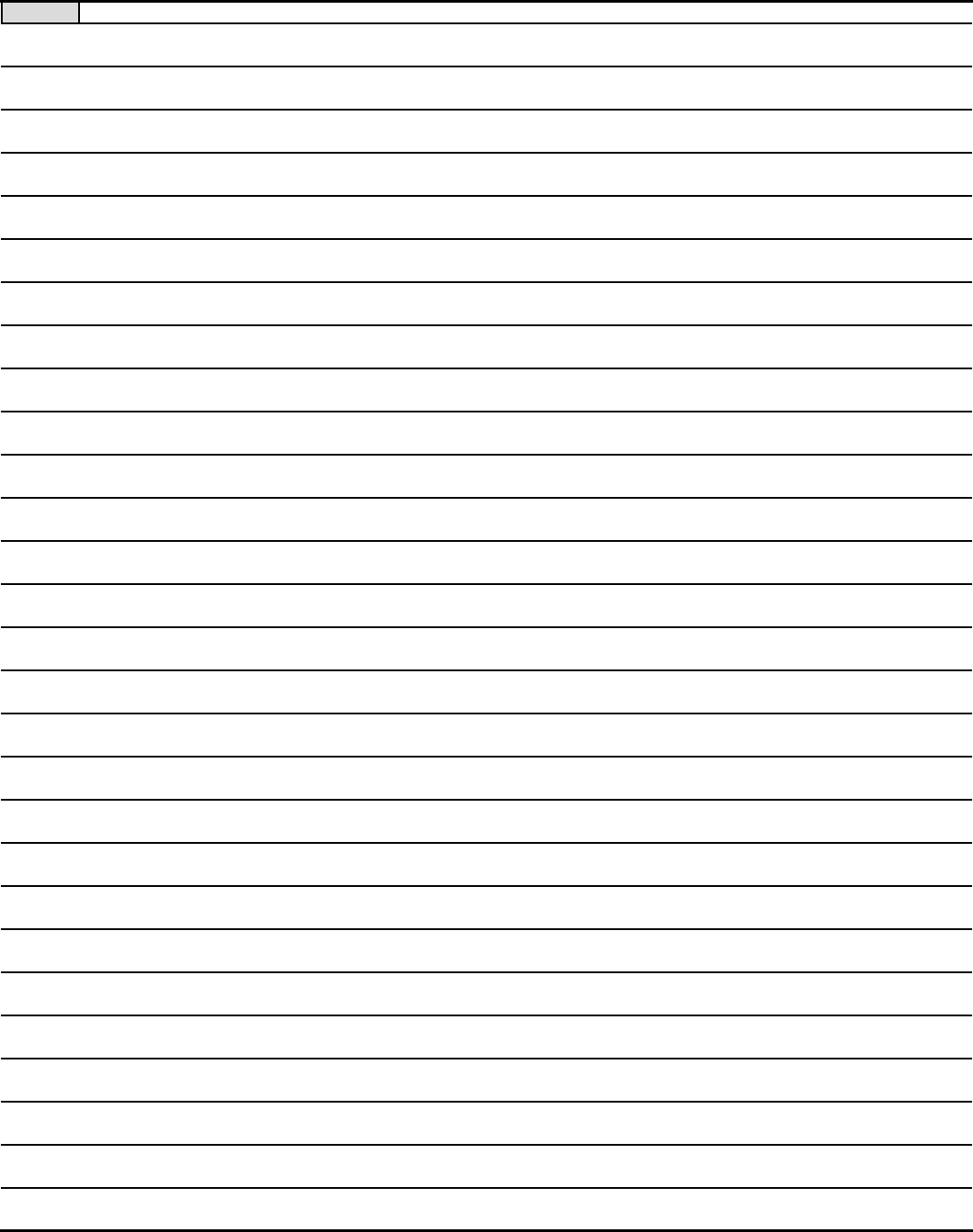

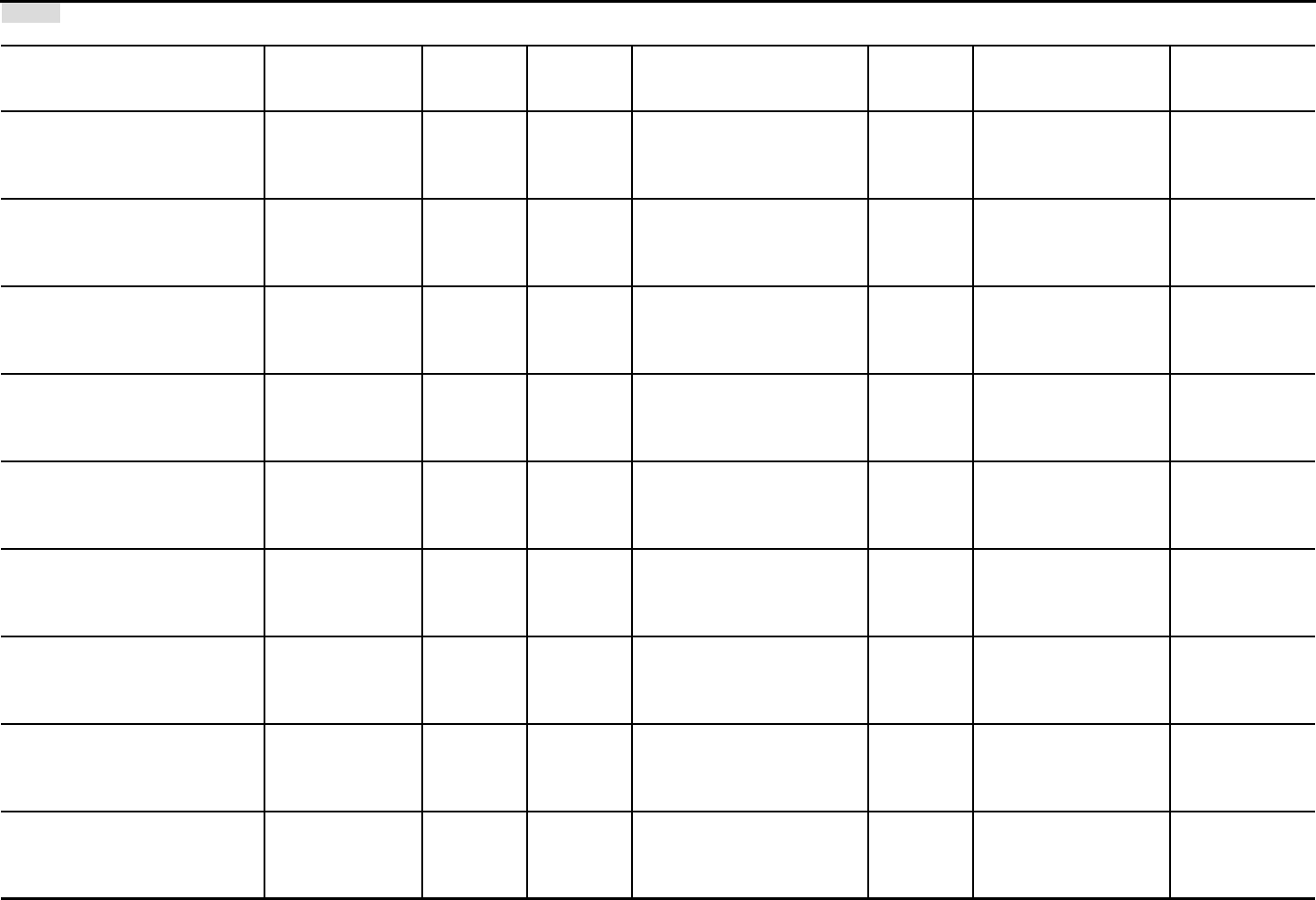

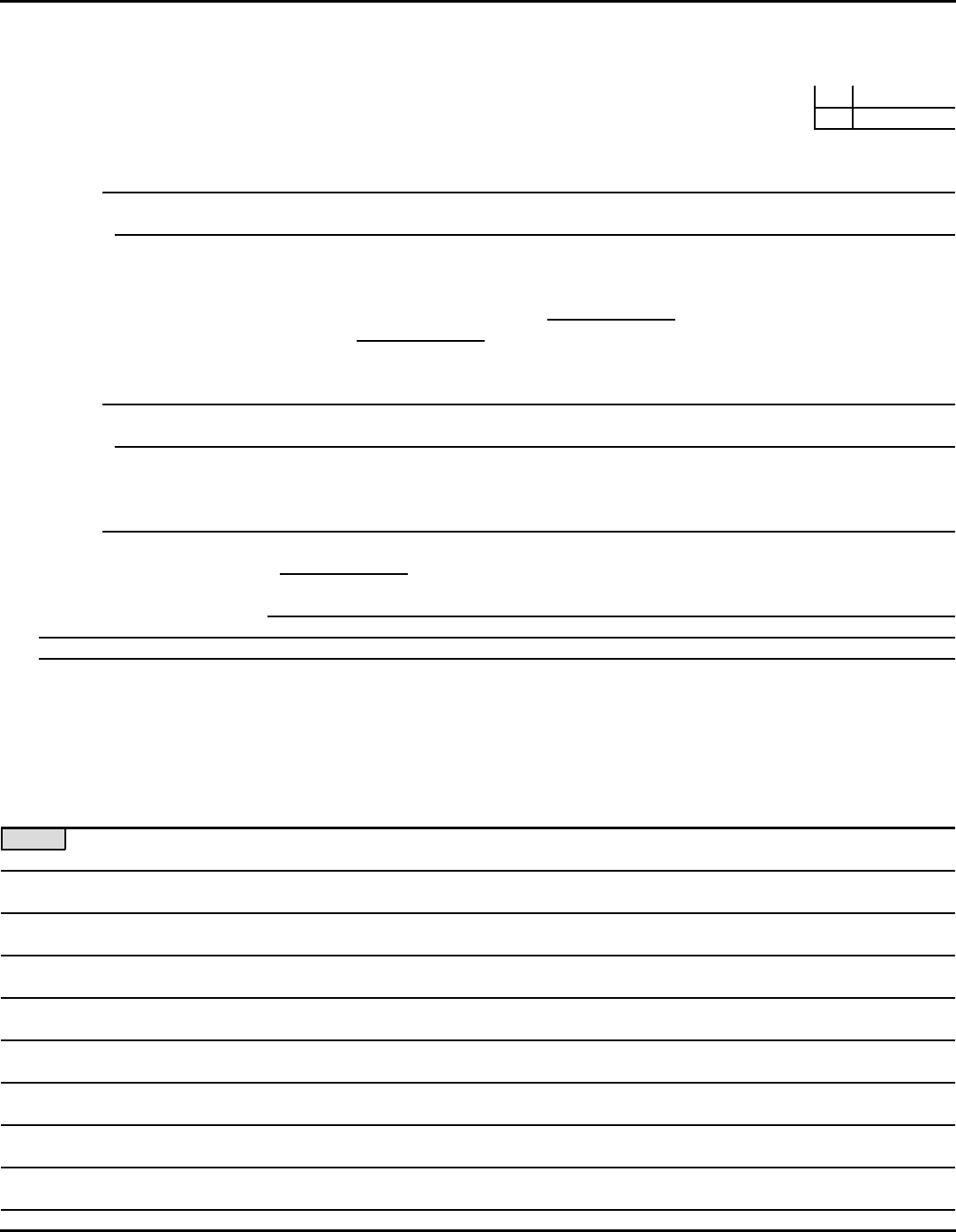

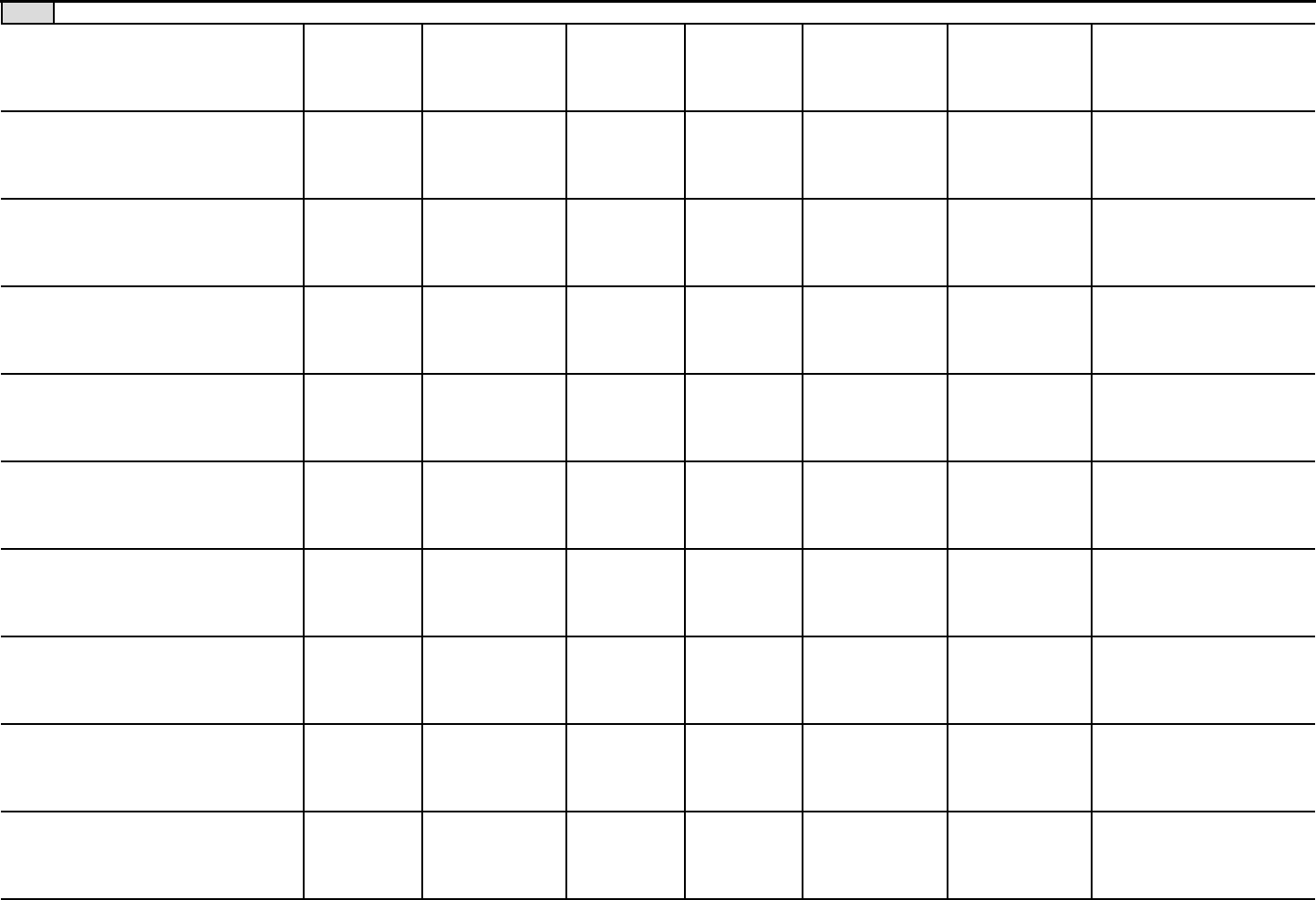

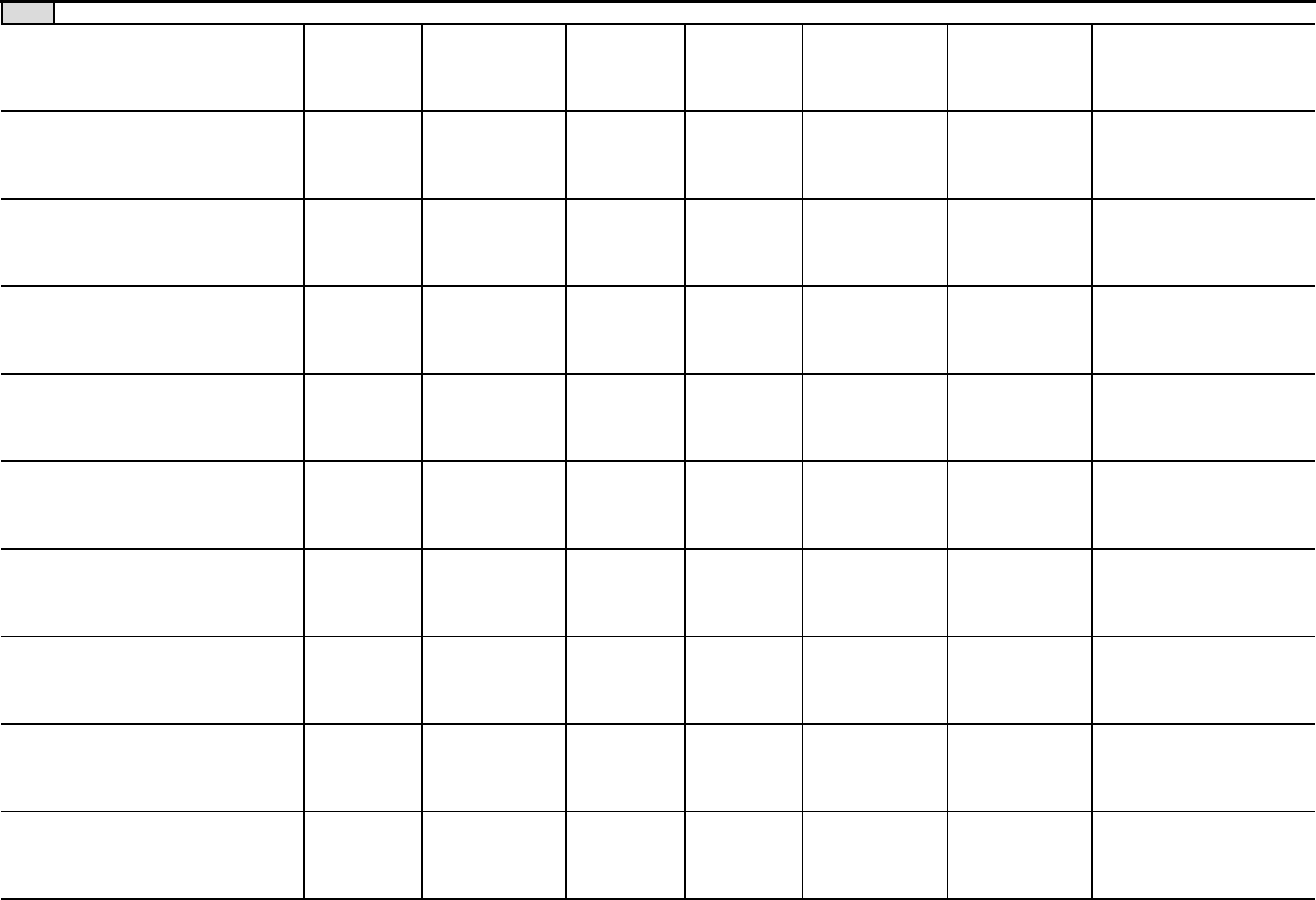

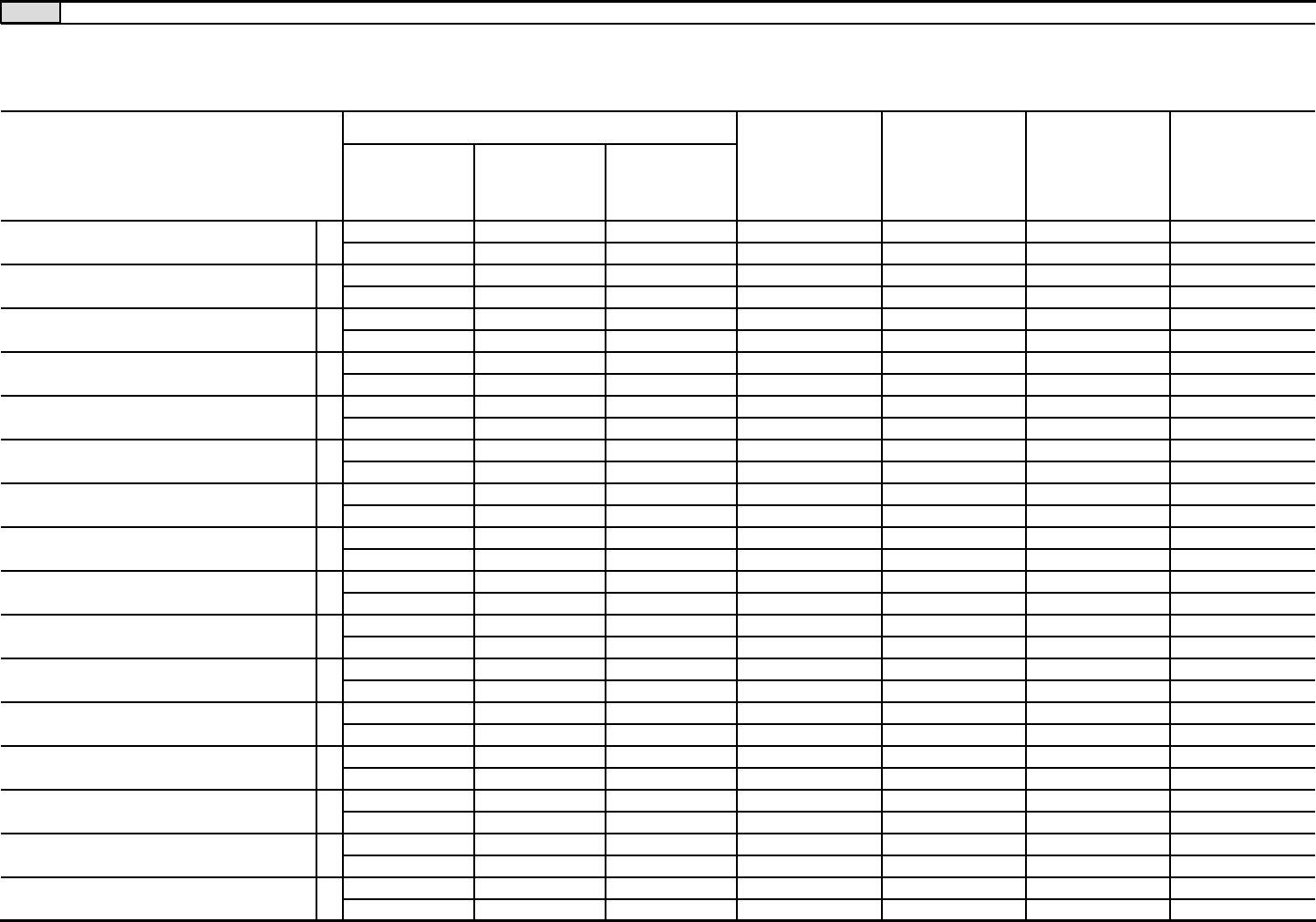

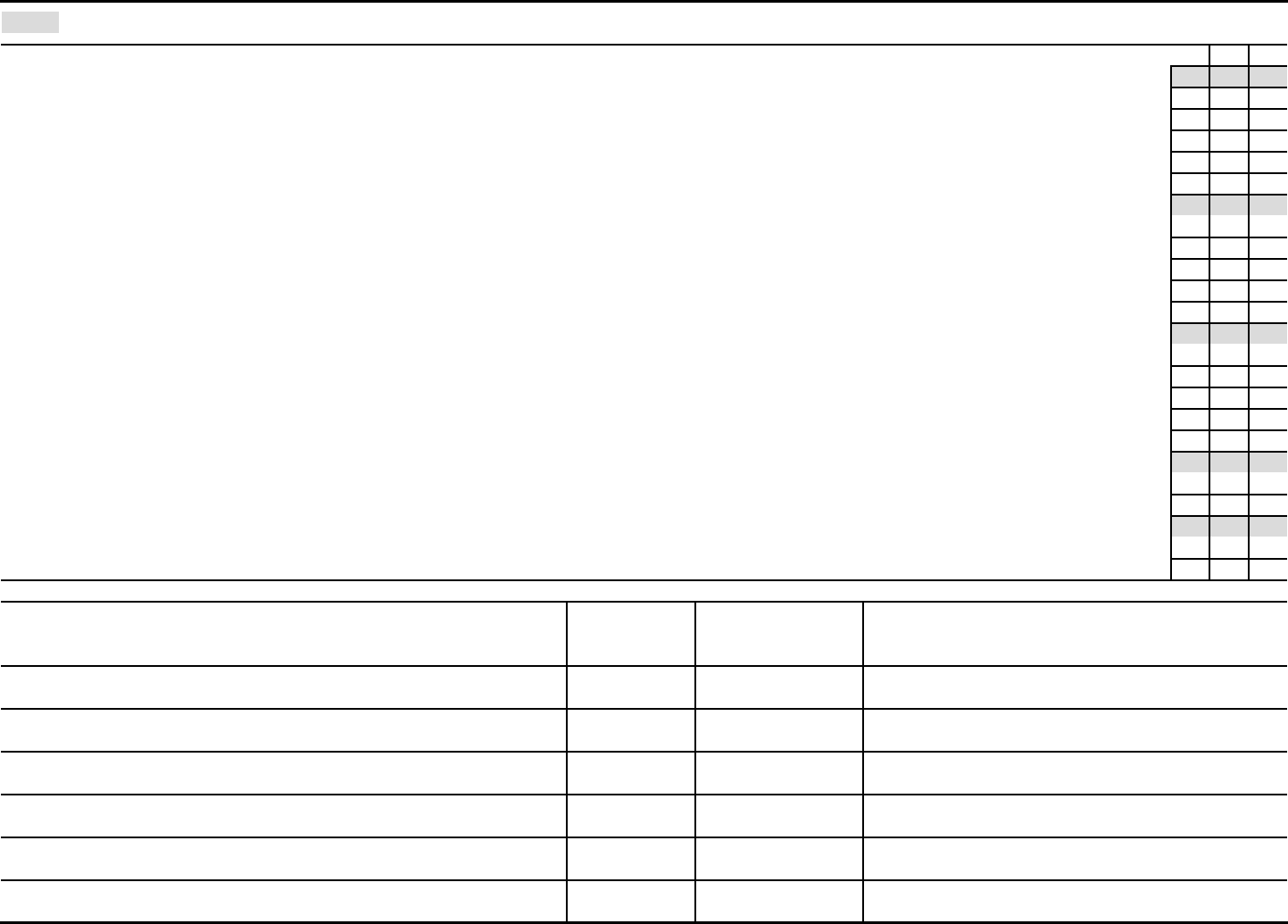

Form 990 (2017) Page

Check if Schedule O contains a response or note to any line in this Part III ••••••••••••••••••••••••••••

Briefly describe the organization's mission:

Did the organization undertake any significant program services during the year which were not listed on the

prior Form 990 or 990-EZ?

If "Yes," describe these new services on Schedule O.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization cease conducting, or make significant changes in how it conducts, any program services?

If "Yes," describe these changes on Schedule O.

~~~~~~

Describe the organization's program service accomplishments for each of its three largest program services, as measured by expenses.

Section 501(c)(3) and 501(c)(4) organizations are required to report the amount of grants and allocations to others, the total expenses, and

revenue, if any, for each program service reported.

( ) ( ) ( )

( ) ( ) ( )

( ) ( ) ( )

Other program services (Describe in Schedule O.)

( ) ( )

Total program service expenses |

Form (2017)

2

Statement of Program Service Accomplishments

Part III

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X

SEE SCHEDULE O

X

X

85,741,796. 49,180,025. 578,608.

HEALTHCARE - PROGRAMS DESIGNED TO IMPROVE AND PROTECT THE ABILITY TO

PROVIDE HIGH-QUALITY REPRODUCTIVE HEALTHCARE FOR ALL.

77,426,827. 35,889,895. 415,369.

ADVOCACY - PROGRAMS DESIGNED TO EMPOWER ALL PEOPLE TO BUILD THE FUTURE

THEY WANT AND CHANGE CULTURAL ATTITUDES ABOUT REPRODUCTIVE HEALTH.

6,342,452. 2,487,238. 51,941.

EDUCATION - PROGRAMS DESIGNED TO EDUCATE THE PUBLIC REGARDING

REPRODUCTIVE HEALTH.

3,539,670. 1,120,764. 59,395.

173,050,745.

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

2

732003 11-28-17

Yes No

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

1

2

3

4

5

6

7

8

9

10

Section 501(c)(3) organizations.

a

b

c

d

e

f

a

b

11a

11b

11c

11d

11e

11f

12a

12b

13

14a

14b

15

16

17

18

19

a

b

If "Yes," complete Schedule A

Schedule B, Schedule of Contributors

If "Yes," complete Schedule C, Part I

If "Yes," complete Schedule C, Part II

If "Yes," complete Schedule C, Part III

If "Yes," complete Schedule D, Part I

If "Yes," complete Schedule D, Part II

If "Yes," complete

Schedule D, Part III

If "Yes," complete Schedule D, Part IV

If "Yes," complete Schedule D, Part V

If "Yes," complete Schedule D,

Part VI

If "Yes," complete Schedule D, Part VII

If "Yes," complete Schedule D, Part VIII

If "Yes," complete Schedule D, Part IX

If "Yes," complete Schedule D, Part X

If "Yes," complete Schedule D, Part X

If "Yes," complete

Schedule D, Parts XI and XII

If "Yes," and if the organization answered "No" to line 12a, then completing Schedule D, Parts XI and XII is optional

If "Yes," complete Schedule E

If "Yes," complete Schedule F, Parts I and IV

If "Yes," complete Schedule F, Parts II and IV

If "Yes," complete Schedule F, Parts III and IV

If "Yes," complete Schedule G, Part I

If "Yes," complete Schedule G, Part II

If "Yes,"

complete Schedule G, Part III

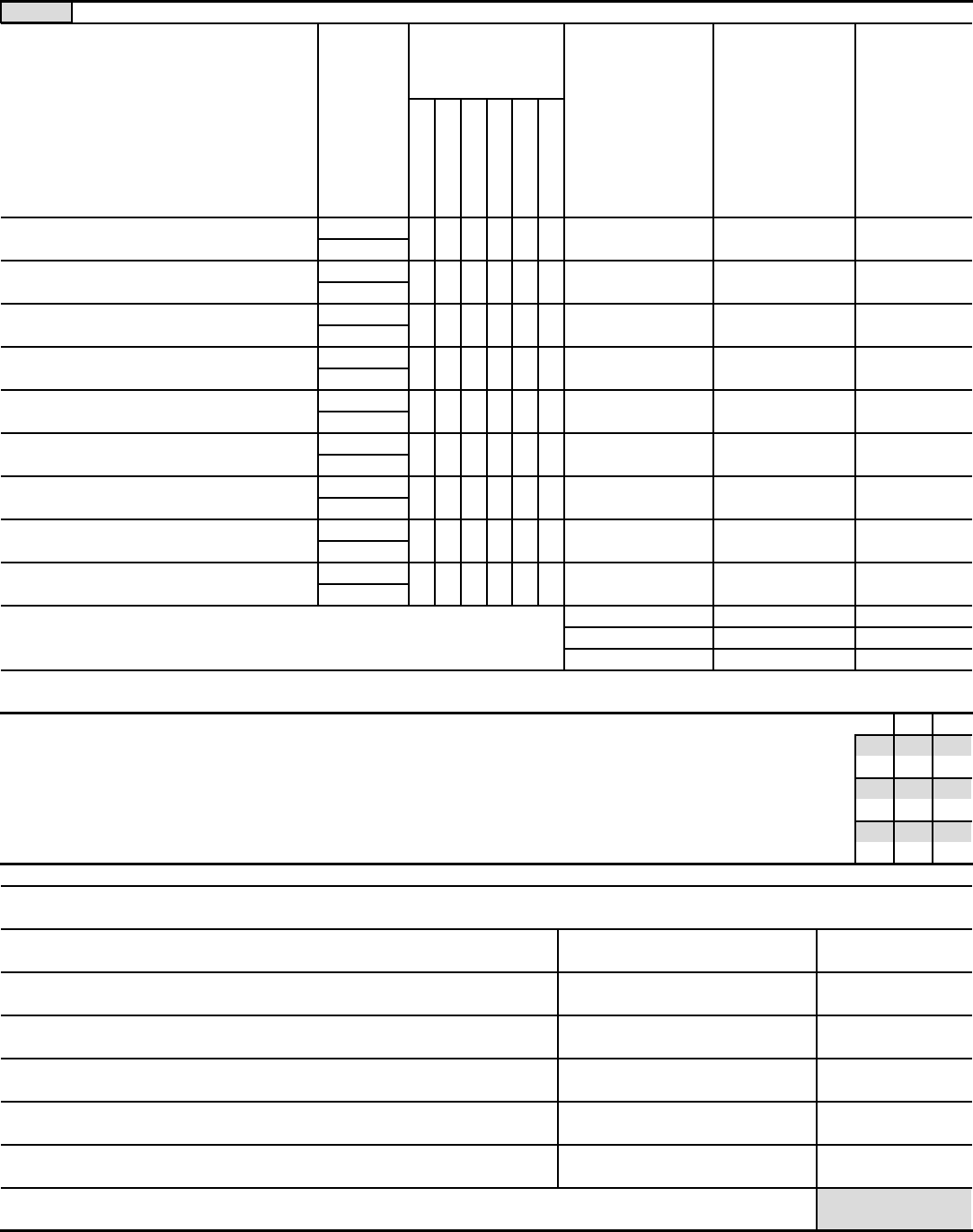

Form 990 (2017) Page

Is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Is the organization required to complete ?

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates for

public office?

~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization engage in lobbying activities, or have a section 501(h) election in effect

during the tax year?

Is the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues, assessments, or

similar amounts as defined in Revenue Procedure 98-19?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~

Did the organization maintain any donor advised funds or any similar funds or accounts for which donors have the right to

provide advice on the distribution or investment of amounts in such funds or accounts?

Did the organization receive or hold a conservation easement, including easements to preserve open space,

the environment, historic land areas, or historic structures?

Did the organization maintain collections of works of art, historical treasures, or other similar assets?

~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report an amount in Part X, line 21, for escrow or custodial account liability, serve as a custodian for

amounts not listed in Part X; or provide credit counseling, debt management, credit repair, or debt negotiation services?

Did the organization, directly or through a related organization, hold assets in temporarily restricted endowments, permanent

endowments, or quasi-endowments?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~

If the organization's answer to any of the following questions is "Yes," then complete Schedule D, Parts VI, VII, VIII, IX, or X

as applicable.

Did the organization report an amount for land, buildings, and equipment in Part X, line 10?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report an amount for investments - other securities in Part X, line 12 that is 5% or more of its total

assets reported in Part X, line 16?

Did the organization report an amount for investments - program related in Part X, line 13 that is 5% or more of its total

assets reported in Part X, line 16?

~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report an amount for other assets in Part X, line 15 that is 5% or more of its total assets reported in

Part X, line 16?

Did the organization report an amount for other liabilities in Part X, line 25?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~

Did the organization's separate or consolidated financial statements for the tax year include a footnote that addresses

the organization's liability for uncertain tax positions under FIN 48 (ASC 740)?

Did the organization obtain separate, independent audited financial statements for the tax year?

~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Was the organization included in consolidated, independent audited financial statements for the tax year?

~~~~~

Is the organization a school described in section 170(b)(1)(A)(ii)?

Did the organization maintain an office, employees, or agents outside of the United States?

~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~

Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising, business,

investment, and program service activities outside the United States, or aggregate foreign investments valued at $100,000

or more?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or other assistance to or for any

foreign organization?

Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or other assistance to

or for foreign individuals?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report a total of more than $15,000 of expenses for professional fundraising services on Part IX,

column (A), lines 6 and 11e? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report more than $15,000 total of fundraising event gross income and contributions on Part VIII, lines

1c and 8a? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a?

•••••••••••••••••••••••••••••••••••••••••••••••

Form (2017)

3

Part IV

Checklist of Required Schedules

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

3

732004 11-28-17

Yes No

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

a

b

20a

20b

21

22

23

24a

24b

24c

24d

25a

25b

26

27

28a

28b

28c

29

30

31

32

33

34

35a

35b

36

37

38

a

b

c

d

a

b

Section 501(c)(3), 501(c)(4), and 501(c)(29) organizations.

a

b

c

a

b

Section 501(c)(3) organizations.

Note.

(continued)

If "Yes," complete Schedule H

If "Yes," complete Schedule I, Parts I and II

If "Yes," complete Schedule I, Parts I and III

If "Yes," complete

Schedule J

If "Yes," answer lines 24b through 24d and complete

Schedule K. If "No", go to line 25a

If "Yes," complete Schedule L, Part I

If "Yes," complete

Schedule L, Part I

If "Yes,"

complete Schedule L, Part II

If "Yes," complete Schedule L, Part III

If "Yes," complete Schedule L, Part IV

If "Yes," complete Schedule L, Part IV

If "Yes," complete Schedule L, Part IV

If "Yes," complete Schedule M

If "Yes," complete Schedule M

If "Yes," complete Schedule N, Part I

If "Yes," complete

Schedule N, Part II

If "Yes," complete Schedule R, Part I

If "Yes," complete Schedule R, Part II, III, or IV, and

Part V, line 1

If "Yes," complete Schedule R, Part V, line 2

If "Yes," complete Schedule R, Part V, line 2

If "Yes," complete Schedule R, Part VI

Form 990 (2017) Page

Did the organization operate one or more hospital facilities? ~~~~~~~~~~~~~~~~

If "Yes" to line 20a, did the organization attach a copy of its audited financial statements to this return? ~~~~~~~~~~

Did the organization report more than $5,000 of grants or other assistance to any domestic organization or

domestic government on Part IX, column (A), line 1?

~~~~~~~~~~~~~~

Did the organization report more than $5,000 of grants or other assistance to or for domestic individuals on

Part IX, column (A), line 2? ~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the organization's current

and former officers, directors, trustees, key employees, and highest compensated employees?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than $100,000 as of the

last day of the year, that was issued after December 31, 2002?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception?

Did the organization maintain an escrow account other than a refunding escrow at any time during the year to defease

any tax-exempt bonds?

Did the organization act as an "on behalf of" issuer for bonds outstanding at any time during the year?

~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~

Did the organization engage in an excess benefit

transaction with a disqualified person during the year?

Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a prior year, and

that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ?

~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization report any amount on Part X, line 5, 6, or 22 for receivables from or payables to any current or

former officers, directors, trustees, key employees, highest compensated employees, or disqualified persons?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization provide a grant or other assistance to an officer, director, trustee, key employee, substantial

contributor or employee thereof, a grant selection committee member, or to a 35% controlled entity or family member

of any of these persons? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Was the organization a party to a business transaction with one of the following parties (see Schedule L, Part IV

instructions for applicable filing thresholds, conditions, and exceptions):

A current or former officer, director, trustee, or key employee? ~~~~~~~~~~~

A family member of a current or former officer, director, trustee, or key employee?

An entity of which a current or former officer, director, trustee, or key employee (or a family member thereof) was an officer,

director, trustee, or direct or indirect owner?

~~

~~~~~~~~~~~~~~~~~~~~~

Did the organization receive more than $25,000 in non-cash contributions?

Did the organization receive contributions of art, historical treasures, or other similar assets, or qualified conservation

contributions?

~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization liquidate, terminate, or dissolve and cease operations?

Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization own 100% of an entity disregarded as separate from the organization under Regulations

sections 301.7701-2 and 301.7701-3?

Was the organization related to any tax-exempt or taxable entity?

~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization have a controlled entity within the meaning of section 512(b)(13)?

If "Yes" to line 35a, did the organization receive any payment from or engage in any transaction with a controlled entity

within the meaning of section 512(b)(13)?

~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~

Did the organization make any transfers to an exempt non-charitable related organization?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization conduct more than 5% of its activities through an entity that is not a related organization

and that is treated as a partnership for federal income tax purposes? ~~~~~~~~

Did the organization complete Schedule O and provide explanations in Schedule O for Part VI, lines 11b and 19?

All Form 990 filers are required to complete Schedule O •••••••••••••••••••••••••••••••

Form (2017)

4

Part IV

Checklist of Required Schedules

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

4

732005 11-28-17

Yes No

1

2

3

4

5

6

7

a

b

c

1a

1b

1c

a

b

2a

Note.

2b

3a

3b

4a

5a

5b

5c

6a

6b

7a

7b

7c

7e

7f

7g

7h

8

9a

9b

a

b

a

b

a

b

c

a

b

Organizations that may receive deductible contributions under section 170(c).

a

b

c

d

e

f

g

h

7d

8

9

10

11

12

13

14

Sponsoring organizations maintaining donor advised funds.

Sponsoring organizations maintaining donor advised funds.

a

b

Section 501(c)(7) organizations.

a

b

10a

10b

Section 501(c)(12) organizations.

a

b

11a

11b

a

b

Section 4947(a)(1) non-exempt charitable trusts. 12a

12b

Section 501(c)(29) qualified nonprofit health insurance issuers.

Note.

a

b

c

a

b

13a

13b

13c

14a

14b

e-file

If "No," to line 3b, provide an explanation in Schedule O

If "No," provide an explanation in Schedule O

Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods and services provided to the payor?

Form (2017)

Form 990 (2017) Page

Check if Schedule O contains a response or note to any line in this Part V

•••••••••••••••••••••••••••

Enter the number reported in Box 3 of Form 1096. Enter -0- if not applicable ~~~~~~~~~~~

Enter the number of Forms W-2G included in line 1a. Enter -0- if not applicable ~~~~~~~~~~

Did the organization comply with backup withholding rules for reportable payments to vendors and reportable gaming

(gambling) winnings to prize winners?

•••••••••••••••••••••••••••••••••••••••••••

Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax Statements,

filed for the calendar year ending with or within the year covered by this return ~~~~~~~~~~

If at least one is reported on line 2a, did the organization file all required federal employment tax returns?

If the sum of lines 1a and 2a is greater than 250, you may be required to (see instructions)

~~~~~~~~~~

~~~~~~~~~~~

Did the organization have unrelated business gross income of $1,000 or more during the year?

If "Yes," has it filed a Form 990-T for this year?

~~~~~~~~~~~~~~

~~~~~~~~~~

At any time during the calendar year, did the organization have an interest in, or a signature or other authority over, a

financial account in a foreign country (such as a bank account, securities account, or other financial account)?~~~~~~~

If "Yes," enter the name of the foreign country:

See instructions for filing requirements for FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR).

Was the organization a party to a prohibited tax shelter transaction at any time during the tax year?

Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction?

~~~~~~~~~~~~

~~~~~~~~~

If "Yes," to line 5a or 5b, did the organization file Form 8886-T? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Does the organization have annual gross receipts that are normally greater than $100,000, and did the organization solicit

any contributions that were not tax deductible as charitable contributions?

If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts

were not tax deductible?

~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If "Yes," did the organization notify the donor of the value of the goods or services provided?

Did the organization sell, exchange, or otherwise dispose of tangible personal property for which it was required

to file Form 8282?

~~~~~~~~~~~~~~~

••••••••••••••••••••••••••••••••••••••••••••••••••••

If "Yes," indicate the number of Forms 8282 filed during the year

Did the organization receive any funds, directly or indirectly, to pay premiums on a personal benefit contract?

~~~~~~~~~~~~~~~~

~~~~~~~

~~~~~~~~~

Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract?

If the organization received a contribution of qualified intellectual property, did the organization file Form 8899 as required?

If the organization received a contribution of cars, boats, airplanes, or other vehicles, did the organization file a Form 1098-C?

~

Did a donor advised fund maintained by the

sponsoring organization have excess business holdings at any time during the year? ~~~~~~~~~~~~~~~~~~~

Did the sponsoring organization make any taxable distributions under section 4966?

Did the sponsoring organization make a distribution to a donor, donor advisor, or related person?

~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~

Enter:

Initiation fees and capital contributions included on Part VIII, line 12

Gross receipts, included on Form 990, Part VIII, line 12, for public use of club facilities

~~~~~~~~~~~~~~~

~~~~~~

Enter:

Gross income from members or shareholders

Gross income from other sources (Do not net amounts due or paid to other sources against

amounts due or received from them.)

~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Is the organization filing Form 990 in lieu of Form 1041?

If "Yes," enter the amount of tax-exempt interest received or accrued during the year ••••••

Is the organization licensed to issue qualified health plans in more than one state?

See the instructions for additional information the organization must report on Schedule O.

~~~~~~~~~~~~~~~~~~~~~

Enter the amount of reserves the organization is required to maintain by the states in which the

organization is licensed to issue qualified health plans

Enter the amount of reserves on hand

~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization receive any payments for indoor tanning services during the tax year?

If "Yes," has it filed a Form 720 to report these payments?

~~~~~~~~~~~~~~~~

••••••••••

5

Part V

Statements Regarding Other IRS Filings and Tax Compliance

990

J

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X

270

0

X

676

X

X

X

X

KENYA

X

X

X

X

X

X

X

X

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

5

732006 11-28-17

Yes No

1a

1b

1

2

3

4

5

6

7

8

9

a

b

2

3

4

5

6

7a

7b

8a

8b

9

a

b

a

b

Yes No

10

11

a

b

10a

10b

11a

12a

12b

12c

13

14

15a

15b

16a

16b

a

b

12a

b

c

13

14

15

a

b

16a

b

17

18

19

20

For each "Yes" response to lines 2 through 7b below, and for a "No" response

to line 8a, 8b, or 10b below, describe the circumstances, processes, or changes in Schedule O. See instructions.

If "Yes," provide the names and addresses in Schedule O

(This Section B requests information about policies not required by the Internal Revenue Code.)

If "No," go to line 13

If "Yes," describe

in Schedule O how this was done

(explain in Schedule O)

If there are material differences in voting rights among members of the governing body, or if the governing

body delegated broad authority to an executive committee or similar committee, explain in Schedule O.

Did the organization contemporaneously document the meetings held or written actions undertaken during the year by the following:

Were officers, directors, or trustees, and key employees required to disclose annually interests that could give rise to conflicts?

Form (2017)

Form 990 (2017) Page

Check if Schedule O contains a response or note to any line in this Part VI •••••••••••••••••••••••••••

Enter the number of voting members of the governing body at the end of the tax year

Enter the number of voting members included in line 1a, above, who are independent

~~~~~~

~~~~~~

Did any officer, director, trustee, or key employee have a family relationship or a business relationship with any other

officer, director, trustee, or key employee? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization delegate control over management duties customarily performed by or under the direct supervision

of officers, directors, or trustees, or key employees to a management company or other person? ~~~~~~~~~~~~~~

Did the organization make any significant changes to its governing documents since the prior Form 990 was filed?

Did the organization become aware during the year of a significant diversion of the organization's assets?

Did the organization have members or stockholders?

~~~~~

~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization have members, stockholders, or other persons who had the power to elect or appoint one or

more members of the governing body?

Are any governance decisions of the organization reserved to (or subject to approval by) members, stockholders, or

persons other than the governing body?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The governing body?

Each committee with authority to act on behalf of the governing body?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~

Is there any officer, director, trustee, or key employee listed in Part VII, Section A, who cannot be reached at the

organization's mailing address? •••••••••••••••••

Did the organization have local chapters, branches, or affiliates?

If "Yes," did the organization have written policies and procedures governing the activities of such chapters, affiliates,

and branches to ensure their operations are consistent with the organization's exempt purposes?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~

Has the organization provided a complete copy of this Form 990 to all members of its governing body before filing the form?

Describe in Schedule O the process, if any, used by the organization to review this Form 990.

Did the organization have a written conflict of interest policy? ~~~~~~~~~~~~~~~~~~~~

~~~~~~

Did the organization regularly and consistently monitor and enforce compliance with the policy?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization have a written whistleblower policy?

Did the organization have a written document retention and destruction policy?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~

Did the process for determining compensation of the following persons include a review and approval by independent

persons, comparability data, and contemporaneous substantiation of the deliberation and decision?

The organization's CEO, Executive Director, or top management official

Other officers or key employees of the organization

If "Yes" to line 15a or 15b, describe the process in Schedule O (see instructions).

~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization invest in, contribute assets to, or participate in a joint venture or similar arrangement with a

taxable entity during the year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If "Yes," did the organization follow a written policy or procedure requiring the organization to evaluate its participation

in joint venture arrangements under applicable federal tax law, and take steps to safeguard the organization's

exempt status with respect to such arrangements?

••••••••••••••••••••••••••••••••••••

List the states with which a copy of this Form 990 is required to be filed

Section 6104 requires an organization to make its Forms 1023 (or 1024 if applicable), 990, and 990-T (Section 501(c)(3)s only) available

for public inspection. Indicate how you made these available. Check all that apply.

Own website Another's website Upon request Other

Describe in Schedule O whether (and if so, how) the organization made its governing documents, conflict of interest policy, and financial

statements available to the public during the tax year.

State the name, address, and telephone number of the person who possesses the organization's books and records: |

6

Part VI

Governance, Management, and Disclosure

Section A. Governing Body and Management

Section B. Policies

Section C. Disclosure

990

J

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X

29

29

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

SEE SCHEDULE O

X X

ELZBIETA SZAFRAN-BODZIONY C/O PPFA - (212)541-7800

123 WILLIAM STREET 10FL, NEW YORK, NY 10038

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

6

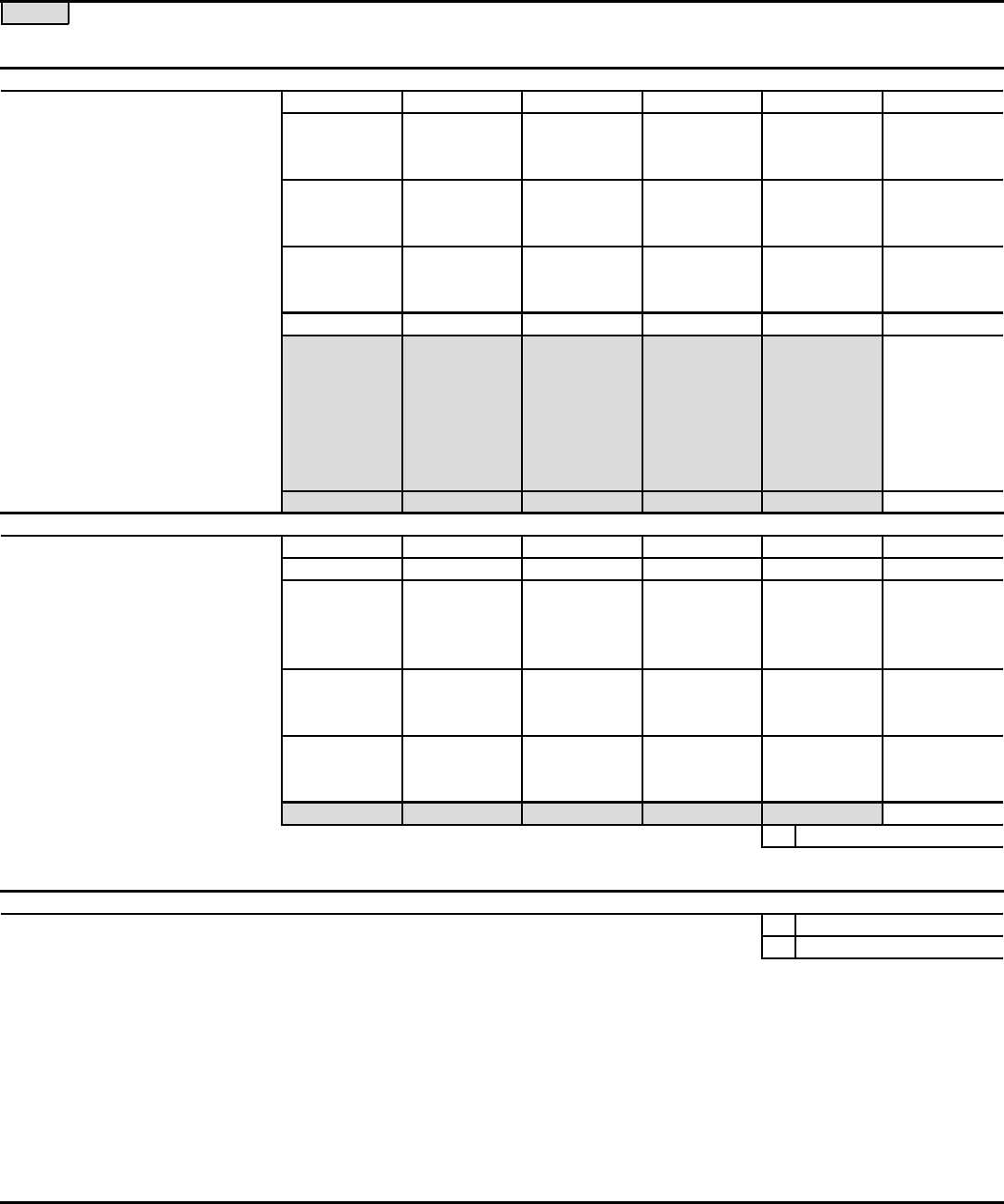

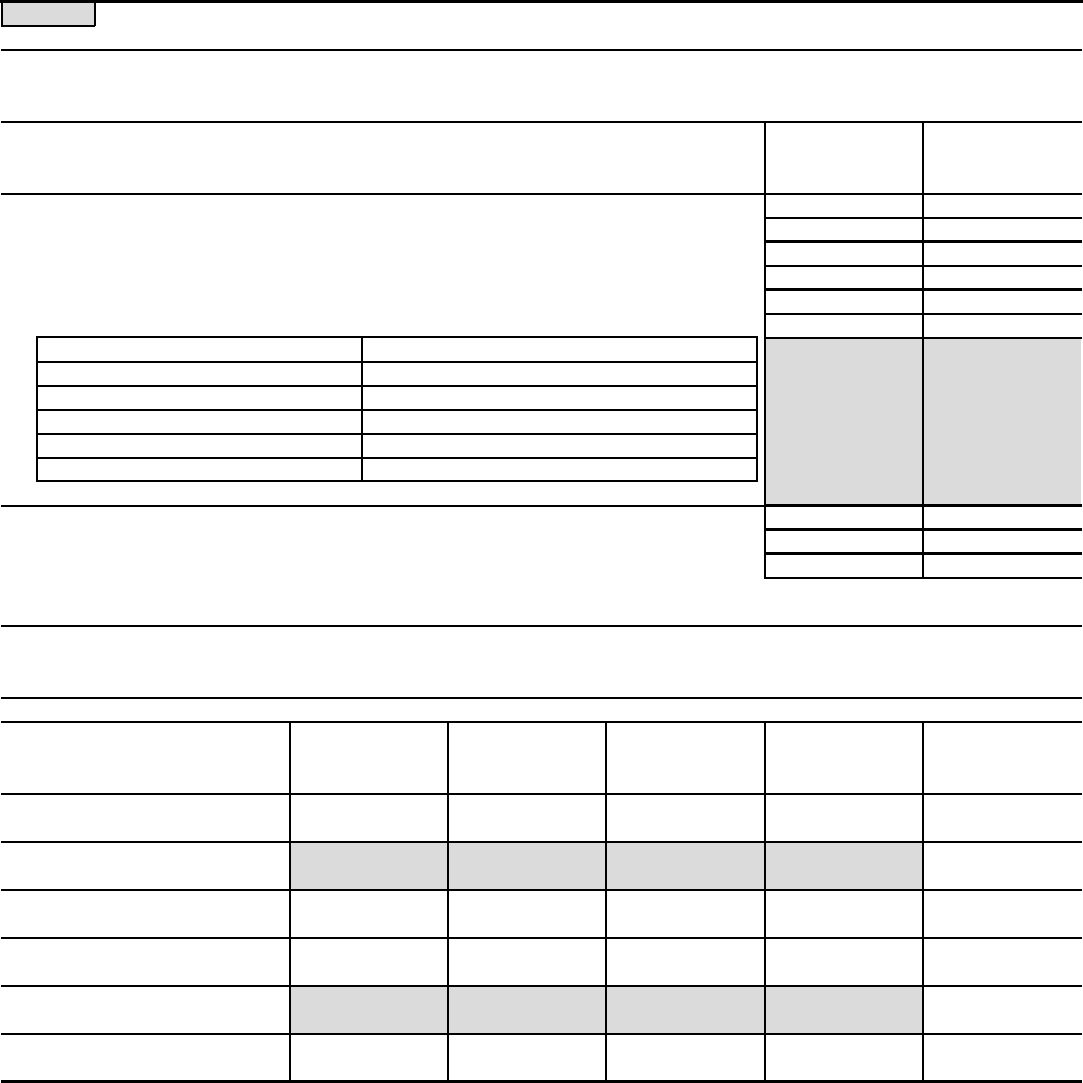

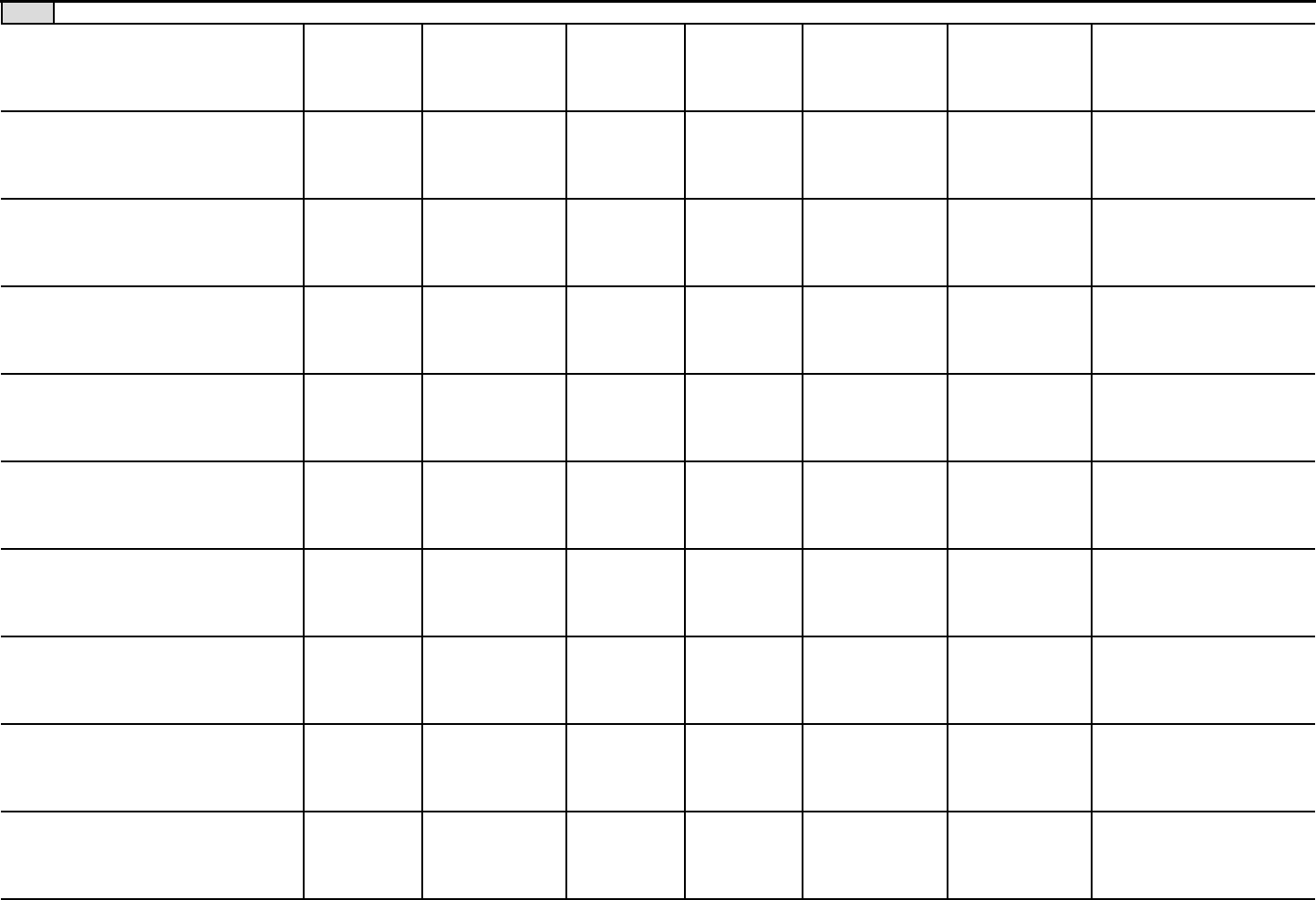

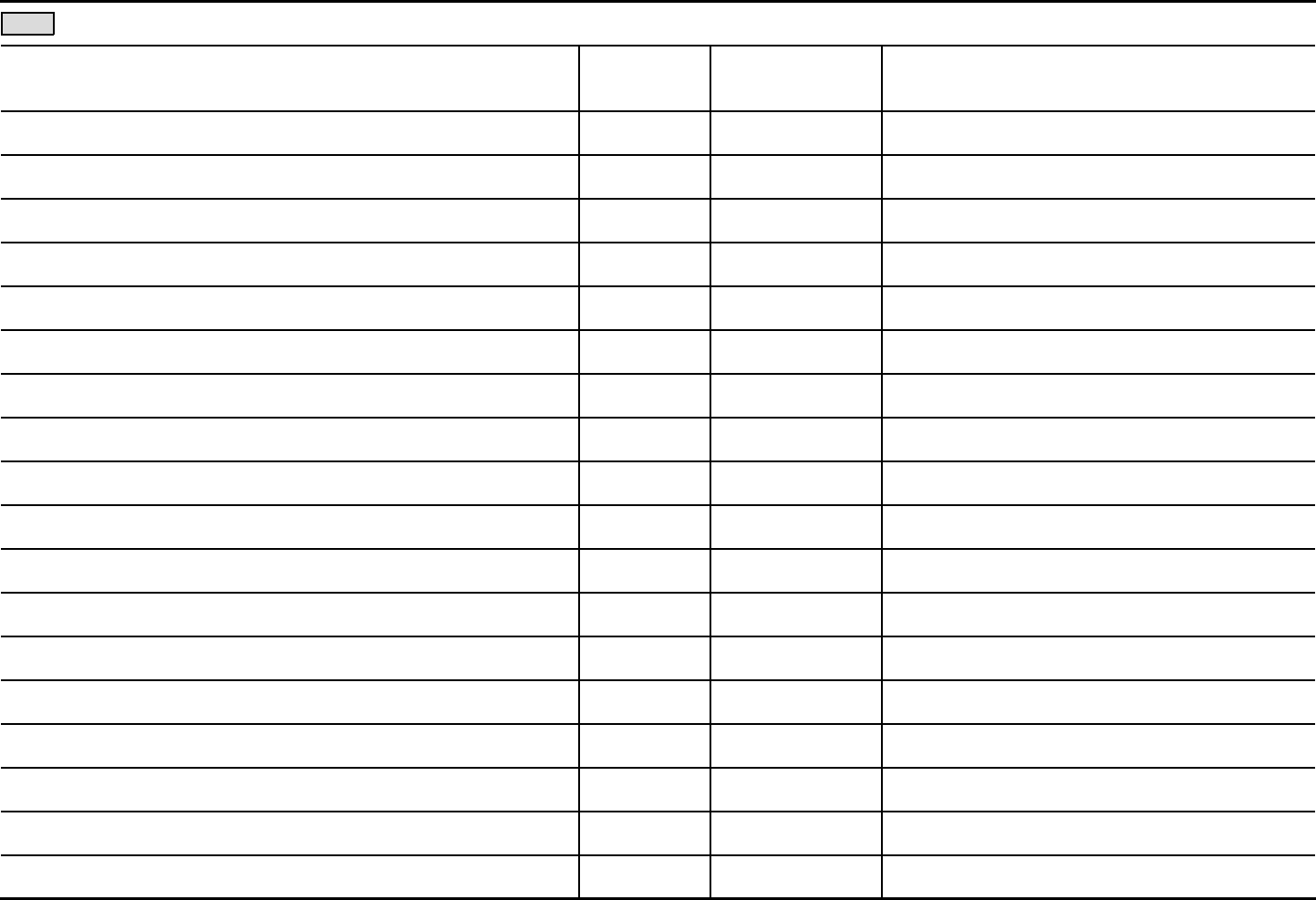

Individual trustee or director

Institutional trustee

Officer

Key employee

Highest compensated

employee

Former

(do not check more than one

box, unless person is both an

officer and a director/trustee)

732007 11-28-17

current

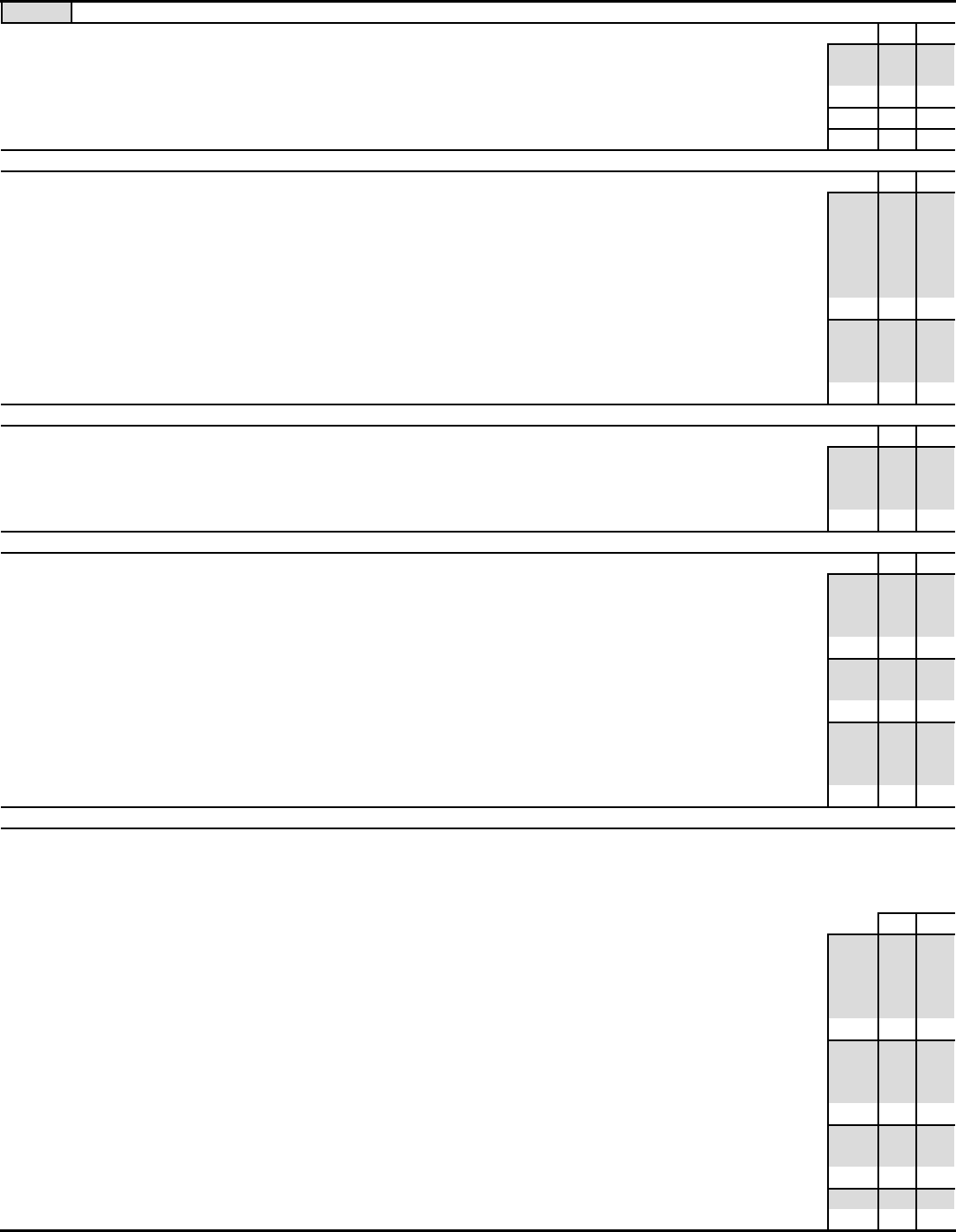

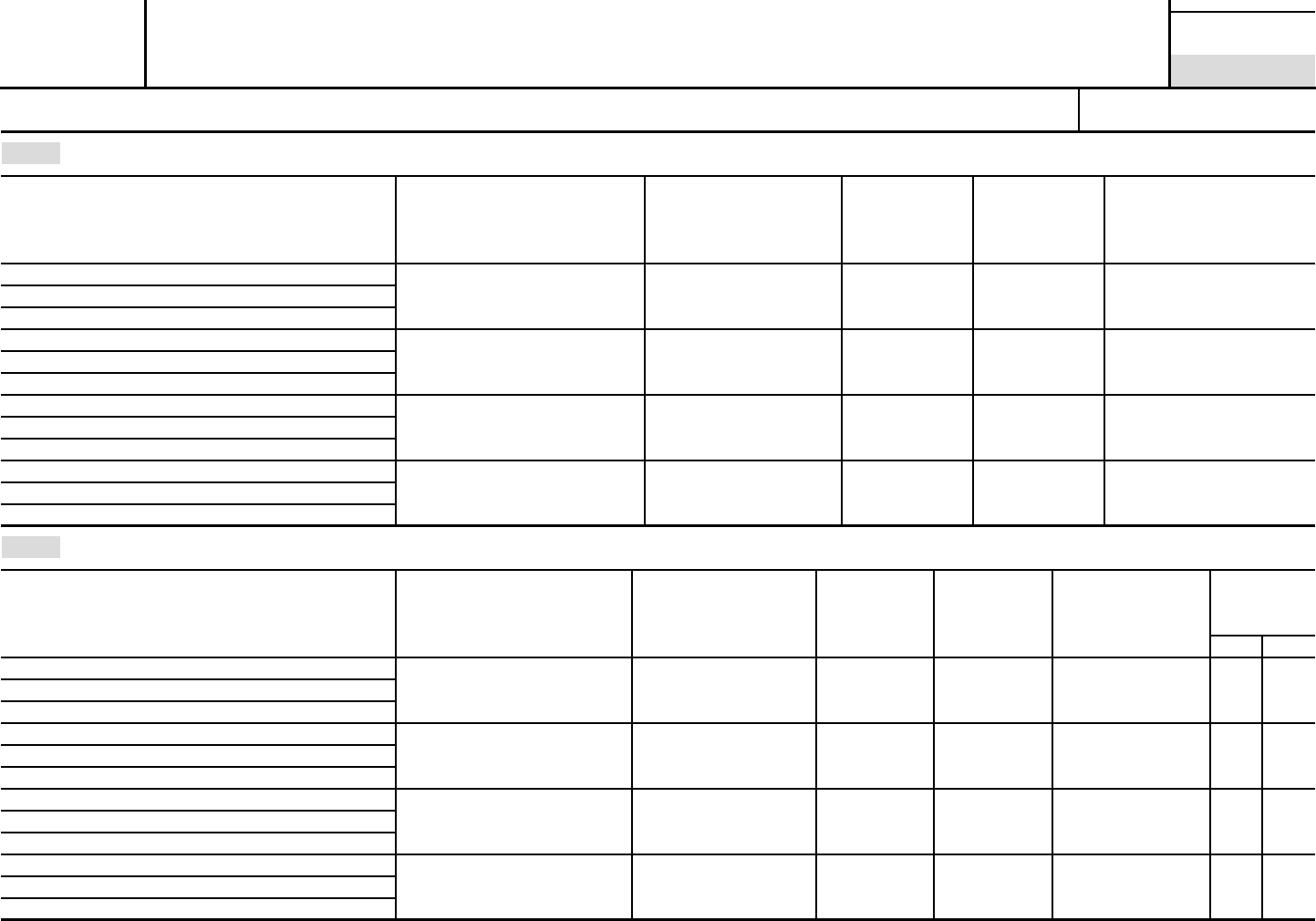

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

1a

current

current

former

former directors or trustees

(A) (B) (C) (D) (E) (F)

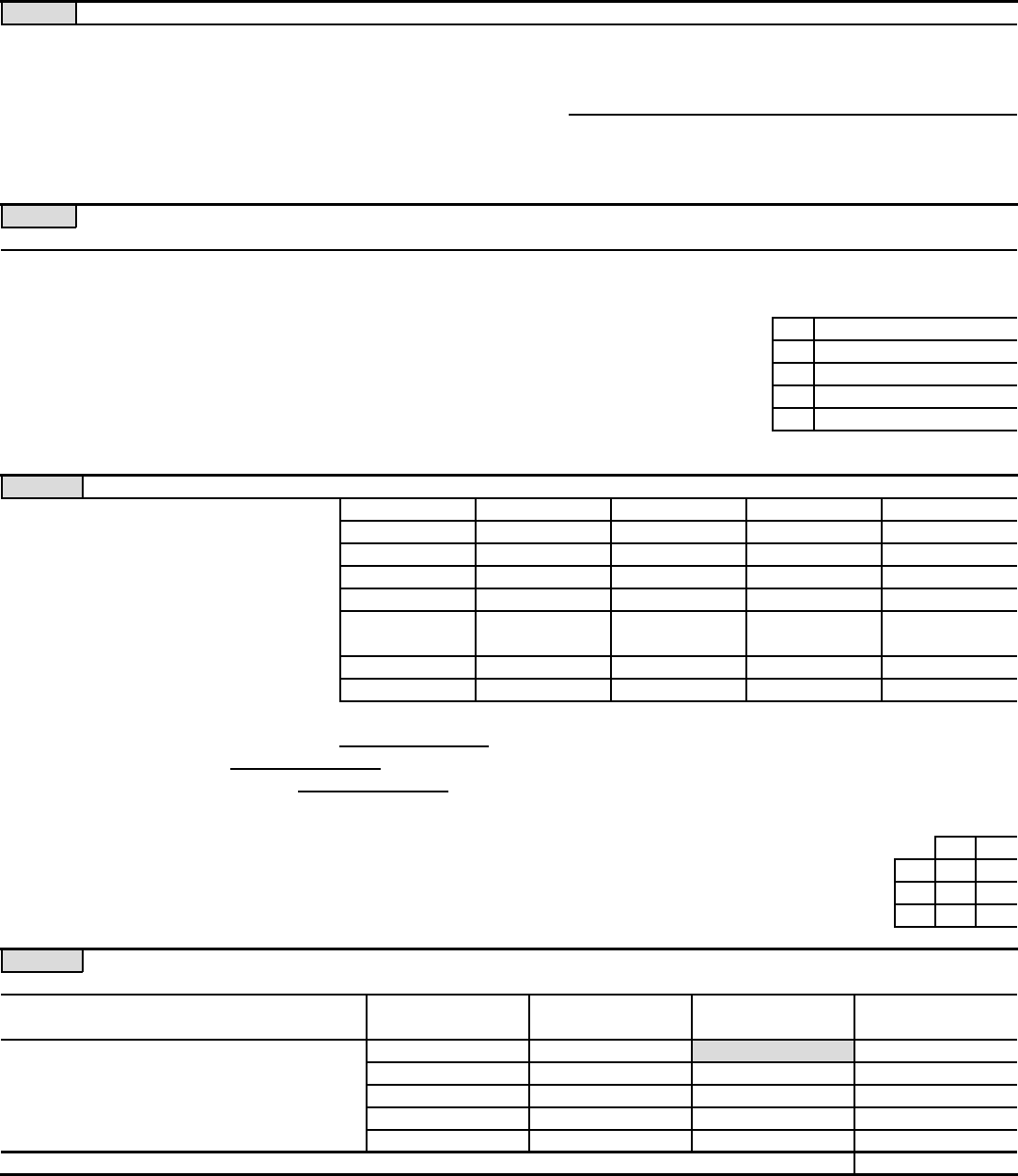

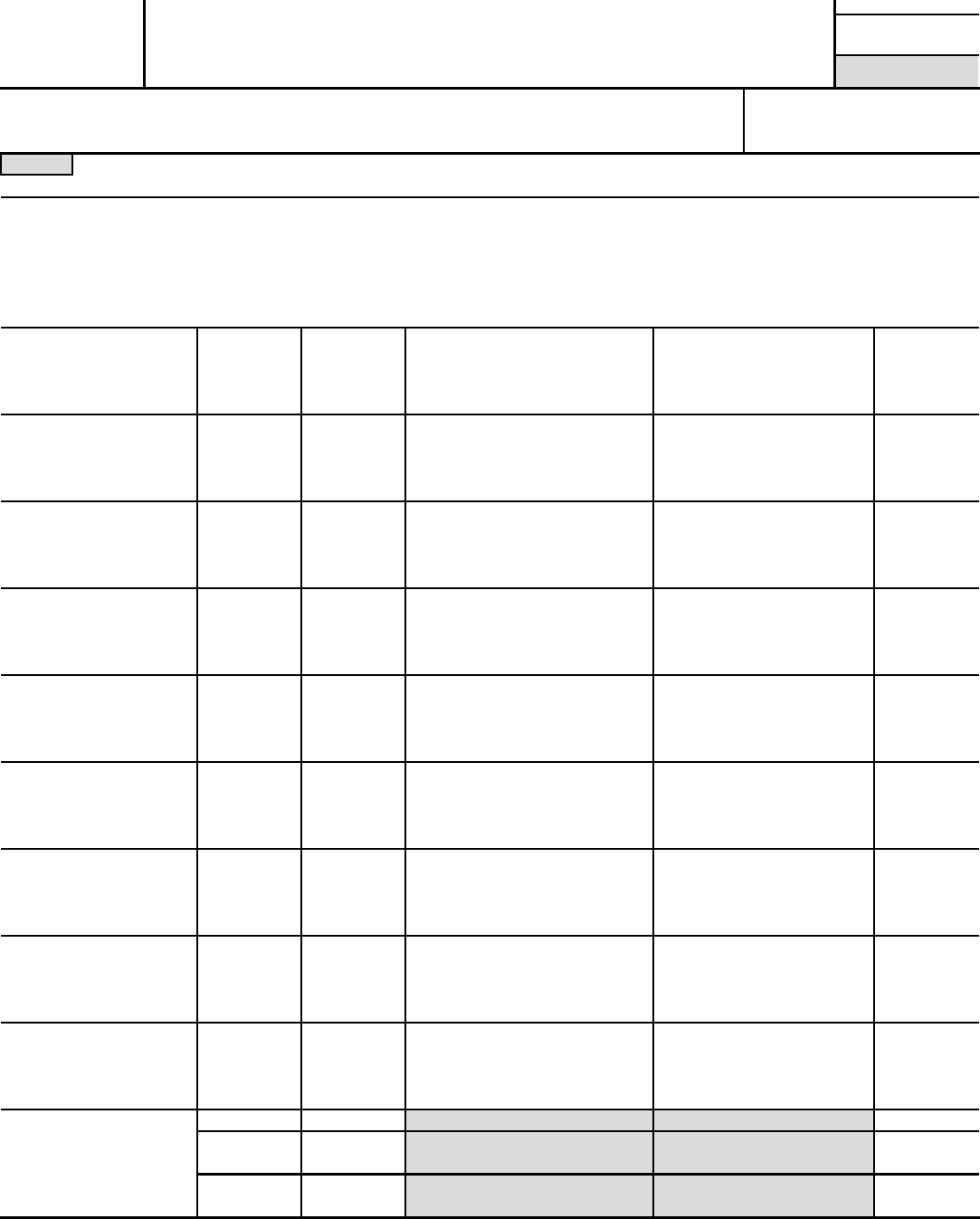

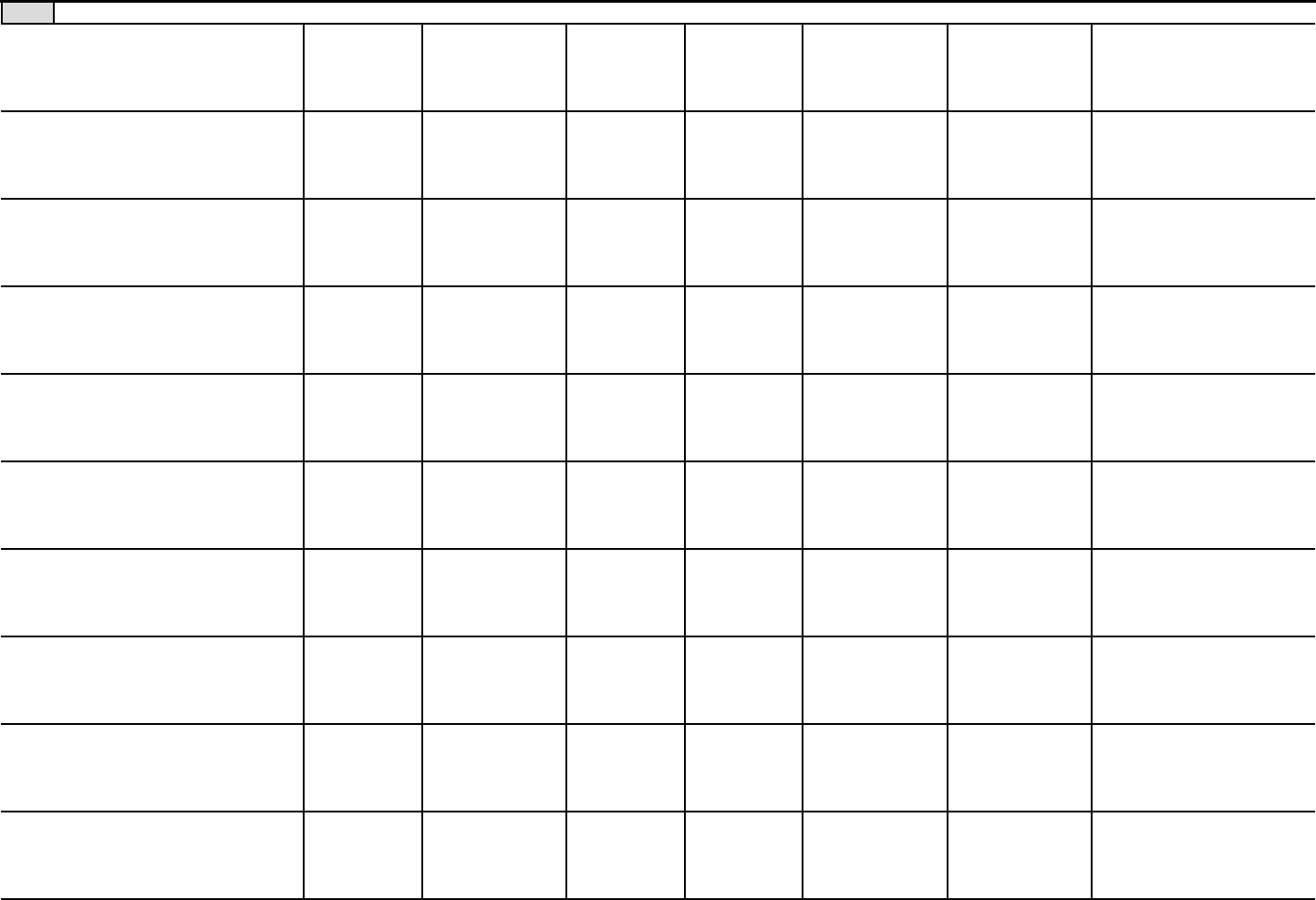

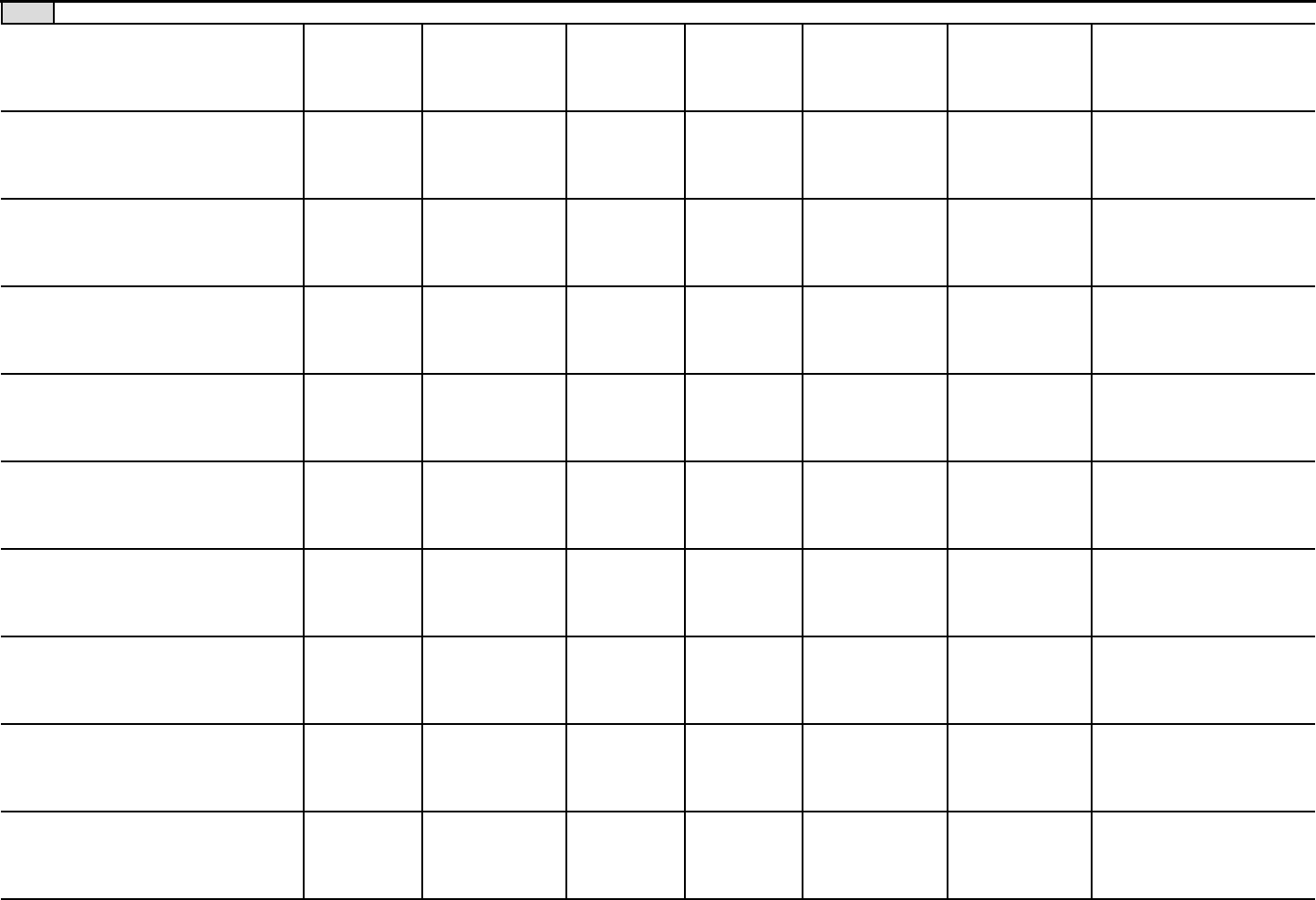

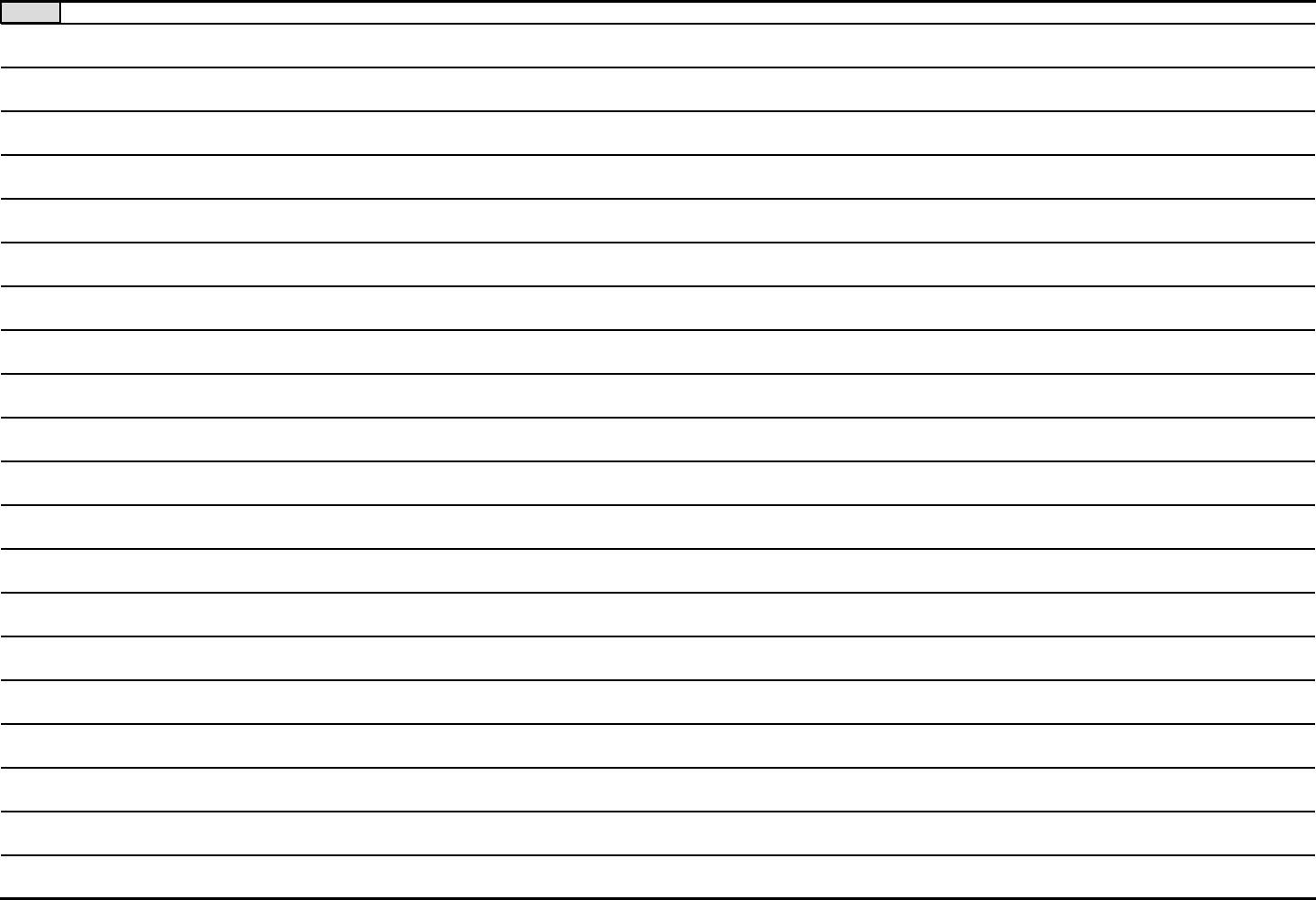

Form 990 (2017) Page

Check if Schedule O contains a response or note to any line in this Part VII

•••••••••••••••••••••••••••

Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the organization's tax year.

¥ List all of the organization's officers, directors, trustees (whether individuals or organizations), regardless of amount of compensation.

Enter -0- in columns (D), (E), and (F) if no compensation was paid.

¥ List all of the organization's key employees, if any. See instructions for definition of "key employee."

¥ List the organization's five highest compensated employees (other than an officer, director, trustee, or key employee) who received report-

able compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the organization and any related organizations.

¥ List all of the organization's officers, key employees, and highest compensated employees who received more than $100,000 of

reportable compensation from the organization and any related organizations.

¥ List all of the organization's that received, in the capacity as a former director or trustee of the organization,

more than $10,000 of reportable compensation from the organization and any related organizations.

List persons in the following order: individual trustees or directors; institutional trustees; officers; key employees; highest compensated employees;

and former such persons.

Check this box if neither the organization nor any related organization compensated any current officer, director, or trustee.

Position

Name and Title Average

hours per

week

(list any

hours for

related

organizations

below

line)

Reportable

compensation

from

the

organization

(W-2/1099-MISC)

Reportable

compensation

from related

organizations

(W-2/1099-MISC)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

Form (2017)

7

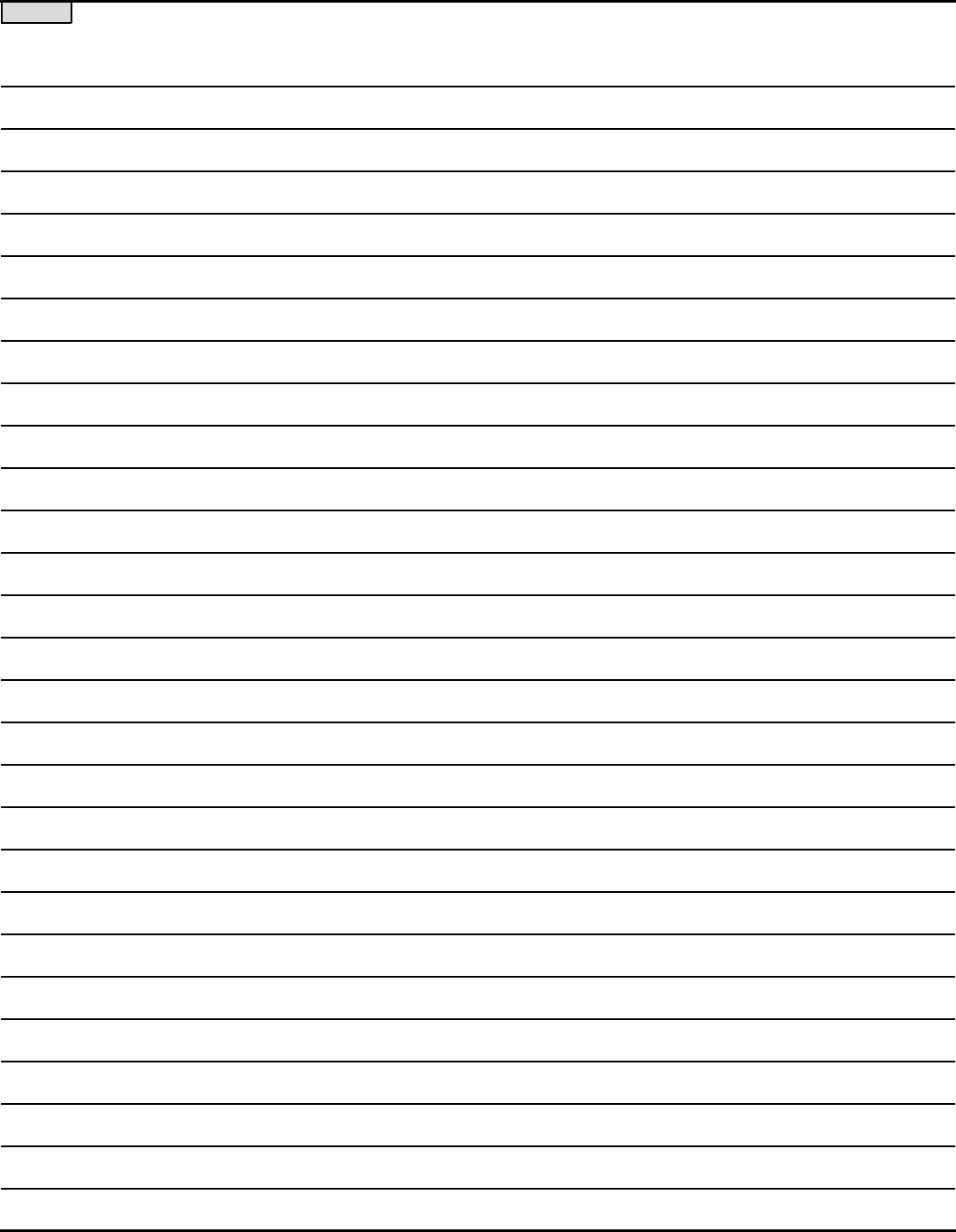

Part VII

Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated

Employees, and Independent Contractors

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

(1) NAOMI ABERLY

1.00

CHAIR

X X 0. 0. 0.

(2) CATHY HAMPTON

1.00

VC & BOARD MEMBER THRU 4/27/18

X X 0. 0. 0.

(3) CARMEN RITA WONG

1.00

VICE CHAIR STARTING 4/27/18

X X 0. 0. 0.

(4) COLLEEN FOSTER

1.00

TREASURER

X X 0. 0. 0.

(5) KATE JHAVERI

1.00

SECRETARY

X X 0. 0. 0.

(6) NATASHA BHUYAN,MD

1.00

DIRECTOR STARTING 4/27/18

X 0. 0. 0.

(7) DHARMA E. CORTES

1.00

DIRECTOR

X 0. 0. 0.

(8) AIMEE BOONE CUNNINGHAM

1.00

DIRECTOR

X 0. 0. 0.

(9) STEPHEN DEBERRY

1.00

DIRECTOR

X 0. 0. 0.

(10) VERONICA DELA ROSA

1.00

DIRECTOR THRU 4/27/18

X 0. 0. 0.

(11) DAISY AUGER-DOMINGUEZ

1.00

DIRECTOR STARTING 4/27/18

X 0. 0. 0.

(12) PEGGY DREXLER

1.00

DIRECTOR

X 0. 0. 0.

(13) SUSAN DUNLAP

1.00

DIRECTOR STARTING 4/27/18

X 0. 0. 0.

(14) MANEESH GOYAL

1.00

DIRECTOR STARTING 4/27/18

X 0. 0. 0.

(15) REV. DR. NEICHELLE GUIDRY

1.00

DIRECTOR STARTING 4/27/18

X 0. 0. 0.

(16) IRIS HARVEY

1.00

DIRECTOR

X 0. 0. 0.

(17) MARYANA ISKANDER

1.00

DIRECTOR

X 0. 0. 0.

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

7

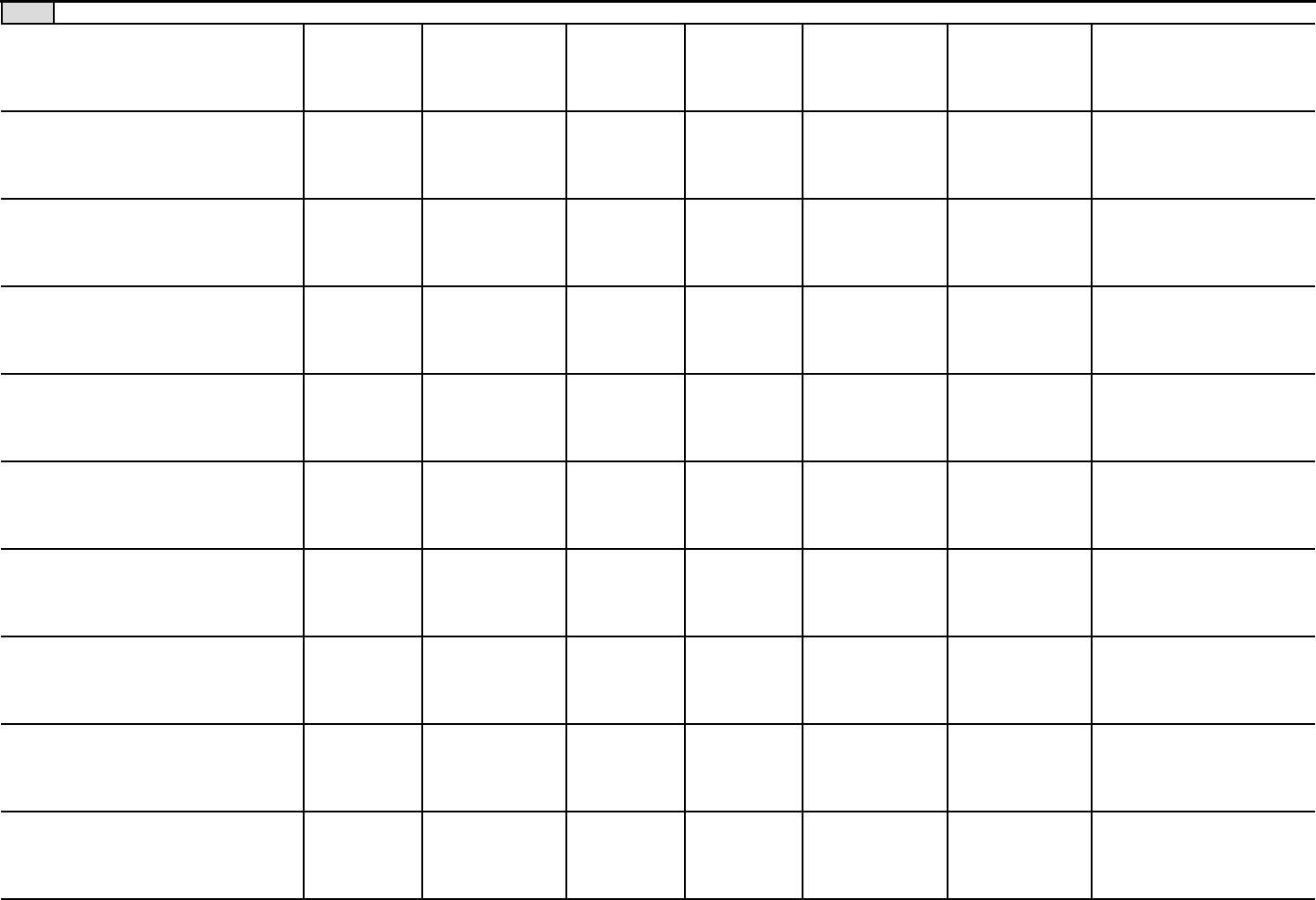

Former

Individual trustee or director

Institutional trustee

Officer

Highest compensated

employee

Key employee

(do not check more than one

box, unless person is both an

officer and a director/trustee)

732008 11-28-17

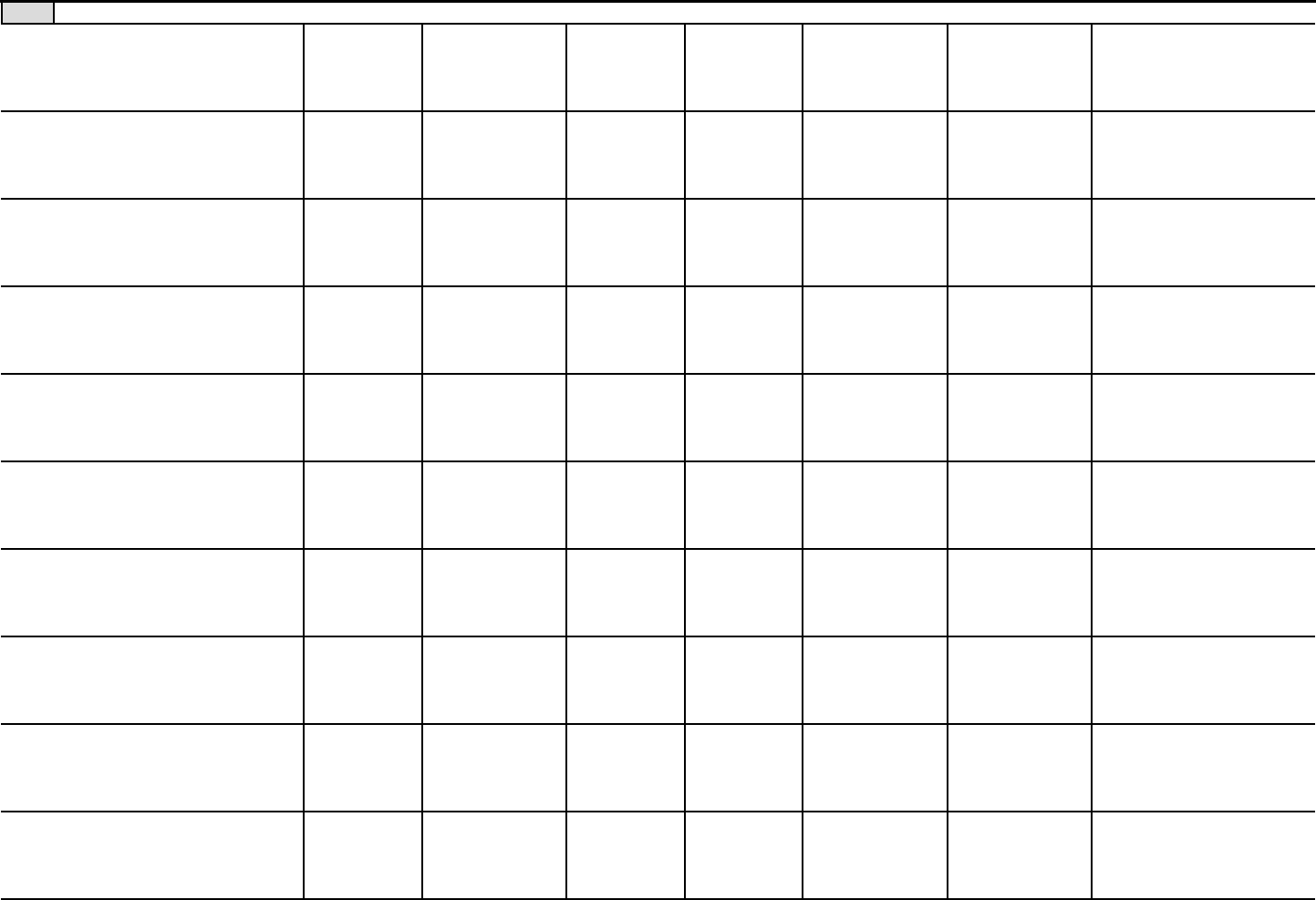

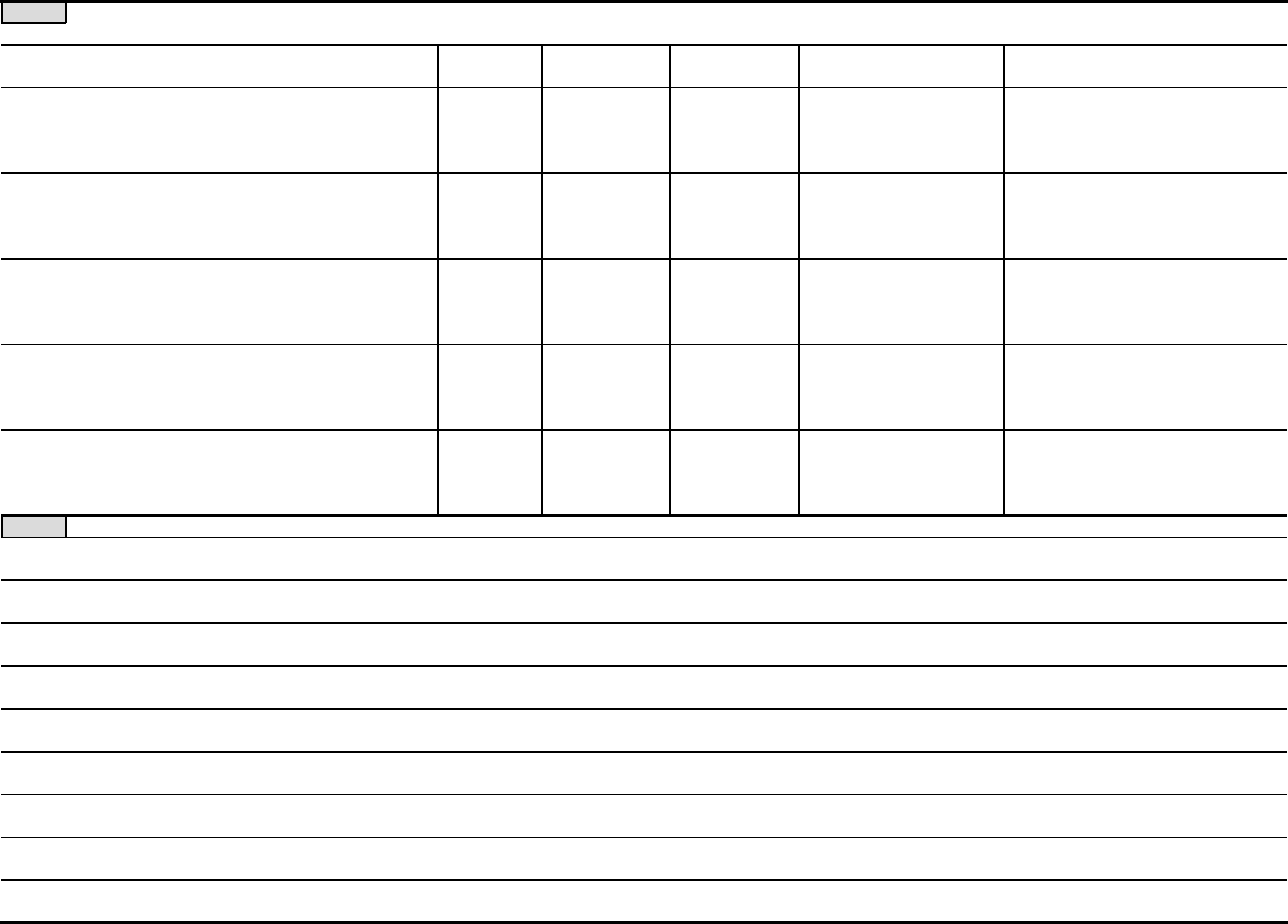

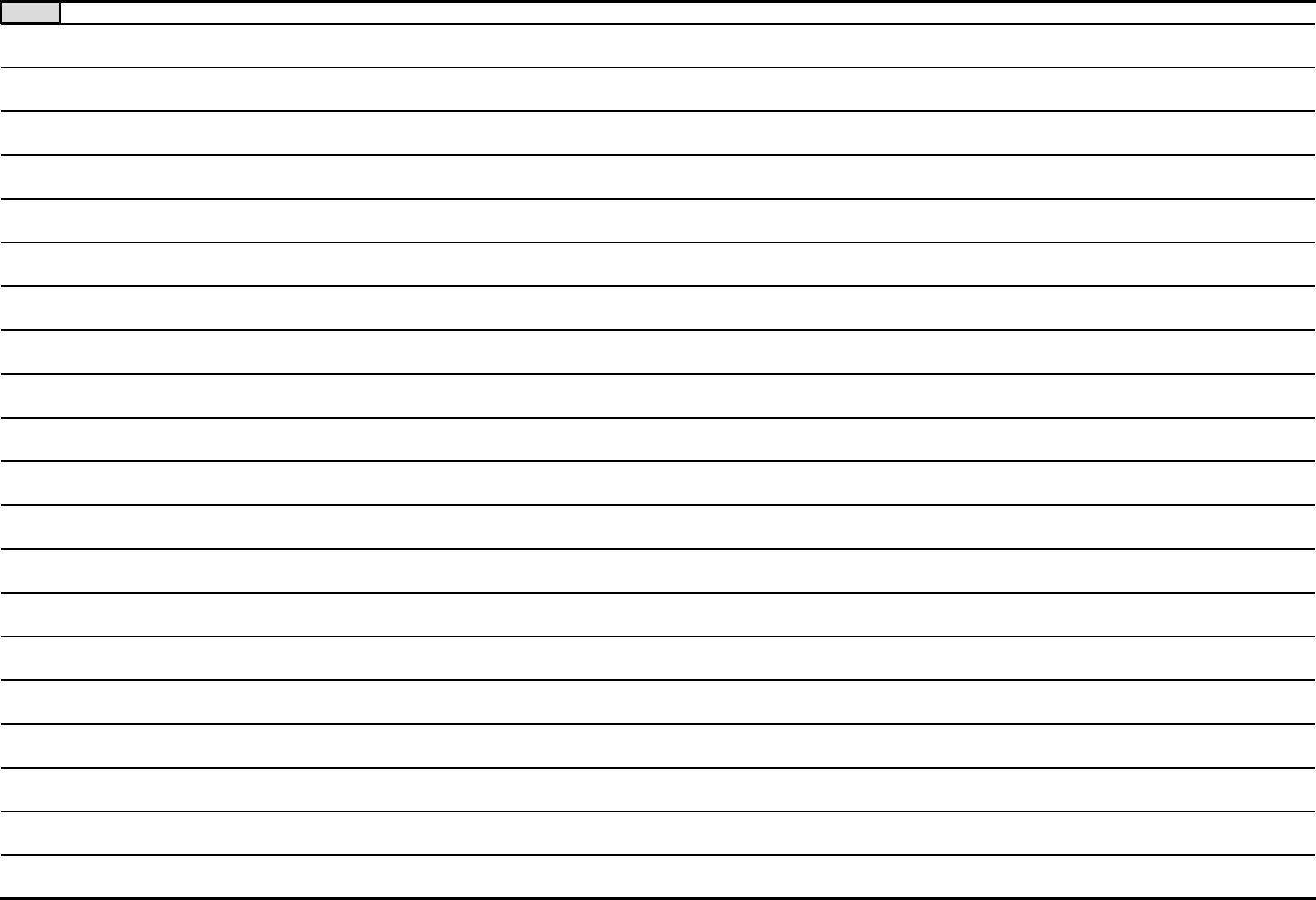

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

(B) (C)

(A) (D) (E) (F)

1b

c

d

Sub-total

Total from continuation sheets to Part VII, Section A

Total (add lines 1b and 1c)

2

Yes No

3

4

5

former

3

4

5

Section B. Independent Contractors

1

(A) (B) (C)

2

(continued)

If "Yes," complete Schedule J for such individual

If "Yes," complete Schedule J for such individual

If "Yes," complete Schedule J for such person

Page

Form 990 (2017)

Position

Average

hours per

week

(list any

hours for

related

organizations

below

line)

Name and title Reportable

compensation

from

the

organization

(W-2/1099-MISC)

Reportable

compensation

from related

organizations

(W-2/1099-MISC)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |

~~~~~~~~~~ |

•••••••••••••••••••••••• |

Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportable

compensation from the organization |

Did the organization list any officer, director, or trustee, key employee, or highest compensated employee on

line 1a? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organization

and related organizations greater than $150,000? ~~~~~~~~~~~~~

Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for services

rendered to the organization? ••••••••••••••••••••••••

Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation from

the organization. Report compensation for the calendar year ending with or within the organization's tax year.

Name and business address Description of services Compensation

Total number of independent contractors (including but not limited to those listed above) who received more than

$100,000 of compensation from the organization |

Form (2017)

8

Part VII

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

(18) MICHELLE JUBELIRER

1.00

DIRECTOR

X 0. 0. 0.

(19) DAVID KARP

1.00

DIRECTOR

X 0. 0. 0.

(20) MINI KRISHNAN

1.00

DIRECTOR

X 0. 0. 0.

(21) MARIA TERESA KUMAR

1.00

DIRECTOR THRU 4/27/18

X 0. 0. 0.

(22) JILL LAFER

1.00

DIRECTOR THRU 4/27/18

X 0. 0. 0.

(23) KEN LAMBRECHT

1.00

DIRECTOR

X 0. 0. 0.

(24) DIANE MAX

1.00

DIRECTOR

X 0. 0. 0.

(25) REV. TIMOTHY MCDONALD

1.00

DIRECTOR THRU 4/27/18

X 0. 0. 0.

(26) MARGOT MILLIKEN

1.00

DIRECTOR

X 0. 0. 0.

0. 0. 0.

4,947,767. 491,381. 774,888.

4,947,767. 491,381. 774,888.

197

X

X

X

MCKINSEY & COMPANY, INC. US

280 CONGRESS ST STE 1100, BOSTON, MA 02210 CONSULTING 10,700,000.

O'BRIEN GARRETT, 1133 19TH ST NW STE 300,

WASHINGTON, DC 20036 CONSULTING & OTHER 9,295,200.

GRASSROOTS CAMPAIGNS, INC.

PO BOX 120557, BOSTON, MA 02112 CANVASSING 5,087,535.

M+R STRATEGIC SERVICES, INC, 1101

CONNECTICUT AVE NW, WASHINGTON, DC 20036 CONSULTING 4,466,037.

ATOS IT OUTSOURCING SERVICES, LLC

2828 NORTH HASKELL, DALLAS, TX 75204 IT SERVICES 3,327,475.

109

SEE PART VII, SECTION A CONTINUATION SHEETS

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

8

Individual trustee or director

Institutional trustee

Officer

Key employee

Highest compensated employee

Former

732201

04-01-17

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

(A) (B) (C) (D) (E) (F)

(continued)

Form 990

Name and title Average

hours

per

week

(list any

hours for

related

organizations

below

line)

Position

(check all that apply)

Reportable

compensation

from

the

organization

(W-2/1099-MISC)

Reportable

compensation

from related

organizations

(W-2/1099-MISC)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

Total to Part VII, Section A, line 1c •••••••••••••••••••••••••

Part VII

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

(27) DONYA NASSER

1.00

DIRECTOR

1.00 X 0. 0. 0.

(28) MICHAEL NEWTON

1.00

DIRECTOR THRU 4/27/18

X 0. 0. 0.

(29) DR. MARK NICHOLS

1.00

DIRECTOR

X 0. 0. 0.

(30) KIMBERLY OLSON

1.00

DIRECTOR

X 0. 0. 0.

(31) JENNY PRICE

1.00

DIRECTOR

X 0. 0. 0.

(32) NATHALIE RAYES

1.00

DIRECTOR

X 0. 0. 0.

(33) SHONDA RHIMES

1.00

DIRECTOR

X 0. 0. 0.

(34) JOE SOLMONESE

33.00

DIRECTOR THRU 5/1/18 THEN TC

2.00 X X 0. 0. 0.

(35) DAYLE STEINBERG

1.00

DIRECTOR THRU 4/27/18

X 0. 0. 0.

(36) SHERRESE CLARKE-SOARES

1.00

DIRECTOR STARTING 4/27/18

X 0. 0. 0.

(37) SARAH STOESZ

1.00

DIRECTOR

X 0. 0. 0.

(38) CECILE RICHARDS

33.00

PRESIDENT & CEO THRU 5/2/18

2.00 X 843,312. 69,123. 120,839.

(39) WALLACE D'SOUZA

29.00

CFO THRU 10/20/17

6.00 X 197,043. 40,359. 49,385.

(40) ABIGAIL SMITH

29.00

INTERIM CFO (10/20/17-3/5/18)

6.00 X 162,338. 33,250. 58,980.

(41) VICKIE BARROW-KLEIN

29.00

CFO STARTING 3/5/18

6.00 X 0. 0. 0.

(42) MELVIN GALLOWAY

30.00

EVP & COO

5.00 X 352,410. 72,180. 30,265.

(43) THOMAS SUBAK

34.00

CHIEF STRATEGY OFFICER

1.00 X 395,665. 8,074. 47,314.

(44) DAWN LAGUENS

30.00

EVP & CHIEF BRAND & CXO

5.00 X 618,860. 142,871. 129,361.

(45) DEBRA ALLIGOOD WHITE

29.00

SR VP & GENERAL COUNSEL

6.00 X 309,099. 63,309. 37,678.

(46) JETHRO MILLER

30.00

CHIEF DEVELOPMENT OFFICER

5.00 X 352,551. 62,215. 18,993.

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

9

Individual trustee or director

Institutional trustee

Officer

Key employee

Highest compensated employee

Former

732201

04-01-17

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

(A) (B) (C) (D) (E) (F)

(continued)

Form 990

Name and title Average

hours

per

week

(list any

hours for

related

organizations

below

line)

Position

(check all that apply)

Reportable

compensation

from

the

organization

(W-2/1099-MISC)

Reportable

compensation

from related

organizations

(W-2/1099-MISC)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

Total to Part VII, Section A, line 1c •••••••••••••••••••••••••

Part VII

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

(47) KIMBERLY CUSTER

35.00

EVP HEALTHCARE

0.00 X 340,366. 0. 56,465.

(48) JENNIE THOMPSON

35.00

MANAGING DIR OF DEVELOPMENT

0.00 X 276,754. 0. 29,225.

(49) DANNETTE HILL

35.00

CHIEF HR OFFICER

0.00 X 301,401. 0. 36,649.

(50) KATHERINE MAGILL

35.00

VP HEALTH OUTCOMES & PO

0.00 X 266,451. 0. 39,752.

(51) FRANKLIN ROSADO

35.00

CHIEF TECHNOLOGY OFFICER

0.00 X 275,437. 0. 57,456.

(52) MOLLY EAGAN

35.00

VP PP EXPERIENCE

0.00 X 256,080. 0. 62,526.

4,947,767. 491,381. 774,888.

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

10

Noncash contributions included in lines 1a-1f: $

732009 11-28-17

Total revenue.

(A) (B) (C) (D)

1 a

b

c

d

e

f

g

h

1

1

1

1

1

1

a

b

c

d

e

f

Contributions, Gifts, Grants

and Other Similar Amounts

Total.

Business Code

a

b

c

d

e

f

g

2

Program Service

Revenue

Total.

3

4

5

6 a

b

c

d

a

b

c

d

7

a

b

c

8

a

b

9 a

b

c

a

b

10 a

b

c

a

b

Business Code

11 a

b

c

d

e Total.

Other Revenue

12

Revenue excluded

from tax under

sections

512 - 514

All other contributions, gifts, grants, and

similar amounts not included above

See instructions.

Form (2017)

Page

Form 990 (2017)

Check if Schedule O contains a response or note to any line in this Part VIII •••••••••••••••••••••••••

Total revenue

Related or

exempt function

revenue

Unrelated

business

revenue

Federated campaigns

Membership dues

~~~~~~

~~~~~~~~

Fundraising events

Related organizations

~~~~~~~~

~~~~~~

Government grants (contributions)

~~

Add lines 1a-1f ••••••••••••••••• |

All other program service revenue ~~~~~

Add lines 2a-2f ••••••••••••••••• |

Investment income (including dividends, interest, and

other similar amounts)

Income from investment of tax-exempt bond proceeds

~~~~~~~~~~~~~~~~~ |

|

Royalties ••••••••••••••••••••••• |

(i) Real (ii) Personal

Gross rents

Less: rental expenses

Rental income or (loss)

Net rental income or (loss)

~~~~~~~

~~~

~~

•••••••••••••• |

Gross amount from sales of

assets other than inventory

(i) Securities (ii) Other

Less: cost or other basis

and sales expenses

Gain or (loss)

~~~

~~~~~~~

Net gain or (loss) ••••••••••••••••••• |

Gross income from fundraising events (not

including $

of

contributions reported on line 1c). See

Part IV, line 18 ~~~~~~~~~~~~~

Less: direct expenses~~~~~~~~~~

Net income or (loss) from fundraising events ••••• |

Gross income from gaming activities. See

Part IV, line 19 ~~~~~~~~~~~~~

Less: direct expenses

Net income or (loss) from gaming activities

~~~~~~~~~

•••••• |

Gross sales of inventory, less returns

and allowances ~~~~~~~~~~~~~

Less: cost of goods sold

Net income or (loss) from sales of inventory

~~~~~~~~

•••••• |

Miscellaneous Revenue

All other revenue ~~~~~~~~~~~~~

Add lines 11a-11d ~~~~~~~~~~~~~~~ |

|

•••••••••••••

9

Part VIII

Statement of Revenue

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

4,988,151.

254,036,513.

28,321,324.

259,024,664.

MEETING REVENUE 900099 535,330. 535,330.

ATTORNEY FEE AWARDS 900099 415,369. 415,369.

RESEARCH 900099 59,395. 59,395.

SERVICES TO AFFILIATES 900099 43,278. 43,278.

1,053,372.

4,845,205. 4,845,205.

325,443. 325,443.

121,200,597.

119,332,858.

1,867,739.

1,867,739. 1,867,739.

168,581.

116,640.

51,941. 51,941.

OVERHEAD FEES 900099 6,728,058. 6,728,058.

INSURANCE REIMBURSEMENT 900099 191,960. 191,960.

CREDIT CARD REBATE 900099 77,014. 77,014.

900099 21,198. 21,198.

7,018,230.

274,186,594. 1,105,313. 0. 14,056,617.

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

11

Check here

if following SOP 98-2 (ASC 958-720)

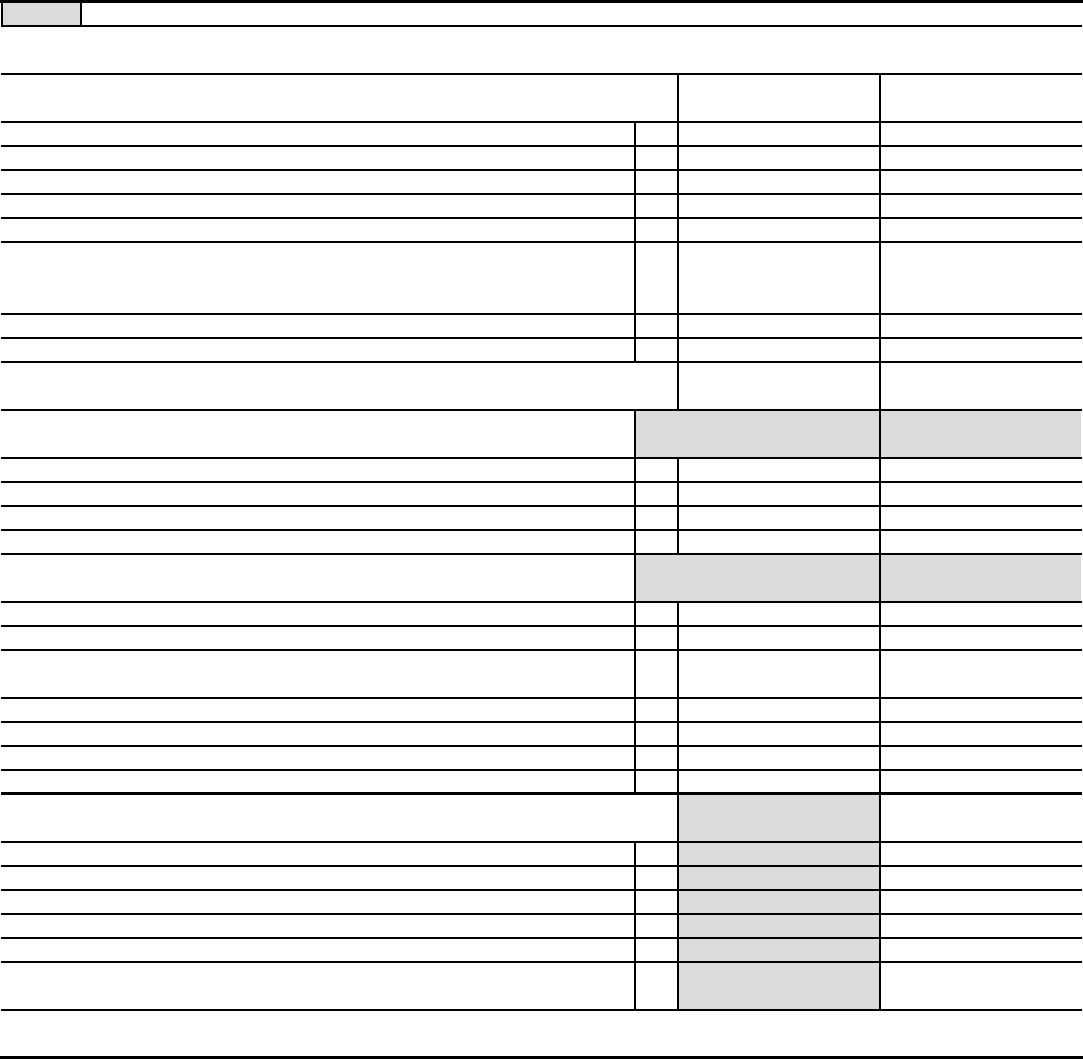

732010 11-28-17

Total functional expenses.

Joint costs.

(A) (B) (C) (D)

1

2

3

4

5

6

7

8

9

10

11

a

b

c

d

e

f

g

12

13

14

15

16

17

18

19

20

21

22

23

24

a

b

c

d

e

25

26

Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A).

Grants and other assistance to domestic organizations

and domestic governments. See Part IV, line 21

Compensation not included above, to disqualified

persons (as defined under section 4958(f)(1)) and

persons described in section 4958(c)(3)(B)

Pension plan accruals and contributions (include

section 401(k) and 403(b) employer contributions)

Professional fundraising services. See Part IV, line 17

(If line 11g amount exceeds 10% of line 25,

column (A) amount, list line 11g expenses on Sch O.)

Other expenses. Itemize expenses not covered

above. (List miscellaneous expenses in line 24e. If line

24e amount exceeds 10% of line 25, column (A)

amount, list line 24e expenses on Schedule O.)

Add lines 1 through 24e

Complete this line only if the organization

reported in column (B) joint costs from a combined

educational campaign and fundraising solicitation.

Form 990 (2017) Page

Check if Schedule O contains a response or note to any line in this Part IX ••••••••••••••••••••••••••

Total expenses Program service

expenses

Management and

general expenses

Fundraising

expenses

~

Grants and other assistance to domestic

individuals. See Part IV, line 22 ~~~~~~~

Grants and other assistance to foreign

organizations, foreign governments, and foreign

individuals. See Part IV, lines 15 and 16 ~~~

Benefits paid to or for members ~~~~~~~

Compensation of current officers, directors,

trustees, and key employees ~~~~~~~~

~~~

Other salaries and wages ~~~~~~~~~~

Other employee benefits ~~~~~~~~~~

Payroll taxes ~~~~~~~~~~~~~~~~

Fees for services (non-employees):

Management

Legal

Accounting

Lobbying

~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~

Investment management fees

Other.

~~~~~~~~

Advertising and promotion

Office expenses

Information technology

Royalties

~~~~~~~~~

~~~~~~~~~~~~~~~

~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~

Occupancy ~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~

Travel

Payments of travel or entertainment expenses

for any federal, state, or local public officials

Conferences, conventions, and meetings ~~

Interest

Payments to affiliates

~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~

Depreciation, depletion, and amortization

Insurance

~~

~~~~~~~~~~~~~~~~~

All other expenses

|

Form (2017)

Do not include amounts reported on lines 6b,

7b, 8b, 9b, and 10b of Part VIII.

10

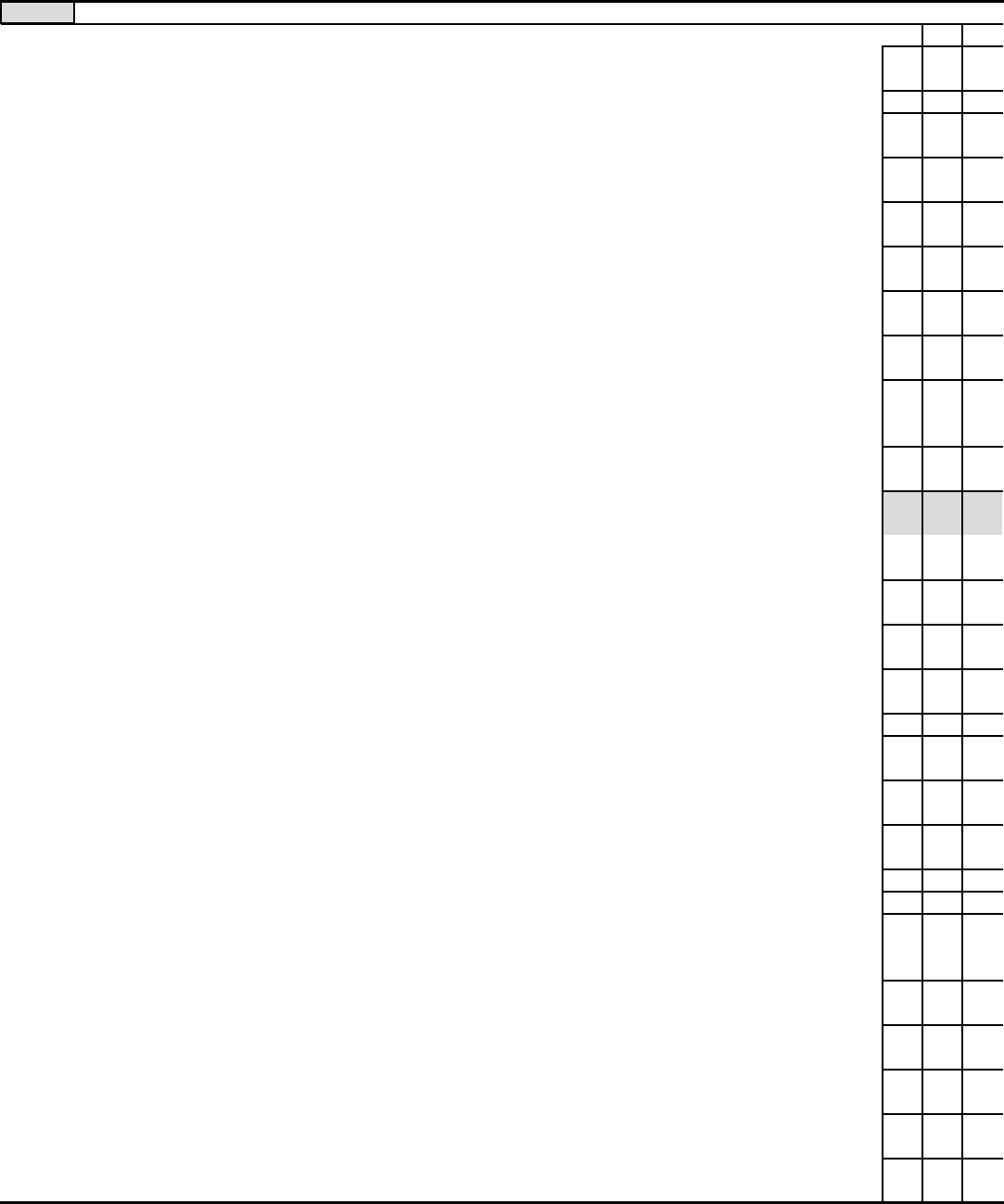

Part IX

Statement of Functional Expenses

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X

88,677,922. 88,677,922.

4,656,880. 1,938,143. 1,551,296. 1,167,441.

48,206,246. 25,391,903. 10,984,724. 11,829,619.

2,401,573. 1,244,875. 566,787. 589,911.

7,981,367. 4,153,608. 1,861,020. 1,966,739.

3,510,414. 1,805,130. 849,865. 855,419.

1,256,597. 1,012,961. 103,306. 140,330.

190,335. 190,335.

137,219. 137,219.

9,568,145. 9,568,145.

751,355. 751,355.

27,040,396. 21,440,983. 2,841,774. 2,757,639.

6,678,472. 5,516,679. 1,161,793.

5,607,552. 1,551,422. 392,170. 3,663,960.

13,458,535. 4,468,457. 4,168,704. 4,821,374.

4,760,584. 2,430,902. 1,190,898. 1,138,784.

5,106,422. 3,758,842. 750,046. 597,534.

4,525,882. 3,039,541. 1,034,176. 452,165.

3,219,323. 1,668,763. 759,781. 790,779.

833,603. 88,282. 530,887. 214,434.

OTHER FUNDRAISING EXPEN 8,238,305. 3,208,995. 5,029,310.

OUTSIDE PRINTING & ARTW 498,647. 197,824. 13,713. 287,110.

REIMBURSED EXPENSES 386,906. 292,331. 65,512. 29,063.

STAFF DEVELOPMENT & TRA 349,345. 225,036. 31,479. 92,830.

1,243,228. 800,927. 231,262. 211,039.

249,285,253.173,050,745. 28,869,090. 47,365,418.

X 14,736,303. 5,740,103. 0. 8,996,200.

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

12

732011 11-28-17

(A) (B)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

1

2

3

4

5

6

7

8

9

10c

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

a

b

10a

10b

Assets

Total assets.

Liabilities

Total liabilities.

Organizations that follow SFAS 117 (ASC 958), check here and

complete lines 27 through 29, and lines 33 and 34.

27

28

29

Organizations that do not follow SFAS 117 (ASC 958), check here

and complete lines 30 through 34.

30

31

32

33

34

Net Assets or Fund Balances

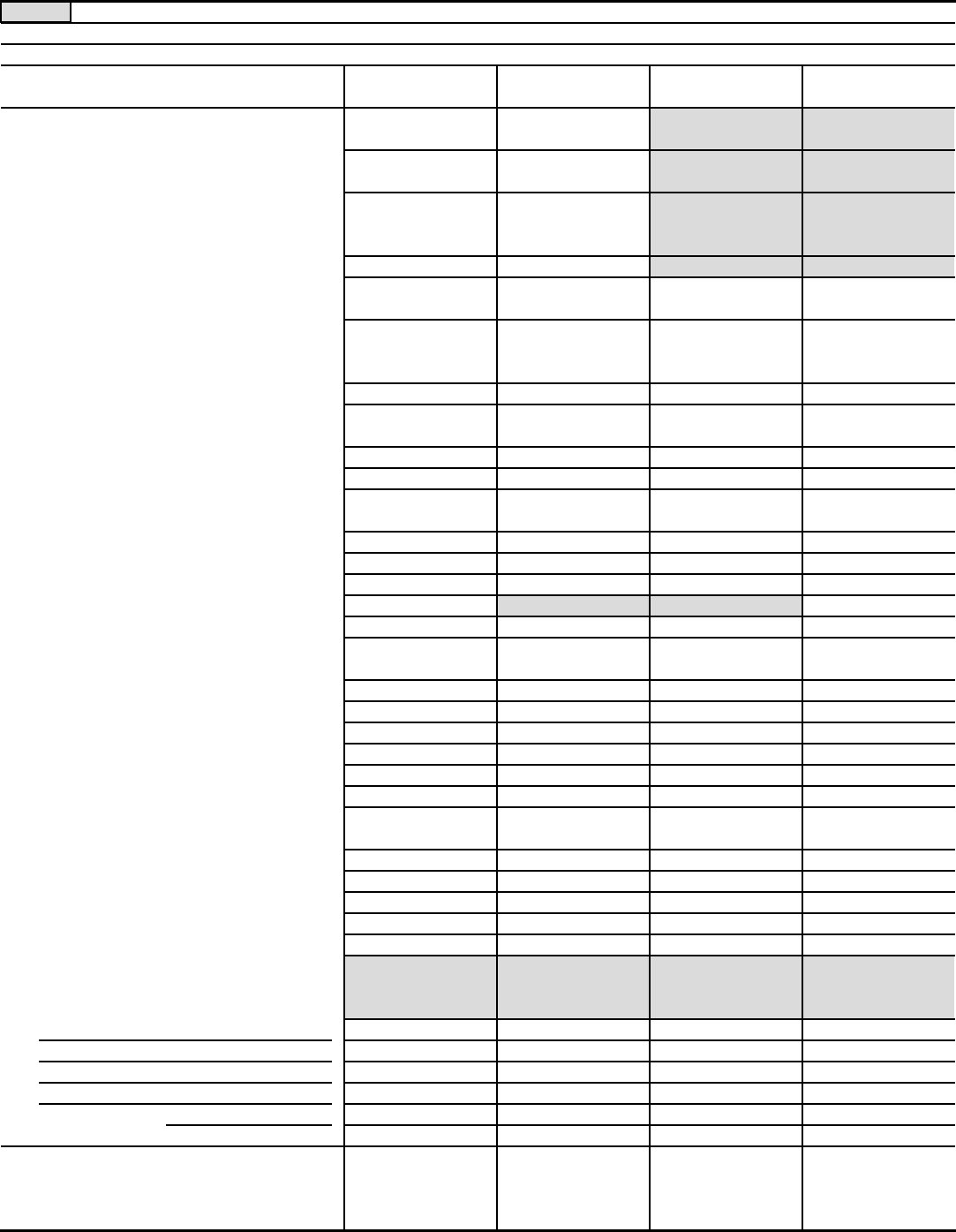

Form 990 (2017) Page

Check if Schedule O contains a response or note to any line in this Part X •••••••••••••••••••••••••••••

Beginning of year End of year

Cash - non-interest-bearing

Savings and temporary cash investments

Pledges and grants receivable, net

~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~

Accounts receivable, net ~~~~~~~~~~~~~~~~~~~~~~~~~~

Loans and other receivables from current and former officers, directors,

trustees, key employees, and highest compensated employees. Complete

Part II of Schedule L ~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Loans and other receivables from other disqualified persons (as defined under

section 4958(f)(1)), persons described in section 4958(c)(3)(B), and contributing

employers and sponsoring organizations of section 501(c)(9) voluntary

employees' beneficiary organizations (see instr). Complete Part II of Sch L ~~

Notes and loans receivable, net

Inventories for sale or use

Prepaid expenses and deferred charges

~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~

Land, buildings, and equipment: cost or other

basis. Complete Part VI of Schedule D

Less: accumulated depreciation

~~~

~~~~~~

Investments - publicly traded securities

Investments - other securities. See Part IV, line 11

Investments - program-related. See Part IV, line 11

Intangible assets

~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~

~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Other assets. See Part IV, line 11 ~~~~~~~~~~~~~~~~~~~~~~

Add lines 1 through 15 (must equal line 34) ••••••••••

Accounts payable and accrued expenses

Grants payable

Deferred revenue

~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Tax-exempt bond liabilities

Escrow or custodial account liability. Complete Part IV of Schedule D

~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~

Loans and other payables to current and former officers, directors, trustees,

key employees, highest compensated employees, and disqualified persons.

Complete Part II of Schedule L

~~~~~~~~~~~~~~~~~~~~~~~

Secured mortgages and notes payable to unrelated third parties ~~~~~~

Unsecured notes and loans payable to unrelated third parties ~~~~~~~~

Other liabilities (including federal income tax, payables to related third

parties, and other liabilities not included on lines 17-24). Complete Part X of

Schedule D ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Add lines 17 through 25 ••••••••••••••••••

|

Unrestricted net assets

Temporarily restricted net assets

Permanently restricted net assets

~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~

|

Capital stock or trust principal, or current funds

Paid-in or capital surplus, or land, building, or equipment fund

Retained earnings, endowment, accumulated income, or other funds

~~~~~~~~~~~~~~~

~~~~~~~~

~~~~

Total net assets or fund balances ~~~~~~~~~~~~~~~~~~~~~~

Total liabilities and net assets/fund balances ••••••••••••••••

Form (2017)

11

Balance Sheet

Part X

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

83,863,983. 101,052,833.

68,163,159. 55,722,356.

514,167. 239,728.

152,426. 113,522.

2,101,978. 3,320,555.

27,452,665.

8,223,700. 17,976,562. 19,228,965.

259,131,003. 273,852,181.

10,718,984. 10,060,304.

3,723,316. 3,817,506.

446,345,578. 467,407,950.

17,472,604. 23,030,336.

40,833,551. 23,062,440.

114,405. 47,280.

26,917,837. 27,687,668.

85,338,397. 73,827,724.

X

236,322,255. 272,246,608.

98,503,059. 95,036,578.

26,181,867. 26,297,040.

361,007,181. 393,580,226.

446,345,578. 467,407,950.

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

13

732012 11-28-17

1

2

3

4

5

6

7

8

9

10

1

2

3

4

5

6

7

8

9

10

Yes No

1

2

3

a

b

c

2a

2b

2c

a

b

3a

3b

Form 990 (2017) Page

Check if Schedule O contains a response or note to any line in this Part XI •••••••••••••••••••••••••••

Total revenue (must equal Part VIII, column (A), line 12)

Total expenses (must equal Part IX, column (A), line 25)

Revenue less expenses. Subtract line 2 from line 1

Net assets or fund balances at beginning of year (must equal Part X, line 33, column (A))

~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~

Net unrealized gains (losses) on investments

Donated services and use of facilities

Investment expenses

Prior period adjustments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Other changes in net assets or fund balances (explain in Schedule O)

Net assets or fund balances at end of year. Combine lines 3 through 9 (must equal Part X, line 33,

column (B))

~~~~~~~~~~~~~~~~~~~

•••••••••••••••••••••••••••••••••••••••••••••••

Check if Schedule O contains a response or note to any line in this Part XII

•••••••••••••••••••••••••••

Accounting method used to prepare the Form 990: Cash Accrual Other

If the organization changed its method of accounting from a prior year or checked "Other," explain in Schedule O.

Were the organization's financial statements compiled or reviewed by an independent accountant? ~~~~~~~~~~~~

If "Yes," check a box below to indicate whether the financial statements for the year were compiled or reviewed on a

separate basis, consolidated basis, or both:

Separate basis Consolidated basis Both consolidated and separate basis

Were the organization's financial statements audited by an independent accountant? ~~~~~~~~~~~~~~~~~~~

If "Yes," check a box below to indicate whether the financial statements for the year were audited on a separate basis,

consolidated basis, or both:

Separate basis Consolidated basis Both consolidated and separate basis

If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit,

review, or compilation of its financial statements and selection of an independent accountant?~~~~~~~~~~~~~~~

If the organization changed either its oversight process or selection process during the tax year, explain in Schedule O.

As a result of a federal award, was the organization required to undergo an audit or audits as set forth in the Single Audit

Act and OMB Circular A-133? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the required audit

or audits, explain why in Schedule O and describe any steps taken to undergo such audits ••••••••••••••••

Form (2017)

12

Part XI

Reconciliation of Net Assets

Part XII

Financial Statements and Reporting

990

PLANNED PARENTHOOD FEDERATION OF

AMERICA, INC. 13-1644147

X

274,186,594.

249,285,253.

24,901,341.

361,007,181.

5,252,585.

2,419,119.

393,580,226.

X

X

X

X

X

X

20300214 142680 FEDERATION 2017.05030 PLANNED PARENTHOOD FEDERATI FEDERAT1

14

(iv) Is the organization listed

in your governing document?

OMB No. 1545-0047

Department of the Treasury

Internal Revenue Service

732021 10-06-17

(i) (iii) (v) (vi)(ii) Name of supported

organization

Type of organization

(described on lines 1-10

above (see instructions))

Amount of monetary

support (see instructions)

Amount of other

support (see instructions)

EIN

(Form 990 or 990-EZ)

Complete if the organization is a section 501(c)(3) organization or a section

4947(a)(1) nonexempt charitable trust.

| Attach to Form 990 or Form 990-EZ.

| Go to www.irs.gov/Form990 for instructions and the latest information.

Open to Public

Inspection

Name of the organization Employer identification number

1

2

3

4

5

6

7

8

9

10

11

12

section 170(b)(1)(A)(i).

section 170(b)(1)(A)(ii).

section 170(b)(1)(A)(iii).

section 170(b)(1)(A)(iii).

section 170(b)(1)(A)(iv).

section 170(b)(1)(A)(v).

section 170(b)(1)(A)(vi).

section 170(b)(1)(A)(vi).

section 170(b)(1)(A)(ix)

section 509(a)(2).

section 509(a)(4).

section 509(a)(1) section 509(a)(2) section 509(a)(3).

a

b

c

d

e

f

g

Type I.

You must complete Part IV, Sections A and B.

Type II.

You must complete Part IV, Sections A and C.

Type III functionally integrated.

You must complete Part IV, Sections A, D, and E.

Type III non-functionally integrated.

You must complete Part IV, Sections A and D, and Part V.

Yes No

Total

For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ. Schedule A (Form 990 or 990-EZ) 2017

(All organizations must complete this part.) See instructions.

The organization is not a private foundation because it is: (For lines 1 through 12, check only one box.)

A church, convention of churches, or association of churches described in

A school described in (Attach Schedule E (Form 990 or 990-EZ).)

A hospital or a cooperative hospital service organization described in

A medical research organization operated in conjunction with a hospital described in Enter the hospital's name,

city, and state:

An organization operated for the benefit of a college or university owned or operated by a governmental unit described in

(Complete Part II.)

A federal, state, or local government or governmental unit described in

An organization that normally receives a substantial part of its support from a governmental unit or from the general public described in

(Complete Part II.)

A community trust described in (Complete Part II.)

An agricultural research organization described in operated in conjunction with a land-grant college

or university or a non-land-grant college of agriculture (see instructions). Enter the name, city, and state of the college or

university:

An organization that normally receives: (1) more than 33 1/3% of its support from contributions, membership fees, and gross receipts from

activities related to its exempt functions - subject to certain exceptions, and (2) no more than 33 1/3% of its support from gross investment

income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975.

See (Complete Part III.)

An organization organized and operated exclusively to test for public safety. See

An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one or

more publicly supported organizations described in or . See Check the box in

lines 12a through 12d that describes the type of supporting organization and complete lines 12e, 12f, and 12g.

A supporting organization operated, supervised, or controlled by its supported organization(s), typically by giving