TAX TYPE Income

YEAR ENACTED 2000

REPEAL/EXPIRATION DATE None

REVENUE IMPACT $41.3 million

(TAX YEAR 2018)

NUMBER OF TAXPAYERS) 413,000

(TAX YEAR 2018)

WHAT DOES THE TAX EXPENDITURE

DO?

The Charitable Contribution Deduction [Section

39-22-104(4)(m), C.R.S.] allows an individual to

deduct the amount of any charitable contributions

over $500 from their state income, if the individual

claimed the standard deduction, instead of itemized

deductions, on their federal income tax return.

WHAT IS THE PURPOSE OF THE TAX

EXPENDITURE?

Statute and the enacting legislation for the

Charitable Contribution Deduction do not state its

purpose; therefore, we could not definitively

determine the General Assembly’s original intent.

However, based on how the deduction operates and

the bill sponsors’ legislative testimony, we

considered a potential purpose: to provide the

benefit of a deduction for charitable contributions

to taxpayers who claim the standard deduction on

their federal income tax return, similar to the

deduction benefit provided to taxpayers who

itemize their deductions on their federal return.

WHAT POLICY CONSIDERATIONS DID

THE EVALUATION IDENTIFY?

The General Assembly may want to consider:

Amending statute to establish a statutory

purpose and performance measures for the

deduction.

Reviewing the deduction’s $500 charitable

contribution floor.

Repealing an obsolete statutory reference to

taxpayers contributing to Hunger-Relief

organizations.

CHARITABLE CONTRIBUTION

DEDUCTION

EVALUATION SUMMARY | APRIL 2022 | 2022-TE18

KEY CONCLUSION: The deduction is effective at equalizing the state-level tax benefit provided to

taxpayers who make charitable contributions and claim the federal standard deduction with the

benefit provided to taxpayers who itemize their federal deductions. Its usage increased significantly

in Tax Year 2018 due to federal legislation, with higher income taxpayers claiming the deduction

more frequently.

2

CHARITABLE CONTRIBUTION DEDUCTION

CHARITABLE

CONTRIBUTION

DEDUCTION

EVALUATION RESULTS

WHAT IS THE TAX EXPENDITURE?

The Charitable Contribution Deduction [Section 39-22-104(4)(m),

C.R.S.] allows an individual to deduct the amount of any charitable

contributions over $500 from their state taxable income, if the

individual claimed the standard federal deduction instead of itemizing

deductions on their federal income tax return. For example, if an

individual makes $1,300 in charitable contributions during the year and

claims the federal standard deduction, they would be allowed to deduct

$800 when calculating their state taxable income. The deduction must

be used in the tax year when the individual makes the contributions,

and if its value exceeds income tax owed, it cannot be carried forward

to future years.

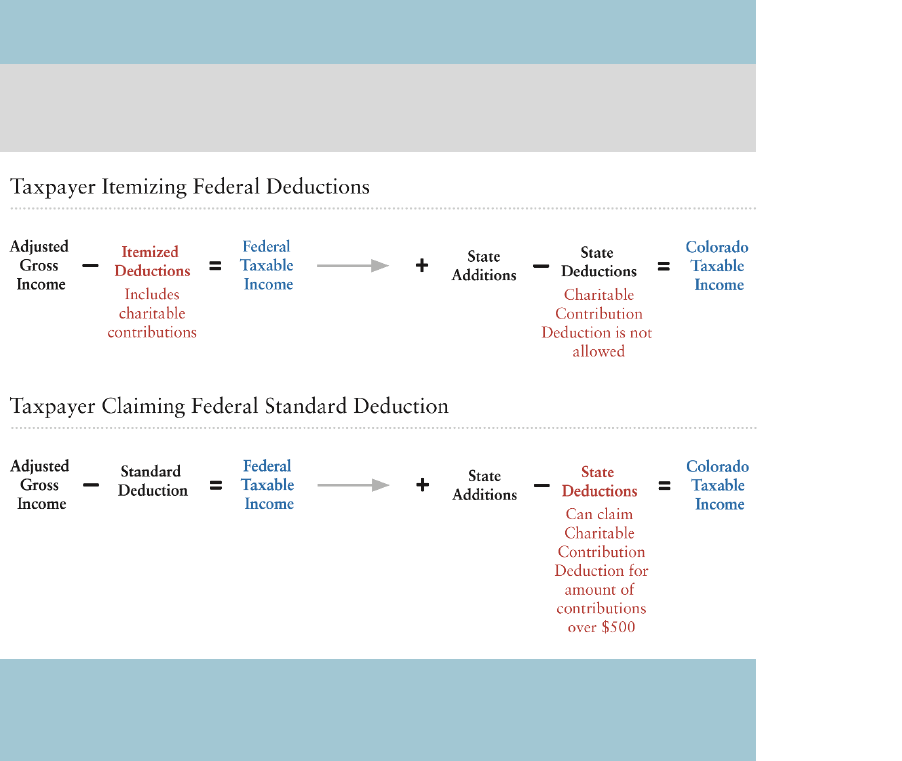

Since 1987, Federal Taxable Income (FTI), which is Adjusted Gross

Income (AGI) minus either itemized deductions or the standard

deduction, has served as the starting point for calculating Colorado

taxable income. Federal law allows taxpayers to deduct charitable

contributions from their AGI, which would also reduce their Colorado

taxable income. However, taxpayers must itemize their federal

deductions to claim a federal charitable contribution deduction. The

State’s Charitable Contribution Deduction allows taxpayers who use

the standard deduction to claim a state-level deduction for charitable

contributions. EXHIBIT 1 shows how taxpayers claim federal and state

deductions for charitable contributions based on whether they itemize

their deductions or claim the standard deduction on their federal tax

return.

3

TAX EXPENDITURES REPORT

EXHIBIT 1. CHARITABLE CONTRIBUTION DEDUCTIONS

FOR FEDERAL AND STATE INCOME TAXES

Taxpayers itemizing deductions subtract charitable contributions before arriving at

federal taxable income, while taxpayers claiming the standard deduction only

subtract charitable contributions before arriving at Colorado taxable income.

SOURCE: Office of the State Auditor description of the calculation of net Colorado

taxable income when a taxpayer claims their charitable contribution either as an

itemized deduction when calculating federal taxable income, or as a state deduction

when calculating state taxable income.

In order to qualify for the state Charitable Contribution Deduction,

taxpayers must:

Be a person who can claim the federal standard deduction under

Internal Revenue Code 26 USC 63. Individuals claimed as

dependents on another return; spouses filing separately if either

spouse itemizes deductions; non-resident aliens; and fiduciaries,

partnerships, or corporations do not qualify.

Claim the federal standard deduction when filing their income tax

return.

4

CHARITABLE CONTRIBUTION DEDUCTION

Make charitable contributions that would qualify for the federal

charitable contribution deduction under Internal Revenue Code 26

USC 170. Contributions can include both cash and non-cash

contributions (e.g., stock and tangible property).

While statute does not specify a cap on the amount of contributions that

can be deducted, Department of Revenue (Department) regulations

indicate that the federal charitable contribution deduction limitations

set forth in 26 USC 170 also apply to the state deduction [1 CCR 201-

2 Rule 39-22-104(4)(m)(2)]. These limitations restrict the amount a

taxpayer can deduct to a maximum percentage of the taxpayer’s AGI,

which varies between 20 and 60 percent of AGI based on the type of

organization that the taxpayer contributes to, and the type of

contribution (i.e., cash or non-cash). For example, taxpayers making a

cash contribution to public charities can claim a deduction of up to 60

percent of their AGI; however, deductions based on cash contributions

to veterans’ organizations or fraternal societies are limited to 30 percent

of the taxpayer’s AGI.

Taxpayers claim the Charitable Contribution Deduction on Line 9 of

the state Subtraction from Income Schedule (Form DR 0104AD), which

they must attach to their Colorado Income Tax Return. Taxpayers enter

the total amount of their contribution and then subtract from their state

taxable income the contribution amount that is over $500.

The General Assembly originally created the Charitable Contribution

Deduction as a Taxpayer’s Bill of Rights (TABOR) refund mechanism

in 2000 (House Bill 00-1053). In 2010, Senate Bill 10-212 repealed

several TABOR refund mechanisms, including the Charitable

Contribution Deduction, and made the deduction permanent and

available in all years (i.e., taxpayers can claim the deduction even when

there is not a TABOR surplus).

While the State has not substantially changed the deduction since 2010,

two major federal changes have had an impact on the number of

taxpayers that claim the standard deduction, and are therefore eligible

5

TAX EXPENDITURES REPORT

for the state deduction, and the total deduction a taxpayer can claim.

First, in 2017, the U.S. Congress passed the Tax Cuts and Jobs Act

(TCJA), which nearly doubled the amount of the standard deduction

through 2025. For example, prior to 2018, the standard deduction for

an individual was $6,500; for Tax Years 2018 through 2025, the

standard deduction increased to $12,000, adjusted annually for

inflation. The TCJA also limited the amount of itemized deductions that

taxpayers could claim for other expenses, including mortgage interest

and state and local taxes paid. In addition to increasing the standard

deduction, the TCJA also temporarily raised the limit on the amount of

charitable contribution deductions that a taxpayer can claim.

Specifically, for Tax Years 2018 through 2025, the charitable

contribution deduction limitation was modified from 50 percent of AGI

to 60 percent.

Second, in response to the COVID-19 pandemic, Congress passed bills

that modified the AGI limitations for charitable contribution

deductions and created a temporary charitable contribution deduction

for individuals that make cash contributions, but claim the standard

deduction on their federal income tax return:

In 2020, the Coronavirus Aid, Relief, and Economic Security

(CARES) Act created a 1-year charitable contribution deduction of

up to $300 for individuals who make a cash contribution and claim

the standard deduction. The CARES Act also temporarily raised the

limit for cash contributions from 60 percent to 100 percent of AGI.

In 2020, the Consolidated Appropriations Act (CAA) extended the

charitable contribution deduction for taxpayers making cash

donations and claiming the standard deduction through 2021. The

maximum amount remained at $300 for individual filers, but

married taxpayers filing jointly could deduct up to $600. The CAA

also extended the CARES Act provision raising the limit for cash

contributions to 100 percent of AGI, through 2021.

6

CHARITABLE CONTRIBUTION DEDUCTION

WHO ARE THE INTENDED BENEFICIARIES OF THE TAX

EXPENDITURE?

Statute does not explicitly state the intended beneficiaries of the

Charitable Contribution Deduction. However, based on its operation,

and testimony from hearings related to the enacting legislation (House

Bill 00-1053), we inferred that the intended direct beneficiaries are

taxpayers who contribute more than $500 to charities, but claim the

standard deduction.

Bill sponsors stated that they intended that the deduction would mainly

benefit low- and middle-income taxpayers, who were more likely than

higher-income taxpayers to claim the federal standard deduction

because their itemizable expenses (e.g., charitable contributions,

mortgage interest, medical expenses, and state and local taxes paid)

generally do not exceed the standard deduction. Additionally, they

indicated that the bill would benefit a smaller number of taxpayers who

may have a high income or high net worth, but who do not have

itemizable expenses that exceed the standard deduction (e.g., retirees

who do not have mortgage payments or significant medical expenses).

However, changes under the TCJA have impacted the number and

income level of Colorado taxpayers who can potentially benefit from

the deduction. Specifically, the standard deduction had only been

annually adjusted for inflation since the 1970s through Tax Year 2017,

until the TCJA roughly doubled the standard deduction for Tax Years

2018 through 2025, from $6,500 to $12,000 for single filers and from

$13,000 to $24,000 for married couples filing jointly. This change

significantly increased the number of Coloradans claiming the federal

standard deduction, and who could therefore claim the State’s

Charitable Contribution Deduction, at all income levels. Specifically,

for Tax Years 2015 through 2017, about 66 percent of Colorado

taxpayers’ returns claimed the standard deduction on their federal

returns. Then in Tax Year 2018, the first year of the temporary increase

in the standard deduction under the TCJA, the proportion of Colorado

returns claiming the standard deduction increased to 86 percent.

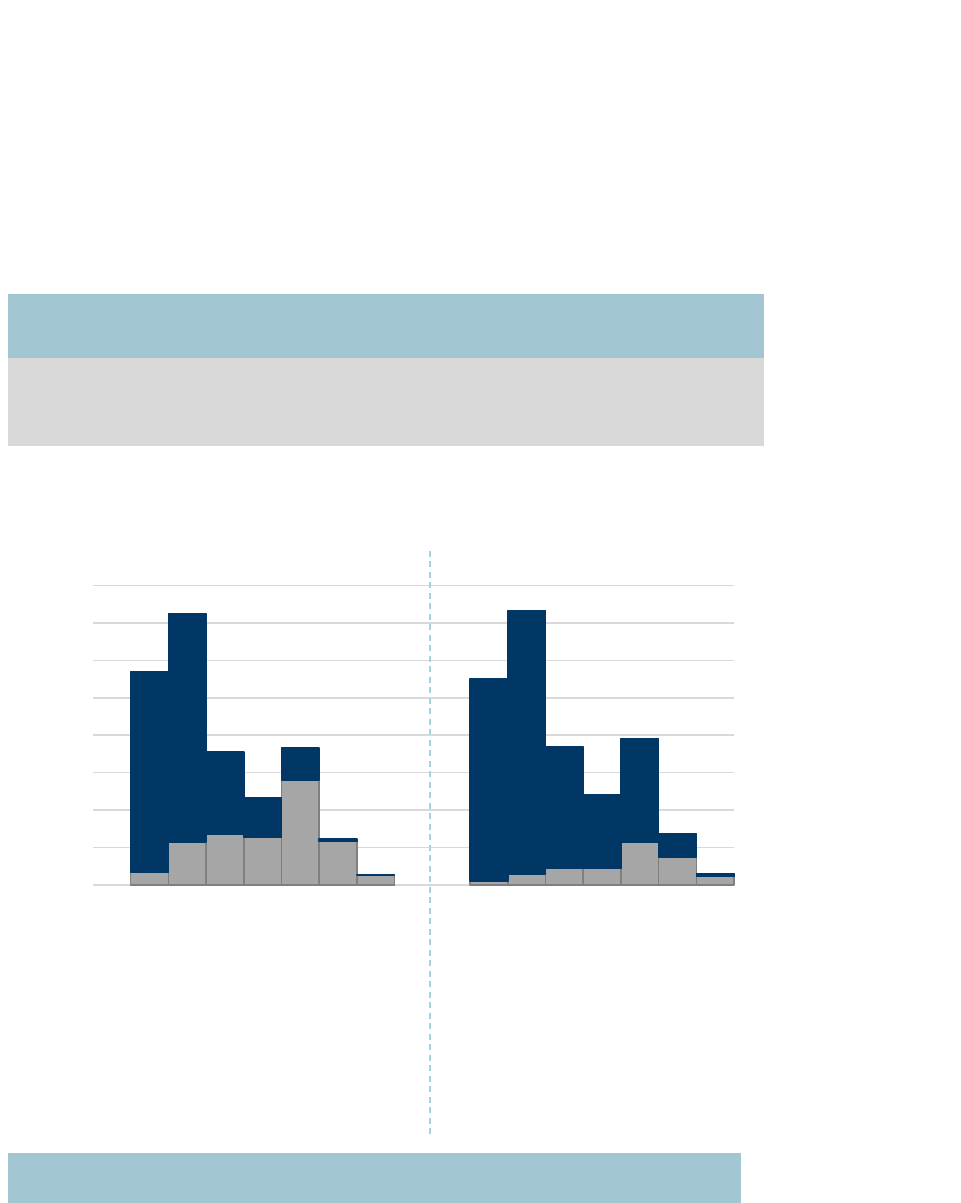

Further, the change in the proportion of taxpayers who claimed the

7

TAX EXPENDITURES REPORT

Itemized Deduction

Standard Deduction

2017

2018

standard deduction was the most significant among taxpayers with

AGIs over $75,000. For example, prior to the TCJA about 27 percent

of taxpayers with AGI’s between $75,000 and $499,000 claimed the

standard deduction; whereas, in Tax Year 2018, after the passage of the

TCJA, 70 percent of these taxpayers claimed it. EXHIBIT 2 shows the

increase in standard deduction filers in Colorado across income levels

from Tax Year 2017 to 2018.

EXHIBIT 2. INCREASE IN RETURNS CLAIMING

THE STANDARD DEDUCTION, BY AGI

Due to temporary increases in the federal standard deduction under the TCJA there

was a large shift of returns claiming the standard deduction instead of itemizing

between Tax Years 2017 and 2018.

SOURCE: Office of the State Auditor analysis of Department of Revenue Statistics of Income

for Tax Years 2017 through 2018.

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

$ 0 to $ 19,999

$ 20,000 to $ 49,999

$50,000 to $74,999

$ 75,000 to $ 99,999

$ 100,000 to $ 199,999

$ 200,000 to $ 499,999

$ 500,000 and over

$ 0 to $ 19,999

$ 20,000 to $ 49,999

$50,000 to $74,999

$ 75,000 to $ 99,999

$ 100,000 to $ 199,999

$ 200,000 to $ 499,999

$ 500,000 and over

2017 2018

TCJA Takes Effect

8

CHARITABLE CONTRIBUTION DEDUCTION

In addition to benefiting taxpayers who claim the Charitable

Contribution Deduction, bill sponsors stated that the deduction may

incentivize taxpayers who claim the standard deduction to make or

increase their charitable contributions, thereby benefitting charitable

organizations. Therefore, we inferred that the indirect beneficiaries of

the deduction include the charities that receive the contributions, and

the greater community that is served by charitable organizations

receiving contributions.

WHAT IS THE PURPOSE OF THE TAX EXPENDITURE?

Statute and the enacting legislation for the Charitable Contribution

Deduction do not state its purpose; therefore, we could not definitively

determine the General Assembly’s original intent. However, based on

how the deduction operates and the bill sponsors’ legislative testimony,

we considered a potential purpose: to provide the benefit of a deduction

for charitable contributions to taxpayers who claim the standard

deduction, similar to the benefit provided to taxpayers who itemize their

deductions. Specifically, because federal taxable income is the starting

point for calculating state taxable income, the bill sponsors for the

deduction testified that taxpayers who make charitable contributions

and itemize their deductions receive a state tax benefit that taxpayers

who claim the standard deduction do not receive. The bill sponsors

stated that the bill would “remedy an inequity in the law by extending

the same benefit to non-itemizing taxpayers that give charitable

contributions that is currently enjoyed by itemizing taxpayers.” The

threshold for the benefit was set at $500 because the bill sponsors

believed that the standard deduction already assumes $500 of charitable

contributions in its calculation, therefore setting a floor for that amount

would prevent a taxpayer from receiving a “double benefit.”

IS THE TAX EXPENDITURE MEETING ITS PURPOSE AND

WHAT PERFORMANCE MEASURES WERE USED TO MAKE

THIS DETERMINATION?

We could not definitively determine if the Charitable Contribution

Deduction is meeting its purpose because statute and the enacting

9

TAX EXPENDITURES REPORT

legislation do not provide a purpose. However, we found that it is likely

meeting the purpose we considered for this evaluation because it is

commonly used by taxpayers who make charitable contributions and

claim the standard deduction, allowing them to claim a similar benefit

as those who make charitable contributions and itemize their

deductions.

PERFORMANCE MEASURE:

To what extent is the deduction used by

eligible taxpayers?

RESULT: Overall, we found that the deduction is commonly claimed by

taxpayers in Colorado, with about 152,000 returns claiming it in Tax

Year 2017, increasing to about 350,000 in Tax Year 2018, following

the passage of the TCJA.

Although the deduction is widely used, we lacked data necessary to

determine the proportion of eligible taxpayers who claimed the

deduction. However, about 17 percent of the 2.1 million Colorado tax

returns that claimed the standard deduction in Tax Year 2018 claimed

the Charitable Contribution Deduction, which is up from about 10

percent in Tax Year 2017. In comparison, about 50 percent of all U.S.

households made charitable contributions of some amount in 2018,

including households that itemize deductions, with an average

contribution amount of about $1,300, according to research conducted

by the University of Indiana, Lilly School of Philanthropy. Therefore, if

charitable giving among Colorado standard deduction filers is similar

to that of the United States as a whole, it appears that some eligible

taxpayers may not have claimed the deduction. It is possible that this is

due to a lack of awareness of the deduction, taxpayers making

contributions that do not exceed the $500 floor, or because it provides

a relatively small tax benefit to taxpayers with contribution amounts

that do not substantially exceed $500. For example, a taxpayer with

$750 in eligible contributions would see a reduction in tax liability from

the deduction of about $11 dollars. Therefore, some taxpayers may not

be motivated to keep a record of their charitable giving in order to claim

the deduction, if they do not anticipate significant tax savings.

10

CHARITABLE CONTRIBUTION DEDUCTION

Furthermore, some taxpayers may lack sufficient taxable income to be

able to benefit from the deduction. For example, taxpayers who are

married and filing jointly and who have a gross income of about

$24,000 would have no federal taxable income after deducting the

standard deduction and therefore, would not be able to receive a benefit

from the Charitable Contribution Deduction.

WHAT ARE THE ECONOMIC COSTS AND BENEFITS OF THE

TAX EXPENDITURE?

Between Tax Years 2015 and 2017, the revenue impact of the

Charitable Contribution Deduction was an average of $12.2 million

annually. In Tax Year 2018, when the TCJA changes nearly doubled

the federal standard deduction, many taxpayers who had been itemizing

and claiming the federal charitable contribution deduction, shifted to

claiming the federal standard deduction and were then able to claim the

state Charitable Contribution Deduction instead. Because of this shift,

there was a decrease in the amount claimed by Colorado taxpayers on

their federal income tax return for itemized charitable contributions,

but an increase in the revenue impact to the State for the Charitable

Contribution Deduction. Specifically, the amount claimed by taxpayers

for itemized charitable contributions on their federal income tax return

dropped about $55.3 million, from $223.5 million in Tax Year 2017 to

$168.2 million in Tax Year 2018, while the revenue impact to the State

for the Charitable Contribution Deduction increased by about $29.9

million, from $11.4 million in Tax Year 2017 to $41.3 million in Tax

Year 2018. However, for taxpayers who switched to claiming the

federal standard deduction and then the state Charitable Contribution

Deduction, their charitable contribution deductions were reduced by

$500 due to the Charitable Contribution Deduction’s $500 floor.

In addition, economic research indicates that tax benefits can encourage

individuals to make charitable contributions by lowering the net cost of

the contribution. Therefore, to the extent that the Charitable

Contribution Deduction encourages taxpayers to make charitable

contributions, it also provides a benefit to the organizations that receive

11

TAX EXPENDITURES REPORT

the contributions. However, because the Charitable Contribution

Deduction provides a relatively small reduction in tax liability, its

impact on donation amounts is also likely small. Specifically, because it

is structured as a deduction, the benefit it provides taxpayers is

equivalent to the deduction amount multiplied by the state income tax

rate (4.55 percent). Further, because the deduction excludes the first

$500 in contributions and is limited to, at most 60 percent of taxpayers’

AGI, taxpayers cannot deduct the full value of their contributions.

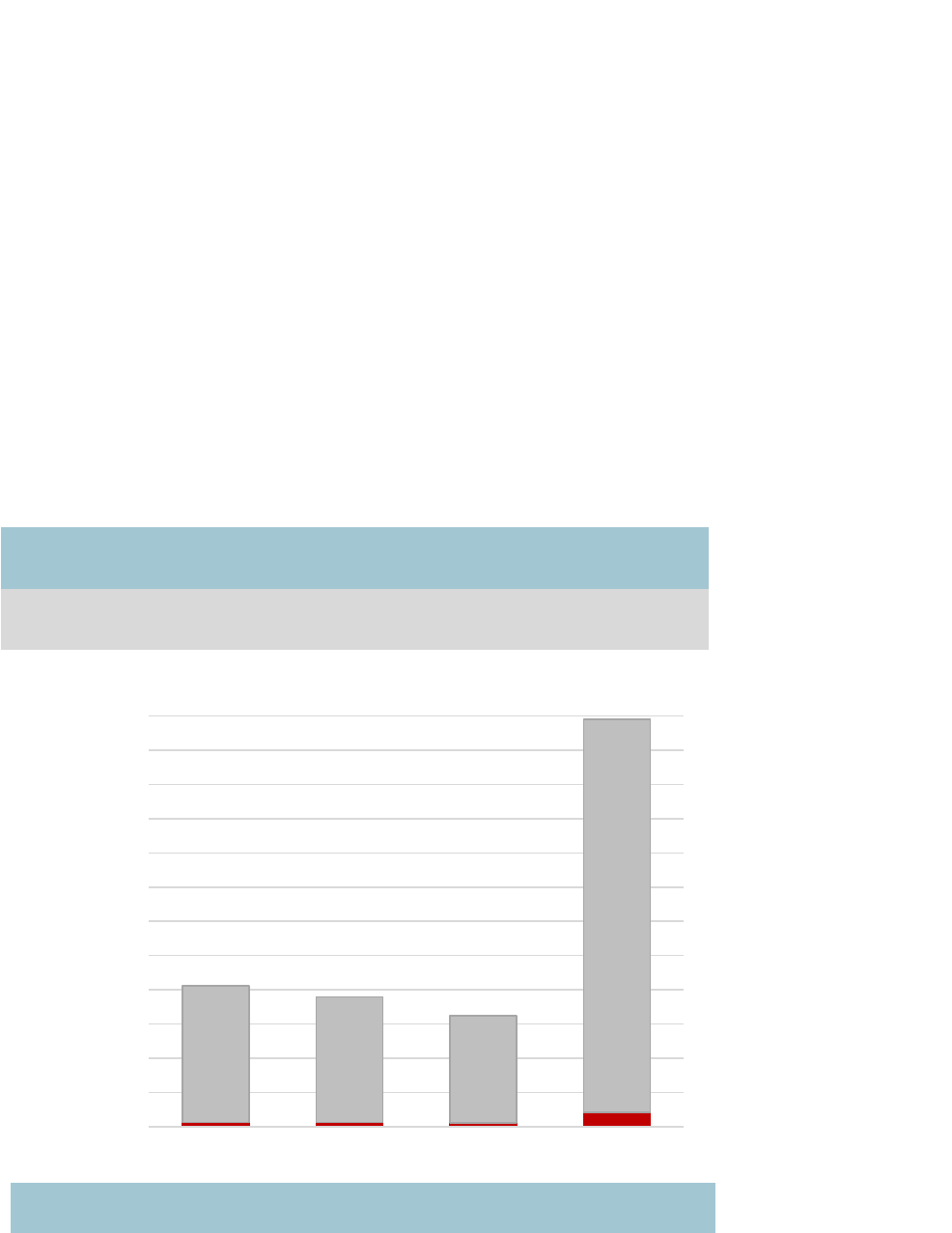

Based on Department data, we found that between Tax Years 2015

through 2018, taxpayers who claimed the deduction received a

reduction in tax liability equivalent to between 3.1 and 3.5 percent of

their charitable contributions for the year. Exhibit 3 shows the

reduction in tax liability as a portion of contribution amounts for

taxpayers who claimed the deduction.

EXHIBIT 3. TOTAL CONTRIBUTIONS

AND REDUCTION IN TAX LIABILITY

For Tax Years 2015 through 2018, taxpayers reduced their tax liability

by a small percentage of their total contributions.

SOURCE: Office of the State Auditor analysis of Department of Revenue tax data

for the Charitable Contribution Deduction for Tax Years 2015 to 2018.

3.1% 3.2% 3.5%

3.5%

$-

$100,000,000

$200,000,000

$300,000,000

$400,000,000

$500,000,000

$600,000,000

$700,000,000

$800,000,000

$900,000,000

$1,000,000,000

$1,100,000,000

$1,200,000,000

2015 2016 2017 2018

Reduction in tax liability

Charitable contributions

2018 TCJA

Takes Effect

12

CHARITABLE CONTRIBUTION DEDUCTION

Additionally, research from the Congressional Research Service, the

Indiana University Lilly School of Philanthropy, the American Institute

of Certified Professional Accountants (AICPA), and other

organizations, finds that the driving factors for charitable contributions

include believing in an organization’s mission, having a personal

connection to the cause or organization, a desire to contribute to the

community, religious beliefs, and other non-financial incentives.

Further, a Colorado Non-Profit Association survey of Colorado donors

from 2014 found that only 38 percent of respondents said that tax

benefits are a “very or somewhat important reason for giving,”

suggesting that most donors would have donated regardless of the

deduction.

However, stakeholders we spoke with also reported that while people

often make a decision to contribute to charity based on these non-

financial incentives, they often increase their contributions, including

giving more at the end of the tax year, in order to benefit from a tax

deduction. Further, charitable organizations often use the availability of

a deduction as a marketing tool to encourage donations and reported

that the presence of a deduction, regardless of the level of financial

benefit to the taxpayer, can have a positive impact on charitable

contributions because it shows that philanthropic behavior is valued.

Therefore, the deduction may increase charitable giving in the state to

some extent. However, this economic impact likely is not confined to

Colorado because taxpayers are not required to contribute to Colorado-

based organizations. We did not have access to data on which

nonprofits received these contributions and therefore, we could not

estimate the economic benefit that was specific to Colorado.

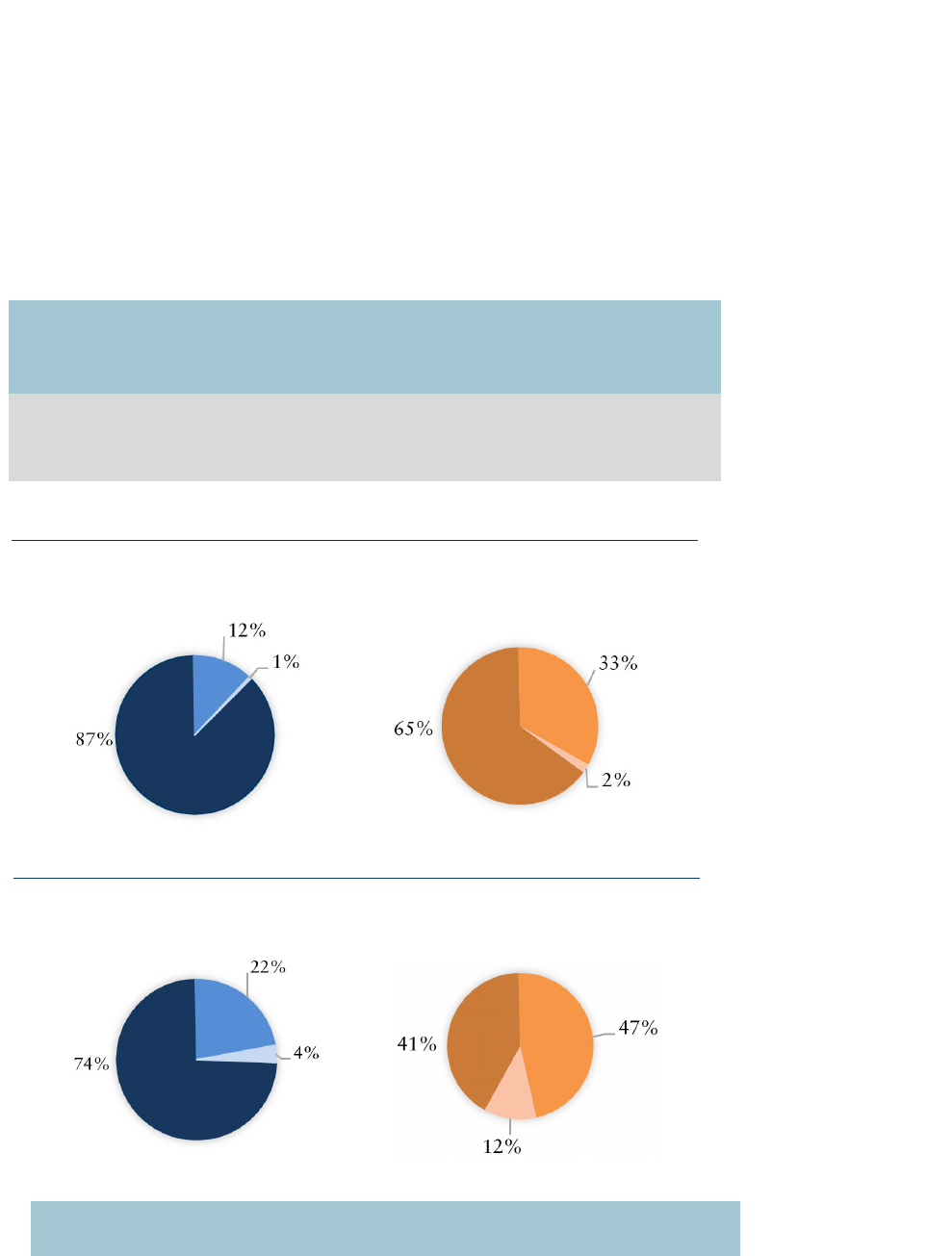

We also evaluated the extent to which the deduction benefits taxpayers

across income levels and found that the TCJA’s changes to the standard

deduction in Tax Year 2018 caused more higher-income taxpayers to

claim the standard deduction and also the Charitable Contribution

Deduction. Specifically, in Tax Year 2017, taxpayer returns with an

AGI of less than $75,000 made up 87 percent of returns claiming the

standard deduction and 65 percent of returns claiming the Charitable

Contribution Deduction. However, in 2018, taxpayer returns with an

13

TAX EXPENDITURES REPORT

AGI of less than $75,000 decreased to 74 percent of returns claiming

the standard deduction, and 41 percent of returns claiming the

Charitable Contribution Deduction. Therefore, while the deduction

continues to benefit taxpayers with low and middle incomes, it also

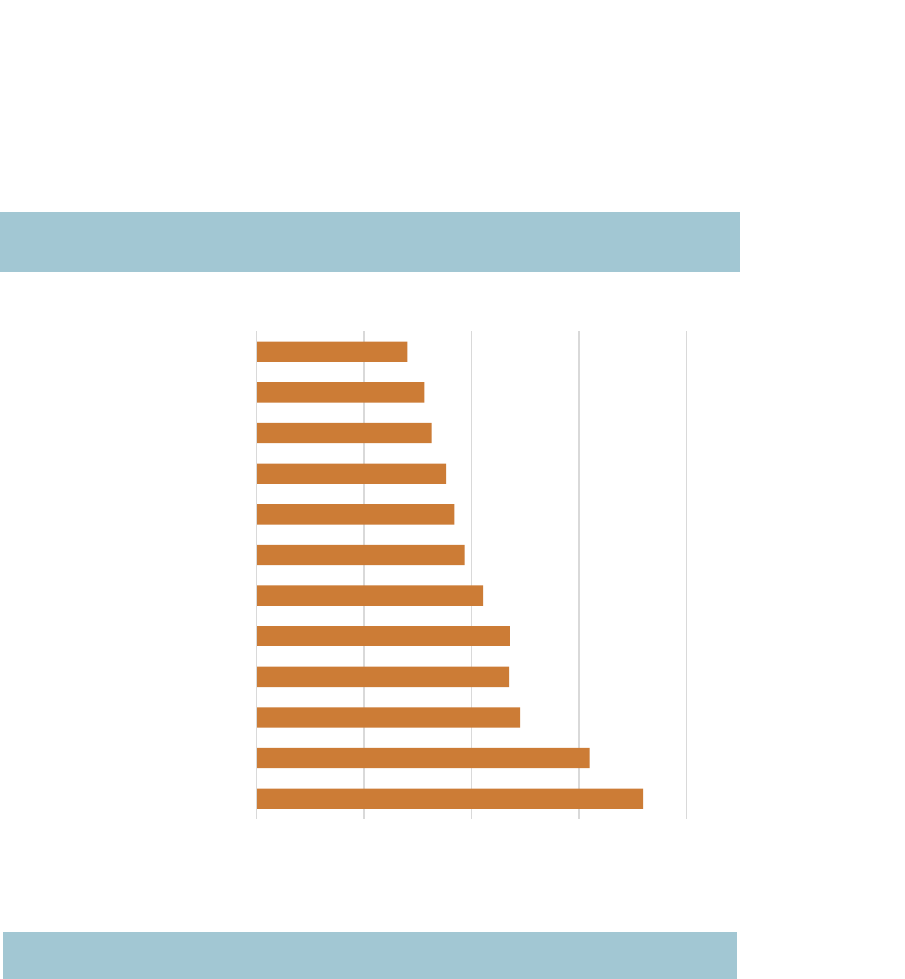

benefits a larger proportion of taxpayers with higher incomes. EXHIBIT

4 shows the shift in income levels for taxpayers claiming the standard

deduction and Charitable Contribution Deduction between Tax Year

2017 and 2018.

EXHIBIT 4. INCREASE IN RETURNS CLAIMING

THE STANDARD DEDUCTION AND CHARITABLE

CONTRIBUTION DEDUCTION, BY AGI

Due to temporary increases in the federal standard deduction under the TCJA there

was a large shift in higher income taxpayers claiming the standard deduction and the

Charitable Contribution Deduction between Tax Years 2017 and 2018.

AGI < $75,000

AGI $75,000 to

$199,000

AGI >= $200,000

AGI < $75,000

AGI $75,000 to

$199,000

AGI >= $200,000

Standard Deduction

Returns by Income

Charitable Contribution

Returns by Income

TAX YEAR 2017

TAX YEAR 2018

Standard Deduction

Returns by Income

Charitable Contribution

Returns by Income

SOURCE: Office of the State Auditor analysis of Department of Revenue Statistics

of Income for Tax Years 2017 through 2018.

14

CHARITABLE CONTRIBUTION DEDUCTION

WHAT IMPACT WOULD ELIMINATING THE TAX

EXPENDITURE HAVE ON BENEFICIARIES?

If the deduction was eliminated, taxpayers who claim the federal

standard deduction and make charitable contributions would no longer

receive a state tax benefit for their contributions. The specific benefit is

unique to each taxpayers’ contribution amount and income taxes owed.

For example, if a hypothetical taxpayer with a charitable contribution

of $2,000 itemizes their deductions on their federal tax return, they can

deduct the full $2,000 from their federal taxable income. Since federal

taxable income is the starting point for calculating state taxable income,

the taxpayer would receive a corresponding state tax benefit of about

$91. If the taxpayer claims the federal standard deduction, they would

be able to deduct up to $1,500 from their state taxable income, and

would receive a tax benefit of about $68. However, if the Charitable

Contribution Deduction was eliminated, the taxpayer claiming the

standard deduction and making charitable contributions would no

longer receive that tax benefit.

According to Department data, for Tax Year 2018, the median

Charitable Contribution Deduction was $1,290. Therefore, if the

deduction was repealed, assuming taxpayers still make the same

contributions, taxpayers who make the median contribution amount

would owe about $59 more in income taxes. However, some taxpayers

could see a more significant impact if their deductions are above the

median. For example, while less than 3 percent of Tax Year 2018

returns claimed a deduction that exceeded $10,000, this deduction

amount currently provides a tax benefit of over $455, which would no

longer be available.

Additionally, because contribution amounts tend to increase as

taxpayers’ AGI increases, the monetary impact of repealing

the expenditure increases as AGI increases. EXHIBIT 5 shows that for

Tax Year 2018, average tax benefits for each AGI level ranged from

about $70 to $180, with taxpayers at the highest AGI level receiving

15

TAX EXPENDITURES REPORT

the largest tax benefit, which would no longer be available if the

deduction was repealed. However, taxpayers with lower- and middle-

income AGIs would be more impacted by a repeal of the deduction, as

a proportion of their income.

EXHIBIT 5. AVERAGE TAX BENEFIT BY TAXPAYER AGI,

TAX YEAR 2018

SOURCE: Office of the State Auditor analysis of Department of Revenue data for returns

claiming the Charitable Contribution deduction for Tax Year 2018.

In addition to increasing the tax liability of taxpayers who currently

claim the deduction, because the deduction may incentivize some

taxpayers to make charitable contributions, charitable organizations

may experience a decrease in donations if the deduction was no longer

available. As discussed, stakeholders indicated that the deduction

encourages taxpayers to make contributions, in particular, providing

$70

$180

$- $50 $100 $150 $200

$ 0 to $ 9,999

$ 10,000 to $ 19,999

$ 20,000 to $ 29,999

$ 30,000 to $ 39,999

$ 40,000 to $ 49,999

$ 50,000 to $ 59,999

$ 60,000 to $ 74,999

$ 75,000 to $ 99,999

$ 100,000 to $ 199,999

$ 200,000 to $ 499,999

$ 500,000 to $ 999,999

$ 1,000,000 and over

Average Tax Benefit

Adjusted Gross Income (AGI)

16

CHARITABLE CONTRIBUTION DEDUCTION

them with an incentive to make larger contributions due to their tax

advantaged status. Further, due to the TCJA, many higher income

taxpayers can no longer benefit at the federal level by claiming an

itemized deduction for their charitable contributions, meaning that the

State’s Charitable Contribution Deduction is the only tax benefit

available for most taxpayers who make contributions. However,

because the typical reduction in tax liability provided by the deduction

is equivalent to about 3.1 to 3.5 percent of the contribution amount, it

may not currently be providing a strong incentive to make charitable

contributions and so the impact to charitable organizations may be

limited. Further, because taxpayers who make very large charitable

contributions, for example those over $30,000, would likely still benefit

from itemizing their federal tax deductions, they would continue to have

incentives at both the federal and state level for making charitable

contributions.

Finally, stakeholders reported that they often rely on the contributions

and deductions the Department reports to understand charitable giving

in Colorado. If the Charitable Contribution Deduction were repealed,

the Department, and therefore stakeholders, would no longer have this

information.

ARE THERE SIMILAR TAX EXPENDITURES IN OTHER STATES?

There are four states (Idaho, North Dakota, Oregon, and South

Carolina), other than Colorado, that base their state taxable income off

of FTI, and therefore, include either itemized deductions or the standard

deduction amount when determining the starting amount of taxable

income. Three of these states (Idaho, Oregon, and South Carolina) offer

taxpayers a charitable contribution deduction, however, these states

differ from Colorado because they do not specify that the deduction is

only for taxpayers who claim the federal standard deduction and they

offer deductions for charitable contributions to specific industries or

organizations located within their states.

17

TAX EXPENDITURES REPORT

ARE THERE OTHER TAX EXPENDITURES OR PROGRAMS

WITH A SIMILAR PURPOSE AVAILABLE IN THE STATE?

As discussed, taxpayers who make charitable contributions and itemize

their federal deductions can claim a federal deduction for charitable

contributions under Internal Revenue Code 26 USC 170. The federal

deduction is limited to between 20 and 60 percent of a taxpayer’s

adjusted gross income depending on the type of organizations they

contribute to and the type of contributions (i.e., cash versus non-cash).

Because Colorado uses federal taxable income as the starting point for

Colorado taxable income, taxpayers who claim the federal deduction

automatically receive a benefit for state tax purposes. However, in

2021, the Generally Assembly passed House Bill 21-1311, which

capped the amount of charitable contributions high-income taxpayers

can deduct. Specifically, beginning in 2022, taxpayers with an AGI of

$400,000 or more must add back itemized deductions that exceed the

cap ($30,000 for single filers and $60,000 for joint filers) to their

Colorado taxable income.

WHAT DATA CONSTRAINTS IMPACTED OUR ABILITY TO

EVALUATE THE TAX EXPENDITURE?

We did not encounter any data constraints that impacted our ability to

evaluate the deduction.

WHAT POLICY CONSIDERATIONS DID THE EVALUATION

IDENTIFY?

THE GENERAL ASSEMBLY MAY WANT TO CONSIDER AMENDING STATUTE

TO ESTABLISH A STATUTORY PURPOSE AND PERFORMANCE MEASURES FOR

THE

CHARITABLE CONTRIBUTION DEDUCTION. As discussed, statute and

the enacting legislation for the deduction do not state its purpose or

provide performance measures for evaluating its effectiveness.

Therefore, for the purposes of our evaluation, we considered a potential

purpose for the deduction: to provide the benefit of a deduction on

charitable contributions for taxpayers who claim the standard

deduction, similar to the deduction benefit provided to taxpayers who

itemize their deductions. We identified this purpose based on how the

18

CHARITABLE CONTRIBUTION DEDUCTION

deduction operates and bill sponsor testimony from hearings for the

enacting legislation (House Bill 00-1053). We also developed a

performance measure to assess the extent to which the deduction is

meeting this potential purpose. However, the General Assembly may

want to clarify its intent for the deduction by providing a purpose

statement and corresponding performance measure(s) in statute. This

would eliminate potential uncertainty regarding the deduction’s

purpose and allow our office to more definitively assess the extent to

which the deduction is accomplishing its intended goal(s).

THE GENERAL ASSEMBLY MAY WANT TO REVIEW THE DEDUCTION’S $500

CHARITABLE CONTRIBUTION

FLOOR. Based on our review of committee

testimony at the time the deduction was created, bill sponsors included

the requirement that taxpayers can only deduct charitable contributions

that are over $500 because they believed that the federal standard

deduction was already structured to include about $500 of charitable

giving, and therefore, this “floor” would prevent a taxpayer from

receiving a double benefit (i.e., effectively receiving $500 of the standard

deduction based on charitable giving, and then deducting this amount

again from state taxable income by claiming the Charitable

Contribution Deduction). However, based on our review of academic

and economic publications regarding the basis of the standard

deduction amount, it is not clear that the standard deduction amount

was structured to include charitable giving, or, if it was, that $500

represents typical giving for taxpayers claiming the standard deduction.

Specifically, while some sources indicate that the standard deduction is

meant to simplify tax filing by providing a deduction amount that is

equivalent to itemized deductions that would be available to the typical

taxpayer, others indicate that it is meant to provide a more progressive

tax system by establishing a base of untaxed income. Additionally, since

2000, when the Charitable Contribution Deduction was established, the

standard deduction amount has increased substantially due to both

adjustments for inflation and changes under the TCJA, however the

$500 floor has not been modified. Specifically, the standard deduction

for single filers increased from $4,400 in Tax Year 2000 to $12,550 in

Tax Year 2021. Further, a review of Congressional testimony for the

19

TAX EXPENDITURES REPORT

TCJA did not indicate whether or not the standard deduction amounts

that were established were intended to account for itemizable expenses.

Therefore, the General Assembly may wish to review the $500 floor to

determine whether it continues to meet its intent for the deduction.

Generally, increasing the floor to account for significant changes to the

standard deduction would reduce the benefit provided to taxpayers and,

therefore, reduce the revenue impact to the State. On the other hand,

decreasing or eliminating the floor would make the deduction available

to taxpayers who make smaller contributions, which tends to include

lower income taxpayers; increase the revenue impact to the State; and

may better align the deduction with the view of the standard deduction

as a mechanism to make the federal tax code more progressive.

THE GENERAL ASSEMBLY MAY WANT TO CONSIDER REPEALING AN

OBSOLETE STATUTORY REFERENCE TO TAXPAYERS CONTRIBUTING TO

HUNGER

-RELIEF ORGANIZATIONS. Statute [Section 39-22-

104(4)(m)(VII), C.R.S.] states that a taxpayer cannot claim the

Charitable Contribution Deduction for contributions for which they

also claim the Food Contributions to Hunger-Relief Charitable

Organizations Credit. This credit expired January 1, 2020, so the

General Assembly may want to consider repealing this provision.